- HBAR dropped 18% and broke below the crucial $0.162 support while correlation with BTC hit 0.97.

- CMF shows heavy outflows, signaling strong selling pressure and weakening recovery potential.

- If momentum improves, HBAR must reclaim $0.133 and $0.145 to avoid deeper losses toward $0.120–$0.110.

Hedera just went through one of its roughest weeks in months. HBAR slipped to around $0.130, losing more than 18%and, more importantly, breaking below a support level that had protected profits for over a month. Once that level gave out, the chart opened up to deeper volatility — and sellers didn’t waste any time pushing price lower.

Hedera is basically moving exactly like Bitcoin

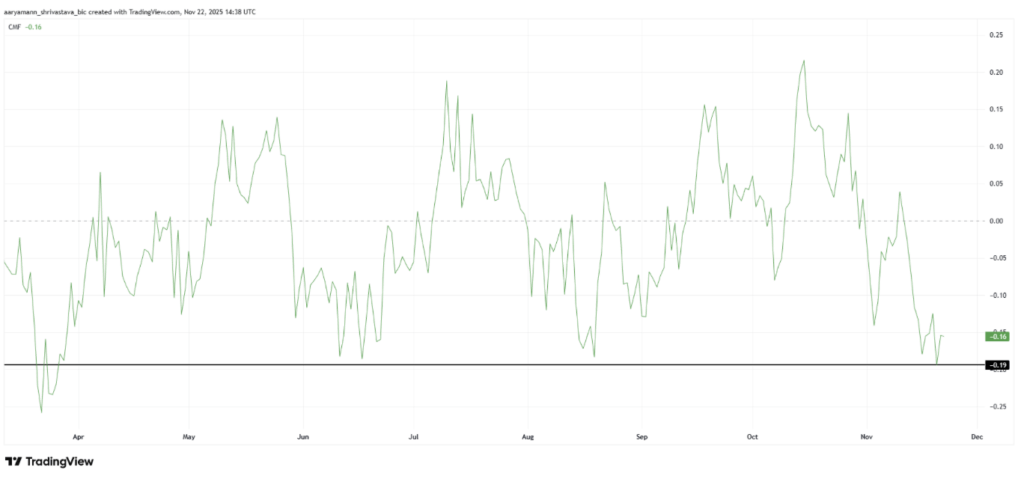

HBAR’s correlation with Bitcoin has spiked to 0.97, almost a perfect mirror. That’s one of the highest readings Hedera has seen all year, and it’s bad news in a week when BTC has been under heavy downside pressure.

Bitcoin falling to $84,408 dragged HBAR with it in almost perfect sync. The higher the correlation, the harder it is for Hedera to move independently — meaning BTC’s weakness has effectively erased any chance for HBAR to buck the trend.

Bearish momentum builds as capital flows out

Macro indicators are making the picture even uglier. The Chaikin Money Flow (CMF) is sitting near an eight-month low, showing heavy outflows of capital. A deeply negative CMF means one thing: investors are pulling money out faster than new capital is entering.

That kind of persistent outflow usually:

- Weakens recovery attempts

- Strengthens bearish trends

- Adds volatility when key support levels break

Unless inflows return soon, HBAR could struggle to regain upward momentum.

Can HBAR bounce — or is more downside coming?

HBAR’s 18% drop pushed it below the critical $0.162 support, which had held firm for over a month. Losing that level exposes price to deeper drops as bearish sentiment grows.

Right now, HBAR trades around $0.129, and if macro conditions don’t improve, the altcoin could fall to $0.120 next. A breakdown below $0.120 may trigger more selling, sending it toward $0.110 — a level not tested in some time.

The bullish scenario

If buyers step back in, an early recovery might start with a move above $0.133.

Clearing $0.145 would be the real turning point — that breakout could open the road toward $0.154, effectively breaking the bearish structure and restoring some confidence.

For now, though, Hedera is stuck moving in Bitcoin’s shadow, and unless either inflows return or BTC stabilizes, the pressure on HBAR is likely to continue.