- Grayscale believes real-world asset tokenization is still early and could grow up to 1,000x over the next several years.

- Chainlink is viewed as critical infrastructure, enabling data, compliance, and connectivity between blockchains and traditional finance.

- Despite recent market pullbacks, Grayscale sees continued institutional demand, regulatory clarity, and long-term accumulation opportunities.

Grayscale believes the real-world asset tokenization story is still in its early innings, and Chainlink could end up playing a much bigger role than many expect. Speaking on the Thinking Crypto podcast, Grayscale Head of Research Zach Pandl said only a tiny slice of global assets has moved on-chain so far. That, in his view, leaves massive room for growth over the next five to ten years as traditional finance slowly shifts toward blockchain infrastructure.

Pandl framed the current phase as foundational rather than explosive. Adoption is happening, just quietly. As banks, funds, and institutions look for better settlement systems and programmable finance, the rails are already being laid.

Why Chainlink Sits at the Center of This Shift

Grayscale recently converted its existing Chainlink investment product into a spot ETF, a move Pandl described as a way to give investors cleaner exposure to one of crypto’s most important infrastructure layers. Chainlink, he explained, isn’t a bet on a single blockchain or narrative.

Instead, it functions as connective tissue.

Chainlink provides trusted data feeds, compliance tooling, and cross-system integrations that allow tokenized assets, stablecoins, and DeFi protocols to work reliably. Without that layer, large-scale tokenization struggles to function. In Pandl’s words, Chainlink is less about speculation and more about where finance itself is heading.

ETFs Are Expanding Beyond Bitcoin and Ethereum

Pandl also pointed to Grayscale’s broader ETF push, which now includes assets like XRP, Solana, Dogecoin, and Chainlink. Regulatory clarity, especially following the long road to Bitcoin and Ethereum ETF approvals, has accelerated how quickly new products are coming to market.

Each asset fills a different role. XRP began as a payments-focused network and is now branching into wider use cases. Solana continues to draw activity because of speed and low fees. Dogecoin, while unconventional, reflects how investor interest has diversified.

Grayscale has also explored privacy-focused assets like Zcash. Pandl stressed that if blockchains are expected to support real financial systems, privacy can’t be optional. Institutions simply won’t operate on rails where balances, payrolls, and transactions are fully exposed.

Recent Market Pullbacks Don’t Signal a Cycle Top

Addressing recent price weakness, Pandl pushed back against fears of a looming multi-year downturn. Bitcoin’s roughly 30% pullback from recent highs may feel uncomfortable, but he described it as fairly normal within strong bull markets.

Historically, Bitcoin often sees multiple corrections of 10% to 30% even during healthy cycles. From Grayscale’s perspective, there’s no clear evidence that the market is rolling over structurally. Instead, the correction looks more like digestion than collapse.

Two forces, Pandl said, continue to support the space: demand for alternative stores of value as debt and inflation risks rise, and easier institutional access as regulations become clearer.

Tokenized Assets Could Grow 1,000x From Here

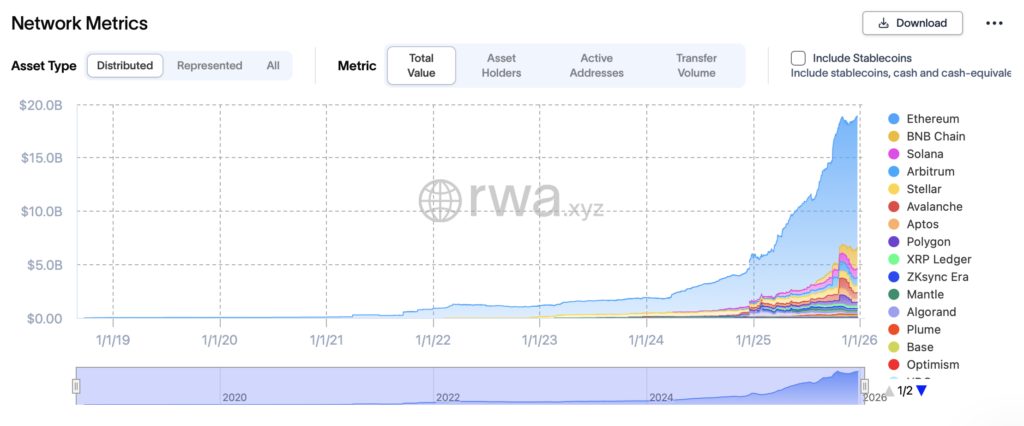

One of the most striking points from Pandl’s comments was scale. Today, tokenized real-world assets total roughly $30–35 billion. That sounds large until it’s compared to global equity and bond markets worth around $300 trillion.

In that context, tokenization barely registers.

Pandl believes tokenized assets could expand by as much as 1,000 times over the next five years as traditional instruments move on-chain. Benefits include faster settlement, 24/7 markets, and entirely new services like on-chain collateral and lending. Platforms like Ethereum may host these assets, but infrastructure providers such as Chainlink are what make the system function.

Volatility Remains, but the Long-Term Case Holds

Crypto’s correlation with equities has increased over time, Pandl acknowledged, but it still behaves more like a commodity than a stock index. Digital assets sometimes move with equities, sometimes not. That unpredictability is part of what makes them useful diversifiers.

Volatility hasn’t disappeared, and it likely won’t anytime soon. Still, Pandl suggested that for investors aligned with the long-term vision, lower prices are not necessarily a threat. They can be an entry point.

From Grayscale’s standpoint, innovation continues, institutions are steadily arriving, and regulatory clarity in the U.S. is improving. The path may not be smooth, but the direction feels increasingly defined.