- Grayscale’s CoinDesk Crypto 5 ETF replaced Cardano with BNB

- The fund tracks the five largest and most liquid crypto assets

- Bitcoin and Ethereum still dominate the ETF’s weighting

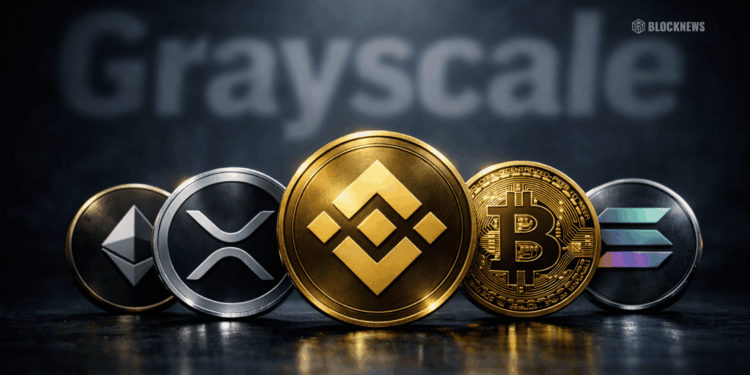

Grayscale’s CoinDesk Crypto 5 ETF has updated its holdings following a scheduled quarterly rebalance. BNB has been added to the fund, while Cardano’s ADA was removed. This adjustment reflects the ETF’s mandate to maintain exposure to the largest and most liquid digital assets by market capitalization.

The rebalance is automatic and rules-based, meaning assets move in or out based on market structure rather than discretionary decisions. BNB’s inclusion signals its continued relevance among top-tier crypto assets in institutional products.

How the ETF Is Structured

The CoinDesk Crypto 5 ETF traces its roots back to 2018, when it launched as a large-cap crypto fund limited to accredited investors. Its conversion to an ETF structure in late 2025 expanded access to retail investors through traditional brokerage accounts.

The fund is listed on NYSE Arca and is designed to provide streamlined exposure to dominant crypto assets without active management. Quarterly rebalancing ensures the portfolio stays aligned with shifts in market leadership.

Current Portfolio Breakdown

Bitcoin remains the core holding, accounting for more than 74% of the ETF. Ethereum follows with just over 13%. The remaining allocation is split between BNB, XRP, and Solana, rounding out the five-asset structure.

This weighting highlights how concentrated institutional crypto exposure still is, with Bitcoin and Ethereum continuing to anchor most regulated investment products.

Why BNB’s Inclusion Matters

BNB’s addition underscores its liquidity, scale, and ongoing role in the broader crypto ecosystem. For regulated funds, inclusion isn’t about narrative or hype. It’s about depth, stability, and the ability to absorb large capital flows without excessive volatility.

Replacing ADA with BNB also reflects how competitive the large-cap tier has become, where even established networks can fall out of favor if liquidity or market share shifts.

Conclusion

Grayscale’s latest rebalance shows how quickly the crypto ETF landscape can evolve. BNB’s entry into the CoinDesk Crypto 5 ETF reinforces its institutional relevance, while the fund’s structure continues to favor assets with scale, liquidity, and staying power.