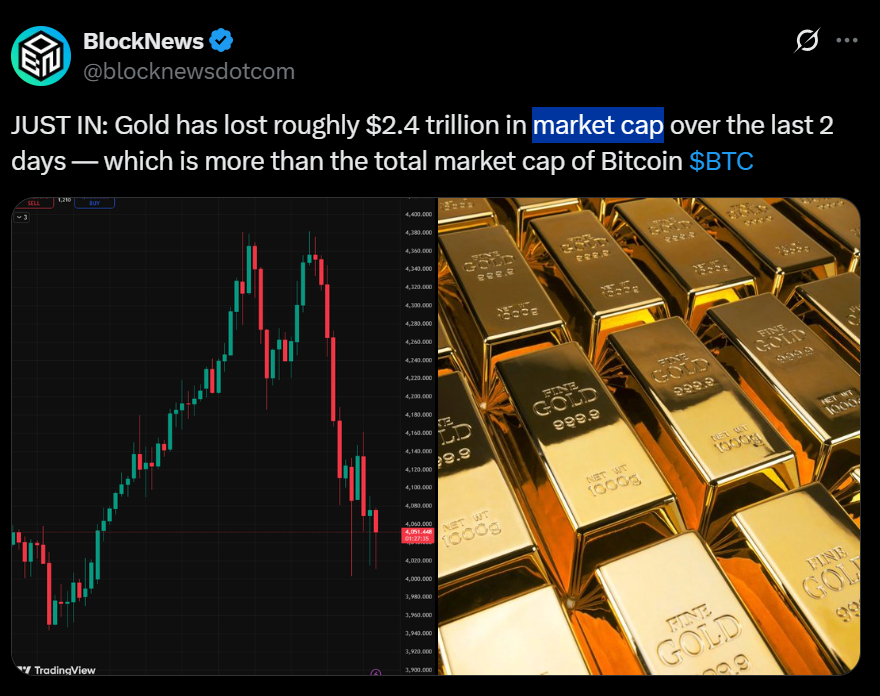

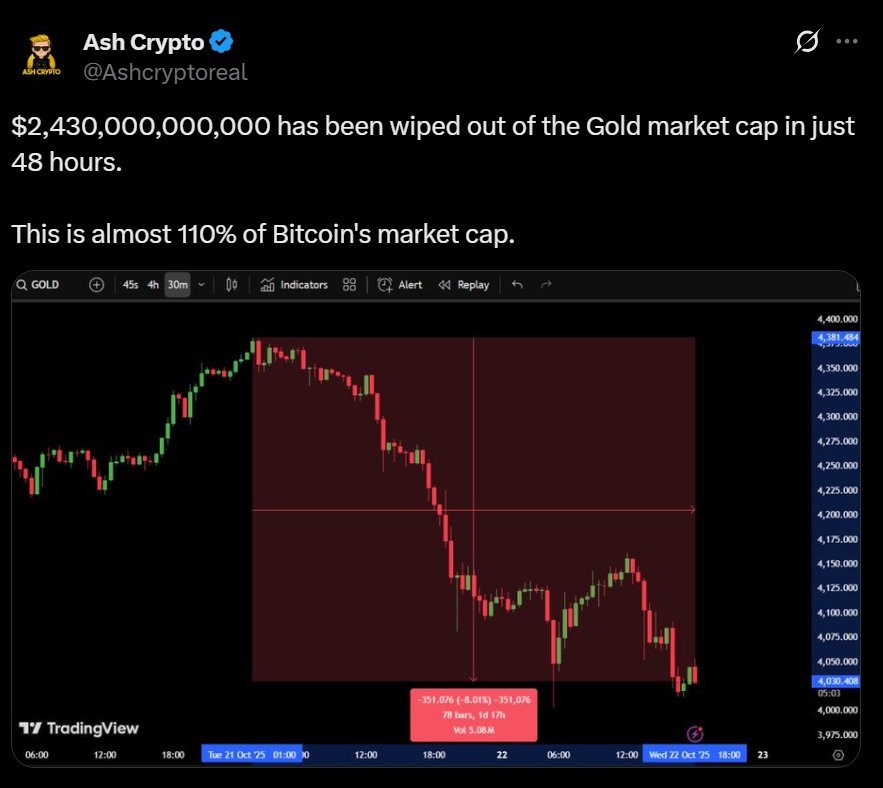

- Gold crashes 8%, erasing $2.43 trillion — over 110% of Bitcoin’s market cap.

- The drop follows a stronger U.S. dollar, investor rotation, and profit-taking.

- Analysts expect gold to rebound toward $5,000 by 2026, but Bitcoin’s resilience is shifting sentiment.

Gold just saw one of its steepest sell-offs in recent memory. In just 48 hours, the metal’s market capitalization collapsed by $2.43 trillion, erasing more than 110% of Bitcoin’s entire market cap. Prices plunged roughly 8%, dropping gold to around $4,129 per ounce — a staggering reversal that’s sent shockwaves through global markets.

Analysts say the carnage stemmed from a surging U.S. dollar, profit-taking after months of rallying, and a rotation of capital into equities and digital assets. The combination hit what was supposed to be the world’s safest hedge asset — and forced investors to question whether the “golden rally” is finally cracking.

Why Gold’s Drop Matters for Bitcoin

The irony? While gold sank, Bitcoin (BTC) held relatively firm near $108,000, fueling debate over which asset truly deserves the “store of value” crown in 2025. Gold’s two-day wipeout equals nearly 1.1x Bitcoin’s market cap, underscoring just how massive the loss was.

Crypto traders say some of that fleeing capital is already finding its way into BTC, which is up about 20% year-to-date, compared to gold’s still-impressive 45% rally. “We’re watching a rotation moment,” said one analyst. “When traditional safe-havens wobble, digital ones suddenly look more attractive.”

Analysts Still Expect Long-Term Gold Recovery

Despite the chaos, top banks like Goldman Sachs, Bank of America, and HSBC remain bullish long term, projecting gold could climb toward $4,900–$5,000 per ounce by late 2026. Central bank accumulation and geopolitical tension are expected to keep demand strong — even if volatility stays wild in the short run.

Still, this week’s $2.43 trillion loss is a sobering reminder that no hedge is truly immune to fast-moving markets. As one strategist put it: “Even gold bleeds when liquidity dries up.”

Bitcoin vs. Gold in 2025: The Great Store-of-Value Debate

The sell-off reignited one of finance’s oldest arguments — Bitcoin vs. Gold. Gold remains the heavyweight, with a $27.6 trillion market cap even after the crash, dwarfing Bitcoin’s $2.16 trillion. Yet Bitcoin’s digital design, portability, and growing institutional backing give it a different kind of edge — one tied to innovation, not tradition.

Analysts note that Bitcoin remains 3.6 times more volatile than gold, but also far more scalable. “Gold is reliable,” said Coin Bureau’s Nic Puckrin, “but Bitcoin is evolving. One’s a vault, the other’s an engine.”