- Germany missed out on $1.1 billion in profits by selling 49,858 BTC too early before Bitcoin hit a new all-time high of over $77,000.

- The crypto market surge was partly influenced by Donald Trump’s re-election as US president and expectations of pro-crypto policies from his administration.

- A German parliament member expressed concerns that if the US considers Bitcoin as a strategic reserve asset, European countries may feel compelled to follow suit due to FOMO.

The decision by Germany to sell its Bitcoin holdings early has resulted in billions in missed profits, as the crypto market sees significant gains following the re-election of President Donald Trump.

Germany Sold 50,000 BTC in July

Germany conducted a sale of nearly 50,000 BTC between June and July, generating approximately $2.8 billion from assets seized in a criminal case. Under German law, assets must be sold if their value fluctuates significantly, to prevent potential losses from volatility.

Missed Profits Now Total $11 Billion

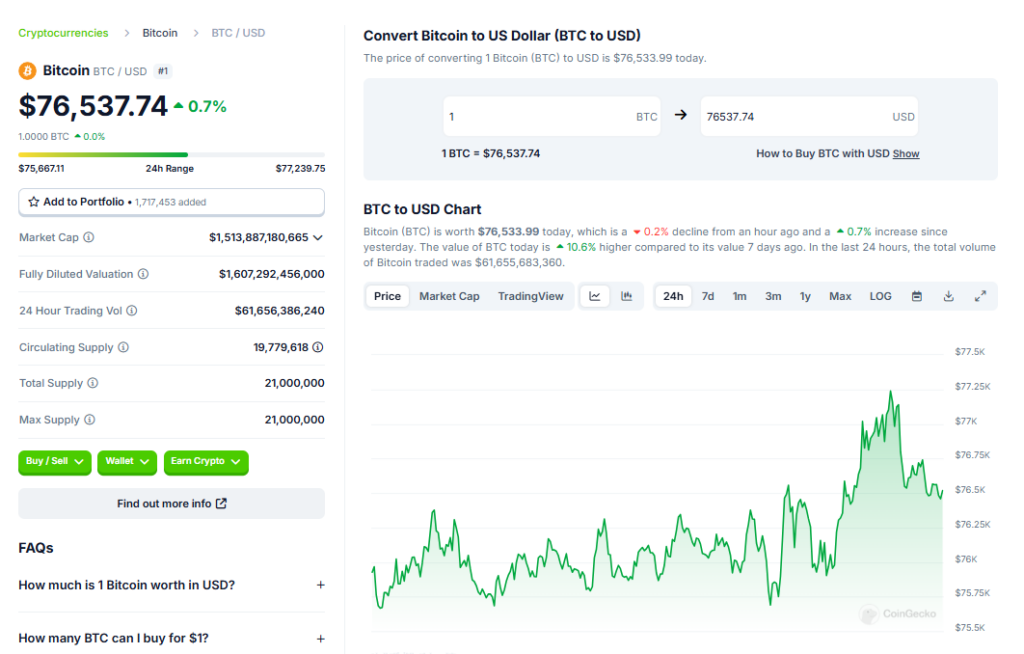

The BTC was sold when prices were around $53,000 per coin. With Bitcoin recently reaching over $77,000, Germany missed out on around $11 billion in potential profits. At current valuations, the 50,000 BTC could have been worth $39 billion.

Crypto Market Surge on Trump Re-election

Germany’s missed opportunity comes as crypto markets rally following Trump’s election victory. The win has fueled optimism and record highs across stocks, Bitcoin, and companies like Tesla.

There is speculation that re-election could lead to crypto-friendly regulatory changes. Bitcoin’s gains have sparked concerns in Germany about the asset potentially becoming a US strategic reserve.

Bitcoin’s Rise Prompts FOMO

As the US explores holding Bitcoin in reserves, a German politician suggested European countries may soon feel compelled to follow suit. The influence of US crypto adoption on other governments was noted.