- The Fed’s balance sheet has started rising again after years of contraction.

- Liquidity expansion tends to support risk assets and future-oriented valuations.

- Bitcoin and crypto are especially sensitive to shifts in liquidity cycles.

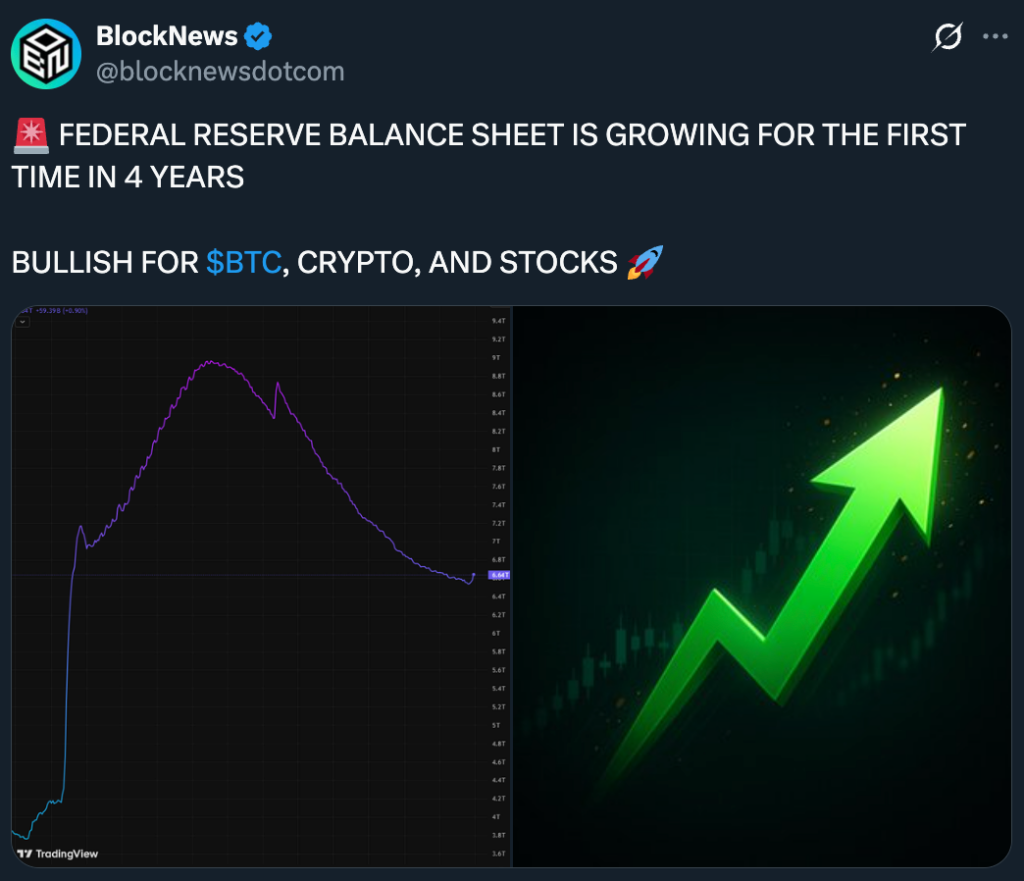

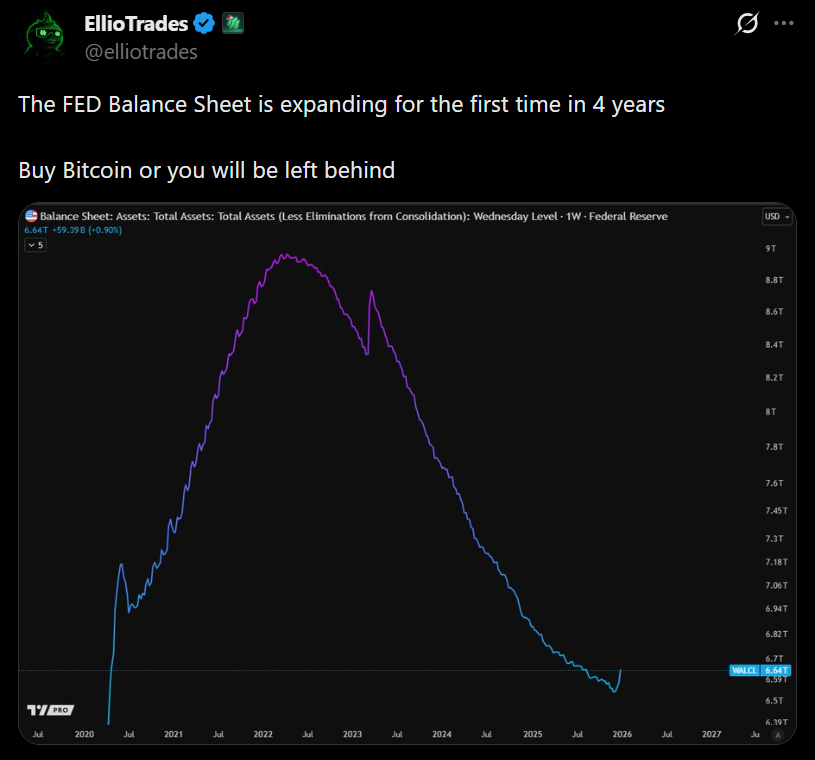

After years of steady contraction, the Federal Reserve’s balance sheet has quietly started moving higher again. This marks a meaningful shift away from quantitative tightening and toward renewed liquidity entering the system. A recent uptick late in December was the first clear increase in roughly four years, and while it didn’t come with a press conference or bold announcement, markets tend to notice these things quickly.

Why Liquidity Changes Market Behavior

When the Fed expands its balance sheet, reserves flow back into the banking system. That doesn’t just sit idle. It lowers friction, improves funding conditions, and gives investors more room to take risk. Assets that rely on future cash flows or long-term utility tend to benefit most in this environment. Growth stocks, speculative tech, and crypto often respond first, because their valuations are highly sensitive to liquidity rather than near-term earnings.

Bitcoin and Crypto React to Liquidity First

Bitcoin and broader crypto markets have shown a strong relationship with liquidity cycles. When the Fed was shrinking its balance sheet aggressively, crypto struggled and internal stress showed up in price structure. If balance sheet expansion becomes sustained rather than temporary, that dynamic can flip. Bitcoin’s sensitivity to liquidity means its beta often turns positive when reserves grow, even before rate cuts enter the conversation.

This Isn’t About Rates, It’s About Flow

What makes this shift notable is that it puts liquidity back on the table as a driver, independent of interest rate policy. Markets don’t just trade on the price of money, they trade on its availability. A growing balance sheet signals that the era of relentless drain may be ending, even if cautiously. That alone can lift sentiment across equities and risk assets.

Why This Matters Going Forward

No single macro signal guarantees a breakout, and this doesn’t mean markets go straight up. But turning points in the Fed’s balance sheet have historically mattered. For investors watching Bitcoin, crypto, and stocks, this change suggests the macro backdrop may be becoming less hostile. Cheap money doesn’t need to be loud to be effective. Sometimes it just needs to stop leaving.