- Bitcoin is up $26,000 following the US Federal Reserve injecting liquidity into the US economy after the closure of Silicon Valley Bank and Signature

- Fed providing new money could mean the crypto market is up for a new bullish rally, according to reports

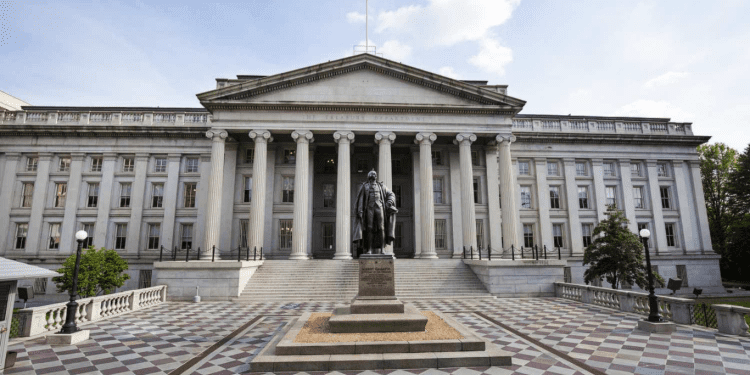

- The Treasury, Fed and FDIC stated that SVB shareholders and debtholders will not be under protection

Bitcoin bulls have been cheered this week as the cryptocurrency skyrocketed over $26,000 in only a few days and looked set to remain on an upward trajectory, but most likely in the short term. The surge comes in response to the U.S. Federal Reserve injecting liquidity into the economy after two central banks had to shut their doors this month — Silicon Valley Bank (SVB) and Signature Bank.

The latter is a practical on-ramp for those wanting to invest in Bitcoin with fiat currency, but investors still need to be optimistic about the Fed’s injection of new funds.

However, only some are convinced by what this means for rate hikes or overall policy, as multiple events have been happening that may rock the crypto market for better or worse.

The U.S. Federal Reserve has injected fresh liquidity into the economy this week, a move that bears more than a passing resemblance to quantitative easing (Q.E.). Risk assets have responded as investors become increasingly keen to engage in higher-yield trades.

In a joint statement by the Treasury, Federal Reserve, and Federal Deposit Insurance Corporation regarding investors in SVB, they said the following:

“Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.”

The crypto markets have similarly seen a surge, despite authorities’ decision to abruptly shut down Signature Bank – an attempt some say was aimed at preventing crypto from exploiting the situation with SVB.

The news brings back memories of earlier years when Q.E. was commonplace, and the booming crypto markets enjoyed a steady flow of investor capital.

Fed on SVB and Signature

The U.S. Federal Reserve takes action when a central bank closes its doors to ensure stability and prevent any potential economic disruption. This could involve offering liquidity injections or financial support to help the affected bank access capital and manage losses.

The closure of two prominent U.S. banks this month, Silicon Valley Bank (SVB) and Signature Bank, was no different. The Fed announced it would provide liquidity after the closures to restore confidence in the markets and protect consumers from being impacted too severely by the closures.

It remains to be seen if this move will have its desired effect, with some commentators already questioning what rate hikes might mean for policy going forward and whether crypto markets can continue to navigate this tumultuous period unscathed.