- Paypal launches its stablecoin Paypal USD(PYUSD).

- Over 66 new token pairs have surfaced on several crypto networks with the intention of unsuspecting users.

- As investors and customers wait to release the original PayPal token, the company has revealed that the actual PayPal USD ERC-20 contract address can be verified via Etherscan.

On Monday, PayPal launched its stablecoin Paypal USD (PYUSD). The firm has asserted that it will soon make its PayPal USD (PYUSD) stablecoin available to users, marking the first time a major financial company is issuing its stablecoin.

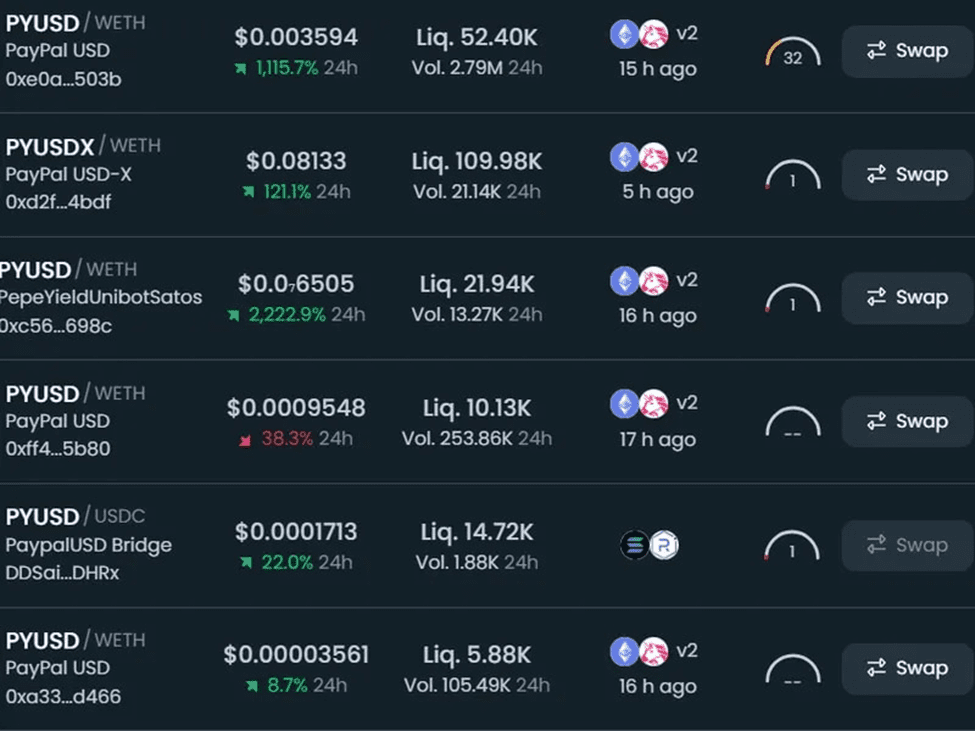

However, the opportunistic crypto industry has already hopped on the trend, creating and spreading fake tokens with a similar ticker. Over 66 new token pairs have surfaced on several crypto networks with the intention of unsuspecting users. Most of these tokens have propped up on networks, such as Ethereum, BNB Chain, Base, and others, as of Asian noon hours on August 8, according to DEXTools data. Most of these have been floated on Ethereum, where the original PYUSD exists.

While the tokens are yet to be released, some con artists attempt to snare unwary users. So far, the strategy has been to create a token called “PYUSD,” boost liquidity by using ether or another token, and then make it available to users on a decentralized exchange (DEX).

A DEX is a platform where people can trade cryptocurrencies without an intermediary. A decentralized exchange uses smart contracts to facilitate trading between individuals but doesn’t take control of their coins.

How The Crypto Impersonators Struck PYUSD?

However, as one might wonder how defrauding can occur, it is all possible. Anyone can call a smart contract and issue tokens on Ethereum (or other blockchains) for a few cents. The presence of decentralized exchanges means tokens can instantly be issued, supplied with liquidity, and traded soon after.

Most of the supply of these tokens are likely purchased by their creators after issuance, giving the illusion of a trendy token while being a honeypot in reality. The hustle may yield a few thousand dollars in a few hours for such developers.

Additionally, because DEX(s) exist, tokens can be created much faster, given liquidity, and exchanged immediately. Further, it is close to impossible that tokens listed with the same ticker on UniSwap or any other decentralized exchange are genuine. This is because PayPal made it clear that PayPal USD may only be traded between verified PayPal and other compatible wallets.

Bogus PYUSD ‘’Honeypots’’

Nonetheless, these imposters have managed to deceive customers and have rallied since launching their fake PayPal stablecoins. The most significant fake PYUSD token, created on Ethereum, saw a startling $2.6 million in trading activity in just over a day of operation.

Most of the bogus PYUSD tokens described are probably “honeypots,” meaning that once an investor buys the token, they cannot sell it and have essentially given away their cryptocurrency.

Instead of waiting to be discovered, sure developers might remove all liquidity from the phony tokens hours after release in a “rug pull.” This results in a 100% price decrease and leaves investors owning digital dust.

However, once launched, the tokens will be used for goods and services on the PayPal payment platform. Users will also be able to transfer PYUSD between PayPal and supported external digital wallets or convert other supported cryptocurrencies of PayPal into and out of PYUSD.

While investors and customers wait to release the original PayPal token, the company has revealed that the actual PayPal USD ERC-20 contract address can be verified via Etherscan. The token itself was created on November 8, 2022.