- ETH hovers around key Fibonacci retracement levels, testing support zones

- MACD signals a potential bearish trend, but a reversal is still possible

- Price action suggests a critical moment—Ethereum must hold key levels or risk further downside

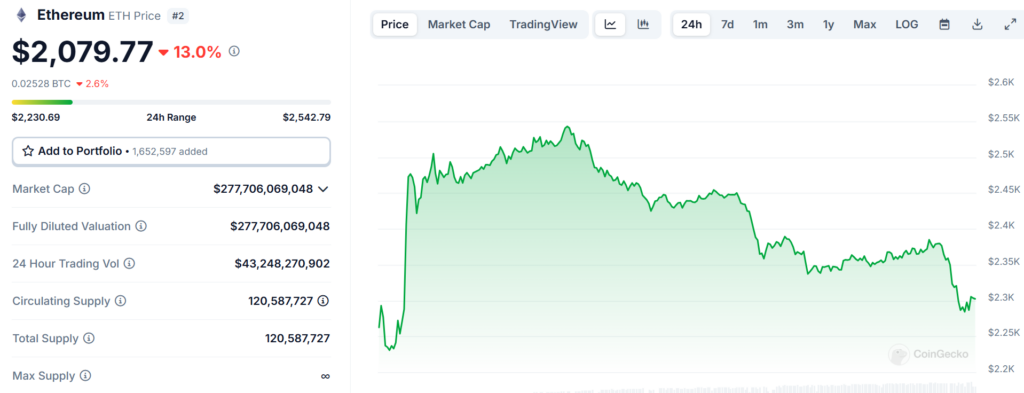

Ethereum has been on a bumpy ride, with price action showing clear signs of weakness after failing to hold onto previous highs. The chart reflects consistent lower highs and lower lows, a pattern that typically signals a downtrend. While ETH saw brief moments of recovery, each attempt at pushing higher was quickly rejected, sending the price lower again.

Looking at the CoinGecko chart, Ethereum has now dipped into a potential reversal zone, commonly known as the golden pocket. This is where buyers usually step in to defend prices, but so far, the response has been mixed. If ETH can stabilize around this level, it could set the stage for a strong recovery. But if it breaks below, things might get rough.

A Rough Day for Ethereum—Where’s the Bottom?

One of the biggest indicators flashing warning signs right now is the MACD (Moving Average Convergence Divergence). The MACD line has crossed below the signal line, a classic bearish crossover, which often indicates a continuation of downward momentum.

However, ETH is no stranger to fakeouts. In past market cycles, similar bearish crossovers have been quickly followed by sudden surges. If Ethereum sees a surge in buying volume, there’s still a chance that the MACD could flatten out and flip bullish again.

For now, traders should keep an eye on whether the MACD slope starts turning upward—that could be an early sign of an incoming bounce.

Holding Support or Breaking Down? The Next Few Hours Are Critical

Ethereum is now resting on a crucial support level, and what happens next will set the tone for the coming days. If buyers step in aggressively, we could see ETH attempt to reclaim lost ground, targeting resistance around $138-$140.

On the flip side, a clean break below support could trigger another leg down, possibly toward the next demand zone around $130-$132. That’s where traders will have to make a decision—is this just a temporary dip, or is ETH gearing up for a deeper drop?

Ethereum, originally launched in 2015 by Vitalik Buterin, is the backbone of DeFi, NFTs, and smart contracts. Despite the short-term volatility, its long-term fundamentals remain strong, making dips like these potential opportunities for accumulation.

Right now, Ethereum is at a crossroads. If key levels hold, it could be the start of a recovery. But if they fail, the downtrend might still have some room to go.