- ETH dropped nearly 40% after Eric Trump called it a “great buy.”

- Market turbulence, a major crypto hack, and Trump’s tariffs dragged Ethereum down.

- WLFI moved $212M in ETH right after Eric’s post, raising eyebrows in the crypto space.

So, yeah… back in late Jan, Eric Trump—the son of former U.S. President Donald Trump—told his 5.7 million followers on X (Twitter, whatever) that it was a great time to buy Ethereum.

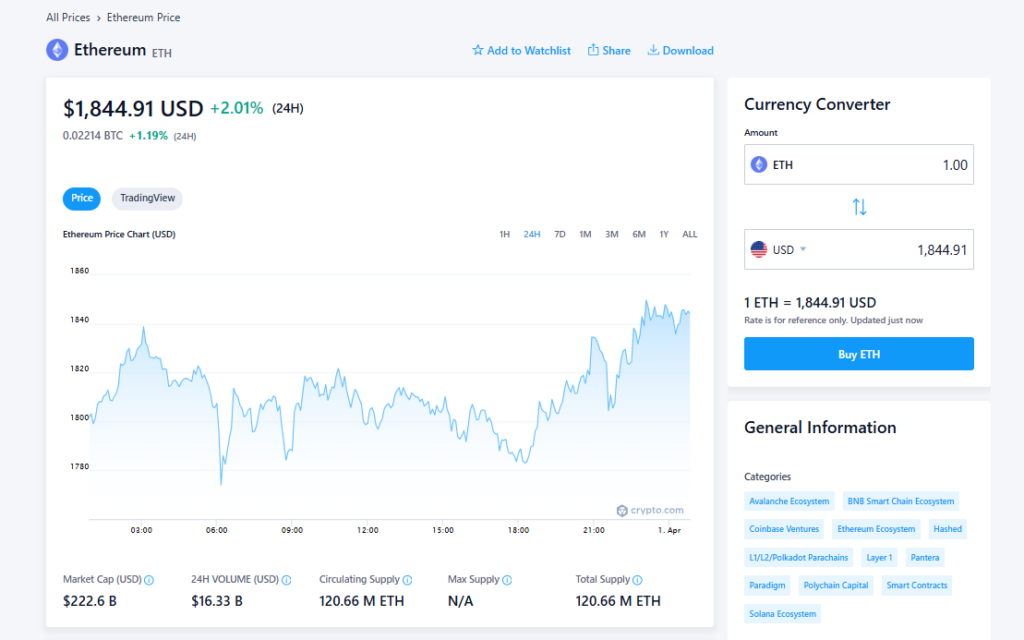

Flash forward to March 31: ETH is trading at around $1,820. That’s nearly 40% down from where it was when he posted. Oof.

Market Chaos, Hacks & Tariffs Didn’t Help

A lot’s happened since that tweet. For starters, Bybit—one of the major crypto exchanges—got hit with a massive security breach. Like, $1.5 billion in ETH gone. Just… gone. That’s the biggest crypto heist ever, by the way.

Then, Trump (the senior one) threw another wrench in the gears—escalating his trade war by slapping 25% tariffs on car imports from China, Mexico, and Canada. That’s kicking in on April 3, and yeah, it’s made riskier assets like crypto even shakier.

Meanwhile, ETH’s dominance in the market dropped hard—from over 10% to under 8.4%, the lowest it’s been in years. Not a good look.

Gold Up, ETH Down

Gold, the good ol’ “safe” asset, has been on a tear—up more than 17% this year, now hovering around $3,085 an ounce. Some analysts are saying ETH might not bottom out till gold tops out. Weird connection, but hey, markets are emotional.

Michaël van de Poppe, who co-founded MN Consultancy, said basically don’t hold your breath for a rebound just yet. Not exactly a pep talk.

WLFI Moves Big ETH Bags — And People Noticed

Here’s where things get even more interesting. Just two days after Eric’s tweet, World Liberty Finance (WLFI), a DeFi firm linked to the Trump fam, moved about 73,783 ETH—over $212 million worth—onto Coinbase Prime. Sketchy timing? Yeah, some folks think so.

WLFI said it was just “routine treasury stuff,” but people in the crypto space aren’t totally buying it. The firm’s done similar big buys before, always right before something Trump-related happens. Coincidence? Hmm.

They even grabbed $20M in tokens before the White House Crypto Summit on March 7. Not shady, just… super convenient?

ETH’s Price Outlook: Bearish (but Maybe Not for Long)

Technically speaking, ETH is looking shaky. As of late March, it’s sitting in what analysts call a bear flag pattern—basically, a short break before another fall. If that plays out, price could drop to around $1,490 in April. Yeah, another 20% slide.

But! There’s a glimmer of hope. If ETH bounces off the $1,800 support again, it could form a double bottom pattern. That’s a bullish setup that might send it back toward $2,500.

For that to happen, ETH needs to break through the neckline around $2,094. If it does, the whole thing flips and, suddenly, bulls have a shot again.

Final Thoughts (Not Investment Advice, Just Vibes)

So is ETH doomed? Nah, not necessarily. But it’s in a tight spot, and the market’s feeling nervous. Eric Trump’s tweet didn’t age well, WLFI’s moves are raising eyebrows, and technicals are throwing out mixed signals.

Maybe we hit $1,500. Maybe it bounces to $2,500. That’s crypto for you—predictably unpredictable.