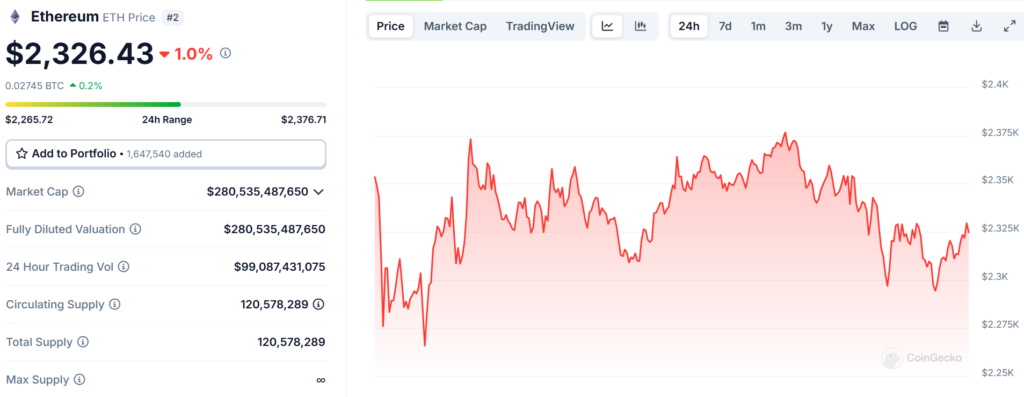

- ETH has been fluctuating between $2,265 and $2,376, showing signs of indecision.

- Trading volume remains exceptionally high, indicating strong market participation.

- Key resistance and support zones will determine Ethereum’s next big price move.

Ethereum has been moving within a relatively tight range over the past day, swinging between $2,265 and $2,376. Right now, it’s trading near $2,326, reflecting a slight decline from earlier highs. The market appears undecided, with ETH attempting to push higher but facing resistance at the upper end of its range.

Looking at its recent performance in CoinGecko, Ethereum has struggled to maintain a clear direction. The price has seen repeated attempts to break out, only to get pulled back down by selling pressure. However, the fact that it hasn’t fallen below key support levels suggests that buyers are still actively defending their positions.

Ethereum’s Price Action: Holding Steady Amid Market Uncertainty

One of the most interesting things about Ethereum’s market activity is its consistent buyers and diamond hands, which hit $99 billion in the last 24 hours. That’s a clear sign that traders are still paying close attention, even if the price isn’t making dramatic moves.

When trading volume stays high, it usually means there’s strong participation from both buyers and sellers. If ETH can sustain this level of activity while inching upward, it could indicate growing confidence in another breakout attempt. However, if volume starts declining alongside price stagnation, it might suggest that enthusiasm is fading, and a pullback could be on the way.

Next Levels for ETH

ETH is currently sitting in a crucial zone. The $2,375-$2,400 range has acted as a tough resistance level, where previous rallies have stalled. If Ethereum manages to push past this barrier, it could open the door for a move toward $2,500 or higher.

On the flip side, $2,265 has been holding as an important support level. If ETH starts slipping below this area, it might trigger a wave of selling that could send the price toward $2,200 or lower. The next few trading sessions will be critical in determining which direction Ethereum heads next.

For now, traders should keep a close eye on volume and price action. If ETH builds momentum and breaks resistance, it could gain further traction. But if selling pressure increases, another dip might be coming.

The Origins of Ethereum

Ethereum was introduced in 2015 by Vitalik Buterin, aiming to create a decentralized computing platform that allows developers to build smart contracts and decentralized applications (dApps). Unlike Bitcoin, which focuses primarily on being a store of value, Ethereum provides a programmable blockchain that supports a wide range of use cases, from DeFi to NFTs.

Over the years, Ethereum has established itself as the leading smart contract platform, but its price remains subject to market sentiment, network upgrades, and macroeconomic trends. Whether this latest consolidation phase leads to another surge or further correction, ETH remains a dominant force in the crypto space.