- Bit Digital dumped all its Bitcoin to load up on ETH, signaling a big shift in institutional sentiment.

- ETH exchange reserves and staking hit all-time highs, but price action remains oddly flat.

- A breakout above $2,736 could spark momentum, while a drop below $2,309 may flip the script bearish.

Ethereum’s sitting still around $2,550, barely blinking. It’s been doing this weird sideways shuffle lately—but behind the scenes, a lot’s shifting. Institutions are piling in, exchange balances are dropping like a rock, and staking numbers are at record highs. Still, the price? Stuck. So the question now is… are whales just offloading in stealth, or is this the quiet before the next leg up?

Bit Digital’s Bold Flip from BTC to ETH

In a pretty bold move, Bit Digital—yep, that Nasdaq-listed mining company—dumped all of its Bitcoin. Like, all of it. They raised about $172 million through a public offering and sold another $28 mil worth of BTC, then rotated all that into Ethereum. In total, they picked up nearly $193 million in ETH, bringing their holdings to a chunky $254.8 million. That kind of pivot doesn’t happen by accident. They’re not just buying, they’re betting on Ethereum big time.

Even more interesting? They said they’re not done—more ETH buys are coming. That sort of public commitment, especially from a listed firm, says a lot about where sentiment might be shifting.

Exchange Reserves Are Drying Up—Fast

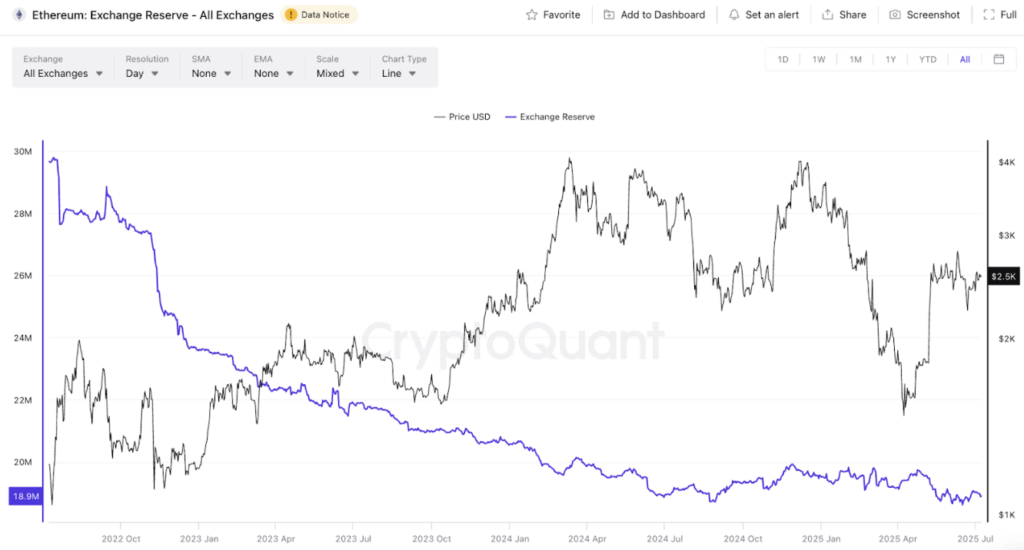

Even with Bit Digital going all-in, ETH’s price still hasn’t flinched. And yet, data from CryptoQuant shows ETH reserves on centralized exchanges are sitting at just 18.9 million—yeah, that’s the lowest level ever. Typically, this would scream “bullish!” to the market. Less ETH on exchanges means less selling pressure, right?

In theory, yeah. It usually signals that people are moving their ETH into cold wallets or staking contracts, taking it out of play. And that’s exactly what we’re seeing. But again—no price reaction. That’s got some folks wondering if others are dumping quietly into every rally attempt. Hmm.

Staking Keeps Climbing, But Price Refuses to Move

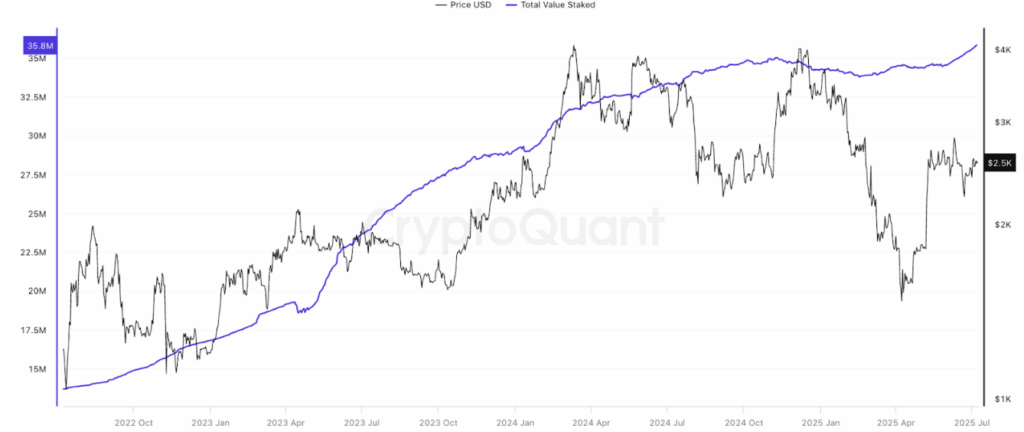

ETH staking’s doing great. Over 35.8 million ETH are now staked, the highest it’s ever been. That means more people are locking up their tokens for yield and helping secure the network—which is great for Ethereum’s long-term health.

But here’s the rub: all that ETH getting staked should be acting like a mini supply shock. Instead, the market’s just… yawning. Some think we’re waiting for a catalyst—a big news pop or macro shift—to light a fire under ETH again. Right now, though, it’s all just pent-up potential.

ETH Trapped in a Range, Watching Fibonacci Lines

For now, ETH’s been stuck in this horizontal grind between $2,515 and $2,590. That range has been holding since early July, and it’s getting real boring. Zooming out, if you plot the Fibonacci retracement from the $1,386 low to the $2,880 high in June, ETH’s stuck right at the 0.236 level ($2,527). Next major resistance sits at $2,736—if that breaks, things could start cooking again.

These Fib levels aren’t magic, but traders swear by them. They map out zones where prices tend to bounce or stall based on past moves. So far, ETH’s bumping its head right under that first line, too shy to break through.

Final Thoughts: Coiled Spring or More Chopping?

Here’s the kicker—Ethereum’s fundamentals are glowing. Exchange supply? Lowest ever. Staking? All-time high. Institutions? Buying, and buying big. But price? Still in snooze mode.

If ETH can snap above $2,736, it might finally validate what the fundamentals have been hinting at for weeks. Until then, it’s like a spring wound tight… ready to pop—or maybe just uncoil sideways again. One thing’s clear though: if ETH dips under $2,309, that bullish setup could unravel fast.