- Whales dumped $93M in ETH to exchanges—definitely not bullish.

- Technical signals like MACD and spot selling suggest bearish momentum is building.

- But most ETH holders are still profitable… for now.

Ethereum’s been looking shaky lately, and now there’s fresh whale drama stirring the pot. In just two days, ETH whales unloaded a whopping 26,182 ETH, worth nearly $93.7 million, straight onto top exchanges like Binance, Kraken, OKX, and Bybit. Yeah, not exactly a quiet exit.

The transfers came in chunks—1,000 to 2,000 ETH per move—clogging centralized platforms with sell-side pressure. It’s got traders wondering: are whales spooked, or just cashing out while the price holds up?

Spot Sellers Rule as Futures Get… Too Hot?

Let’s not sugarcoat it—bearish energy is spreading. The Spot Taker CVD is now showing a heavy tilt toward sellers, which lines up with the influx of ETH hitting exchanges. Basically, people are selling more than they’re buying. Not a great sign.

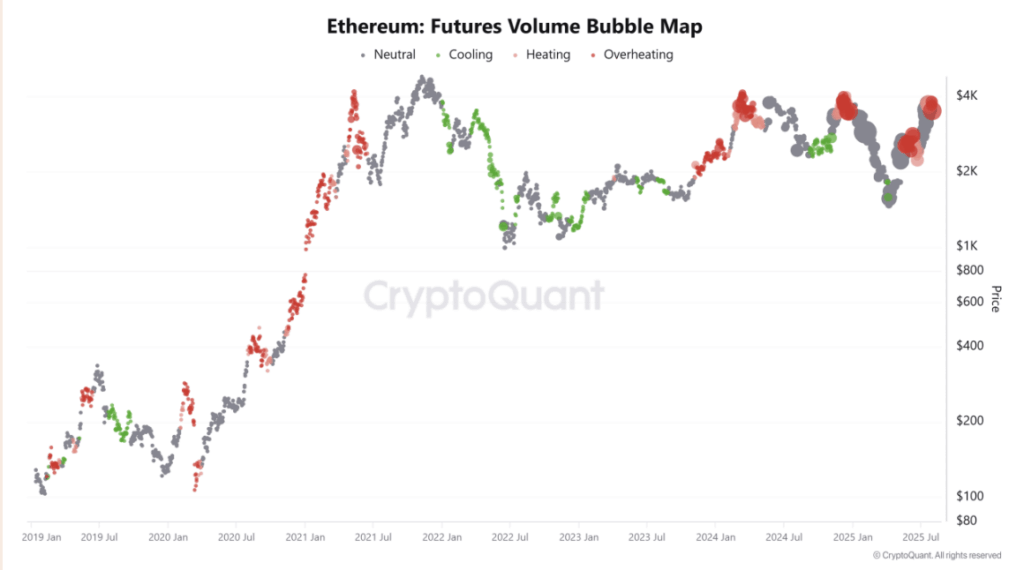

Meanwhile, over in derivatives land, CryptoQuant’s bubble map is flashing warnings. Futures volumes around ETH’s $3,400–$3,500 range are overheating. A lot of leverage building up here, and when things get that frothy, even small price dips can cause major wipeouts. If funding flips or traders start panicking, we could see a liquidation cascade. Again.

Still in the Green… For Now

Interestingly, not everything is doom and gloom. According to IntoTheBlock, a solid 92.26% of ETH addresses are still sitting on profits. Only 4.77% are underwater, and another 2.97% are break-even.

That gives Ethereum a bit of a cushion—people aren’t desperate to sell just yet. But here’s the catch: that $3,458 support zone? It’s kinda crucial. If ETH drops below that, those break-even holders might start sweating and dump their bags, which could snowball quickly.

Support’s Holding—But Just Barely

ETH has dipped into that $3,458–$3,490 range, which previously sparked a reversal. It’s a good support zone… but it’s also showing cracks. The MACD just flipped bearish on the daily chart. That’s not a great look. The signal line crossed above the MACD line, a classic sign that bullish momentum’s fading fast.

If buyers don’t step up soon, the floor might fall out. And if that happens? ETH could slide all the way to $2,906—a drop that could sting real bad.

Whale Moves: Wild, Unpredictable, and Nerve-Racking

To make things messier, whale flows are all over the place. A 7-day spike of 8,294% in netflows just reversed a -2,854% decline over 90 days. That kind of swing doesn’t scream confidence. Whales seem nervous or unsure, maybe adjusting to macro stuff or just profit-taking.

This randomness isn’t helping market structure at all. It’s adding noise, making price action harder to trust. If whales keep pulling out while the chart keeps bleeding, ETH could be in for more rough waters ahead.