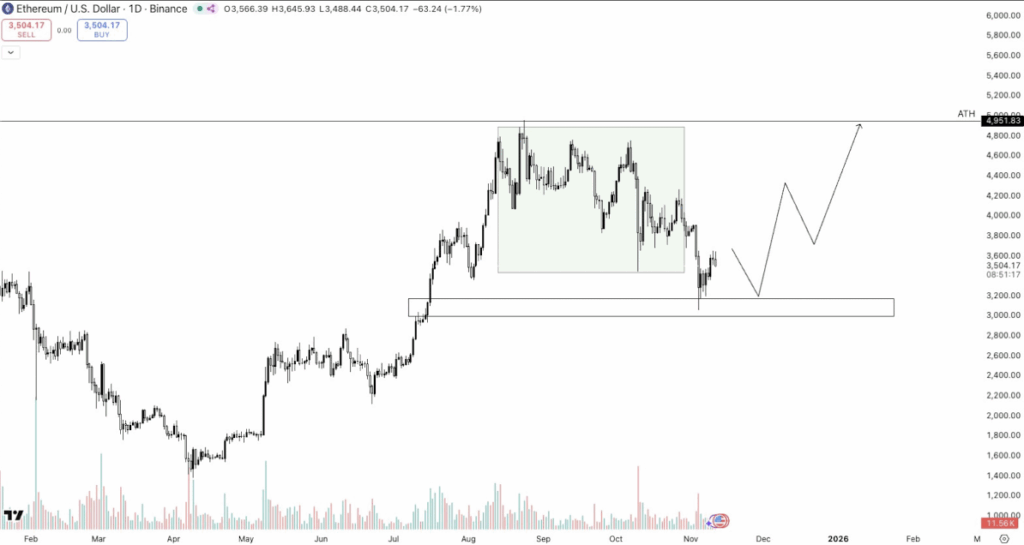

- Ethereum is consolidating around the $3,500 zone after a dip, with bulls fiercely defending the key $3,000 support, keeping the door open for a potential rebound toward the $4,300 area if that floor doesn’t break.

- On-chain data shows renewed whale and institutional interest, including a single buyer scooping up over 75,000 ETH (~$269M) plus more than $1.37B in November accumulation, hinting that big money is quietly positioning for the next leg.

- Short term, ETH must reclaim and flip the $3,700 region from resistance back into support, while holding the $3,520–$3,348 band, with upside momentum likely to strengthen further if Bitcoin also pushes higher.

Ethereum is back in that familiar “holding the line” phase. After a sharp dip and a stretch of choppy trading, ETH is showing fresh signs of resilience, with traders zooming in on a few support zones that could decide the next big move. Price has been hovering around the 3,500 dollar area, and both retail and institutional players seem to be quietly paying attention again, not quite euphoric, but definitely not checked out either.

For now, the big line in the sand is still the 3,000 dollar level. Analysts keep circling this zone as the crucial base for the current bullish structure. If it holds, the broader narrative points toward a potential push back up toward the 4,300 region in the coming weeks. Market activity feels like cautious optimism: whales are nibbling, ETF flows are still coming in, and even with short-term volatility, confidence hasn’t completely cracked.

Price Chops Around $3,500 In A “Healthy” Pullback

After a mid-November slide down toward roughly 3,400 dollars, Ethereum slipped into a consolidation phase, hovering near the 3,500 handle. Crypto analyst Crypto Caesar summed it up pretty well, noting that momentum has cooled, but bulls are still defending that broader range quite aggressively. At the moment, ETH trades around 3,564 dollars, showing small daily losses while volume picks up beneath the 3,590 mark.

On the charts, this looks a lot like a range-bound reset rather than a full-on breakdown. Many analysts see it as a “healthy pullback” inside a bigger uptrend that started when ETH bounced from the 2,800 lows earlier in 2025. As long as the 3,000 dollar support doesn’t crack, the structure leaves room for Ethereum to re-align with that larger trend and attempt another leg higher toward 4,300. If that floor gives way, though, the tone flips quickly from “healthy” to “uh-oh.”

Whales Quietly Stack ETH As Institutions Re-Engage

While retail traders argue over levels on social media, on-chain data shows the bigger wallets making clear moves. Recent flows highlight renewed accumulation from what looks very much like institutional and deep-pocketed buyers. One verified whale, for example, snapped up 75,418 ETH in just 12 hours via Binance — roughly 269 million dollars worth — bringing total holdings to about 266,901 ETH, valued close to 949 million dollars.

Market analyst Ted Pillows commented that whales “are becoming interested in Ethereum again,” which is usually a polite way of saying big money is positioning early. These buys aren’t happening in isolation either. Across November, whales reportedly accumulated more than 1.37 billion dollars in ETH even as the price dropped around 12%. That kind of behavior often acts as a soft bottom signal: it doesn’t guarantee an immediate moonshot, but it does say the smartest wallets don’t see this range as overvalued.

The $3,700 Level Flips From Friend To Foe

Support isn’t the only story here; resistance is getting stubborn too. Market commentator Sjuul from AltCryptoGems pointed out that the 3,700 dollar zone — which previously acted as reliable support — is now at risk of flipping into resistance. The Bitfinex ETH/USDT chart highlights at least three bounces from this horizontal band since late October, making it a pretty important line in the sand.

Right now, ETH is trading just below it, near 3,565 dollars. That leaves Ethereum in a slightly awkward spot: strong enough not to fall apart, not strong enough to break cleanly above. The short-term outlook from many traders is “carefully bullish but not blind.” A decisive move through 3,700 with volume could open up a clearer path higher, while repeated rejections there might trap price in a frustrating sideways chop or trigger another leg down before any meaningful rally.

Short-Term Technicals: Support Bands And Wave Counts

On lower timeframes, intraday analysis shows Ethereum hovering over a support band between roughly 3,520 and 3,348 dollars. There’s also a cluster of long liquidation leverage stacked between about 3,507 and 3,460, which means if price slides into that area, you could see some sharp wicks as leveraged longs get flushed.

Elliott Wave projections from traders like pejman zwin suggest ETH is finishing up a corrective wave, potentially setting the stage for renewed bullish momentum once the structure completes. Immediate resistance zones are marked near 3,631, 3,665, and 3,707 dollars. If Ethereum can chew through those levels, especially with Bitcoin pushing higher at the same time, the probability of a sustained rebound improves noticeably. BTC’s behavior still plays the role of “big brother” here; if it breaks up, ETH often follows.

Outlook: ETH Still At The Heart Of The 2025 Bullish Narrative

Big picture, Ethereum is still sitting right at the center of most 2025 bull cycle conversations. The 3,000 dollar support level, plus steady whale accumulation and continued ETF inflows, gives ETH a sturdier base than the day-to-day noise might suggest. On-chain data remains supportive too: around 32% of the total ETH supply is staked, and more than 15 billion dollars has flowed into Ethereum ETFs since approvals in 2024, which is a pretty strong vote of confidence.

At last check, ETH was trading near 3,477.63 dollars, down just under 1% over the last 24 hours — nothing dramatic, just more chop. Going forward, traders are being told to watch three things closely: key support and resistance levels, whale behavior, and Bitcoin’s trend. Those three signals together will likely dictate whether Ethereum grinds sideways, breaks lower briefly, or finally makes a convincing run toward 4,300 and beyond.

For now, the consensus tone is cautiously optimistic. No one is calling victory yet, but very few serious analysts are writing Ethereum off either. If support keeps holding and large buyers stay active, ETH still has a real shot at revisiting its highs — and maybe even writing new ones — before this cycle is over.