- Ethereum remains locked in a broader downtrend as whale selling and ETF outflows weigh on price

- A major ETH whale locked in over $15 million in profit while institutions pulled more than $500 million from spot ETFs

- Price is testing a key Fibonacci support zone, with early signs that sell pressure may be easing

Ethereum hasn’t caught a break lately, and the broader market isn’t helping. As risk appetite faded across altcoins, ETH stayed pinned under pressure, unable to build anything more than short-lived bounces. After topping out near $4,900 earlier in the cycle, the trend slowly rolled over. At press time, Ethereum was trading around $2,856, down 2.36% on the day and roughly 10% over the week, a stretch that’s clearly testing patience.

That prolonged slide seems to be changing behavior at the top end of the market. Both large holders and institutions are starting to step back, and the data is showing it pretty clearly.

Whales start locking in profits

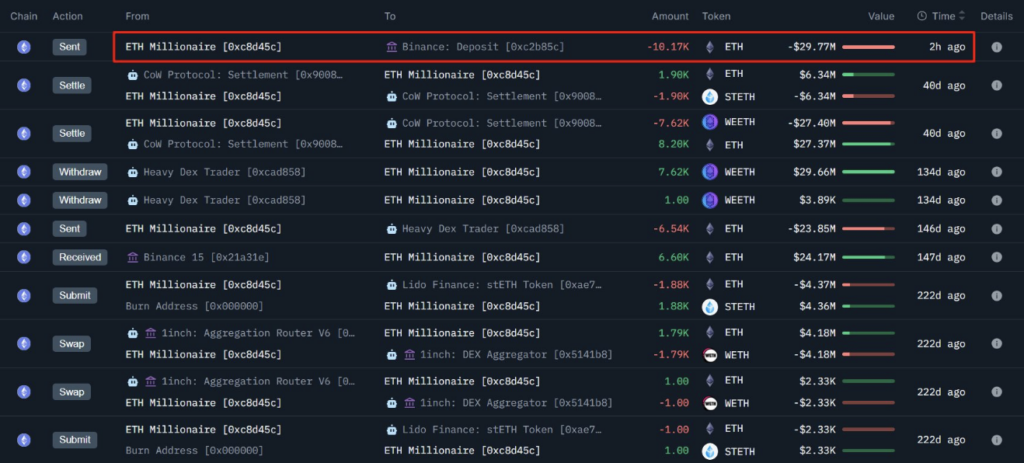

On-chain activity revealed that at least one major Ethereum whale decided it was time to take money off the table. According to Onchain Lens, the address deposited 7,654 ETH, worth about $21.6 million, into Binance. Lookonchain later confirmed that this move locked in close to $4 million in profit.

What’s more interesting is that this wasn’t a one-off. Just hours earlier, the same whale had already sent 10,169 ETH, valued near $29.8 million, to the exchange, realizing another $11.3 million gain. Combined, that’s 17,823 ETH, roughly $51.4 million, moved to Binance in a short window.

Digging deeper, the strategy looks calculated. The whale originally withdrew 19,505.5 ETH, staked the assets, and later redeposited 20,269 ETH, picking up around 763 ETH in staking rewards along the way. After the latest transfers, total realized profit sits near $15.4 million.

Historically, this kind of selling during an established downtrend often signals caution rather than panic. Big holders tend to exit when they see limited upside ahead and want to protect gains, not when they expect a quick rebound.

Institutions pull back even harder

While individual whales are trimming exposure, institutions appear to be heading for the exit in a more coordinated way. Data from SoSoValue shows Ethereum spot ETFs have now recorded net outflows for five straight sessions. Over that short span, cumulative outflows reached roughly $533 million.

On December 17 alone, ETFs saw about $22.4 million leave the market. In just five days, total assets across Ethereum spot ETFs dropped from around $21 billion to $17 billion, a $4 billion contraction that’s hard to ignore.

Sustained outflows like this usually point to reduced conviction. Institutions don’t rush in and out lightly, so a steady sell-side bias suggests many are bracing for continued weakness, or at least choosing to sit this phase out.

Breakdown risk meets early stabilization signals

Price action reflects that uneasy balance. Sellers continue to defend higher levels aggressively, while buyers struggle to keep rallies alive. That tug-of-war has kept ETH locked in its broader downtrend.

Momentum indicators lean bearish. The Stochastic Momentum Index has slipped deep into oversold territory, a sign that downside pressure has been intense and persistent. ETH is currently hovering just above the 0.618 Fibonacci retracement near $2,807. If that level gives way, the next major zone sits closer to the 0.786 retracement around $2,633.

Still, there’s a small shift worth noting. Exchange netflows flipped sharply negative, dropping to roughly -47,100 ETH from about +46,000 ETH the day before. That swing suggests fewer coins moving onto exchanges, and potentially, reduced immediate selling pressure.

If buyers can defend the $2,807 area, Ethereum may attempt a short-term rebound toward $2,929. Any stronger recovery would likely run into resistance near the $3,200 region. For now though, ETH remains stuck between heavy skepticism and early signs that sellers may finally be slowing down, just a bit.