- A whale with a flawless 100% win rate opened a $131M long position on Ethereum, signaling strong bullish conviction.

- Ethereum exchange reserves hit multi-year lows as holders move coins off exchanges, creating a potential supply squeeze.

- Analysts, including Tom Lee, project ETH could surge to $12K–$22K amid growing institutional adoption and DeFi expansion.

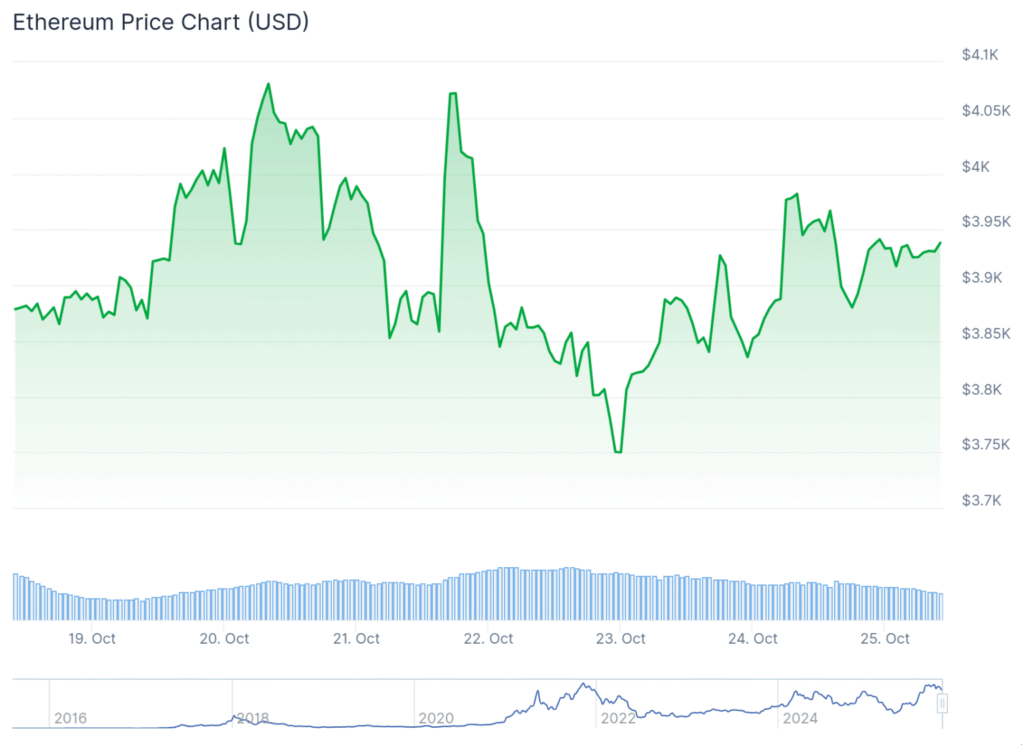

Ethereum just crossed back above the $4,000 mark, and one whale seems absolutely certain it’s headed higher. The trader — who reportedly has a perfect win rate — opened a massive long position worth $131 million, betting big that ETH still has room to run. At the same time, exchange reserves have fallen to multi-year lows, tightening supply and setting the stage for what could be a serious price squeeze if momentum continues.

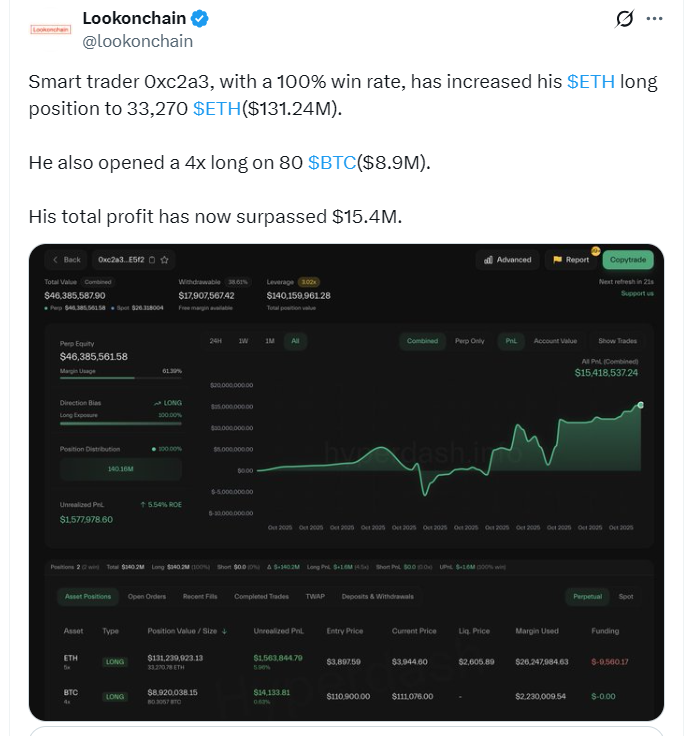

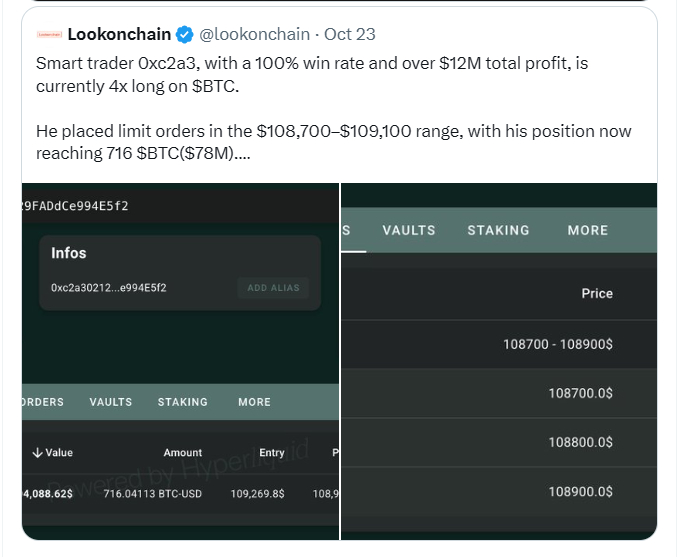

A Perfect Track Record Meets a Massive Bet

This trader’s history is something out of a legend — a 100% win rate across all recorded positions. According to on-chain data, they’ve now added 33,270 ETH to their portfolio, all long, valued at just over $131 million. They’ve also gone long on 80 Bitcoin with 4x leverage, worth nearly $9 million. In just the past two weeks, the trader has locked in $16 million in profits, showing a consistent ability to time the market when others hesitate. Their latest bet suggests confidence that Ethereum isn’t done climbing — not by a long shot.

Shrinking Exchange Supply Adds Fuel

ETH reserves on centralized exchanges are at their lowest levels in years. More holders are moving coins into cold storage, a classic sign of long-term confidence and lower selling pressure. When this happens, the market often sees sudden spikes — simply because there’s less ETH available for traders to sell. It’s a setup that could magnify any upward move, especially as retail traders begin chasing breakouts above $4,000. Right now, Ethereum’s market cap sits at roughly $478 billion, with $37 billion in daily trading volume.

Analysts Target $12K–$22K Long Term

Fundstrat’s Tom Lee remains one of the most bullish voices on Ethereum, predicting it could soar between $12,000 and $22,000 as institutional adoption grows and DeFi expands. Sentiment among traders backs that optimism — about 82% remain bullish, eyeing $4,300 as the next resistance and $3,800 as a firm support zone. If ETH can break above $4,100 in the near term, analysts say it could open the floodgates for a new leg higher, especially with whales already positioning ahead of the move.