- Ethereum hosts about $201 billion of the roughly $314 billion in tokenized assets across all chains, underscoring its role as the leading settlement layer in 2025.

- Stablecoins and tokenized funds, including products from giants like BlackRock and Fidelity, have driven a 2,000% surge in onchain fund AUM and helped anchor ETH’s $430B market cap to real economic activity.

- ETH exchange supply on Binance has fallen to its lowest level since May 2024, signaling accumulation and easing sell pressure, which could support future price upside if risk sentiment improves.

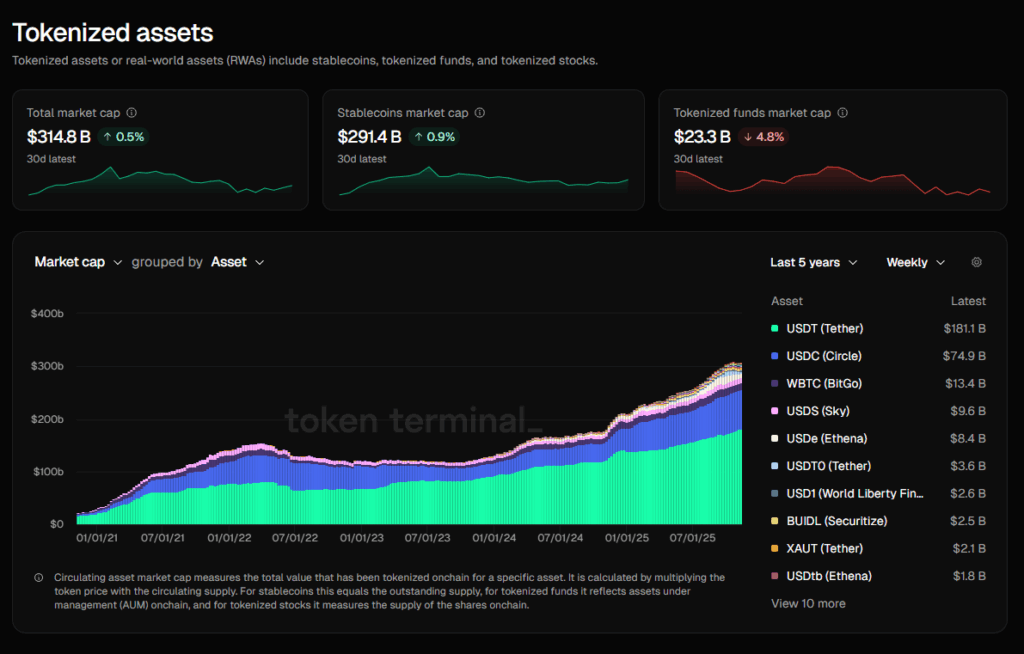

Ethereum’s role in the tokenized asset boom isn’t just a narrative anymore — it’s showing up in hard numbers. As of Nov. 11, tokenized assets across all blockchains total roughly $314 billion, and Ethereum alone accounts for about $201 billion of that stack. That’s nearly two-thirds of the entire market, and it firmly cements Ethereum as the most utilized settlement layer in crypto in 2025.

This growing dominance is reshaping how investors think about Ether (ETH) itself. Instead of valuing ETH purely as a speculative asset or “gas token,” more market participants are starting to see it as the base asset securing a massive onchain financial system — stablecoins, tokenized funds, real-world assets, and more.

In other words, the more value migrates onto Ethereum, the harder it becomes to treat ETH like just another altcoin. It’s increasingly the collateral and security layer for a big chunk of tokenized finance.

Stablecoins and Tokenized Funds Are Driving Real Onchain Demand

Under the hood, stablecoins are still the backbone of Ethereum’s economy. Combined USDT and USDC issuance on Ethereum continues to power deep liquidity across DeFi, exchanges, and cross-border payments, keeping transaction throughput among the highest in the industry.

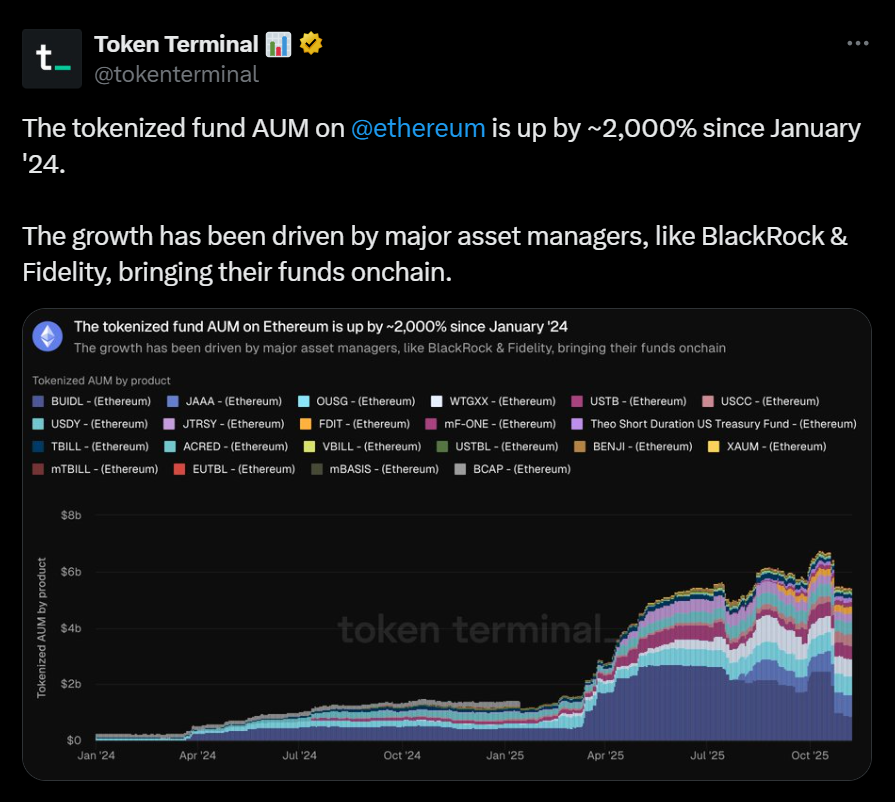

But the story now goes way beyond stablecoins. Tokenized fund AUM on Ethereum has surged nearly 2,000% since January 2024, fueled by institutional players like BlackRock and Fidelity bringing traditional products onchain. What used to live only in brokerage accounts is now being wrapped, fractionalized, and moved onto Ethereum rails.

Fidelity Digital Assets has highlighted that, outside of Bitcoin and Ethereum themselves, some of the most important innovation in digital assets is happening in stablecoins and real-world asset (RWA) tokenization. Stablecoins processed around $18 trillion in volume over the past 12 months, even outpacing Visa’s $15.4 trillion annual throughput — a pretty wild signal of how quickly onchain money movement is catching up to traditional rails.

RWAs are also becoming Ethereum’s fastest-growing category. Tokenized treasuries, funds, and credit products on Ethereum now total roughly $12 billion, about 34% of the global $35.6 billion RWA market. Protocols like Ondo, Centrifuge, and Maple are pulling in capital by offering yields in the 4–6% range on tokenized U.S. Treasuries and secured credit.

Analytics from Token Terminal even suggest that this trend is starting to anchor ETH’s valuation. With Ethereum’s market cap sitting near $430 billion, they’ve argued that the market cap of tokenized assets on Ethereum effectively sets a “floor” for ETH’s own market cap — because the network is now tied to tangible, revenue-generating, onchain activity instead of pure speculation.

Falling Exchange Supply Signals Accumulation and Potential Upside

On the supply side, onchain and exchange data are painting a quiet but important picture for ETH itself. Data from CryptoQuant shows that ETH balances on Binance, the largest Ether trading venue by volume, have been falling sharply since mid-2025, reaching their lowest level since May 2024. After peaking early in the summer, the ETH exchange supply ratio dropped steadily into November, landing around the 0.0327 level.

This kind of persistent outflow is usually associated with accumulation. Coins moving off exchanges into cold storage or long-term wallets means fewer tokens are sitting on order books ready to be sold. At the same time, ETH’s price already topped out near the $4,500–$5,000 zone in August and September before cooling off to around $3,465–$3,500 now.

Analysts note that when exchange supply falls while network utility rises, it often reduces sell pressure and sets the stage for either price stabilization or a renewed move higher, assuming risk appetite doesn’t completely evaporate. With Ethereum now hosting hundreds of billions in tokenized assets and RWAs accelerating, the fundamental backdrop looks a lot more like “core financial infrastructure” than a passing trend.