- Ethereum surged 17% this week, reclaiming $4,500 and targeting the $4,700–$6,000 range as bullish momentum builds.

- RSI and MACD indicators show strong buying pressure without overbought signals, hinting at more upside potential.

- Institutional players like Bitmine added $12B in Ether, fueling optimism for continued growth despite rising competition.

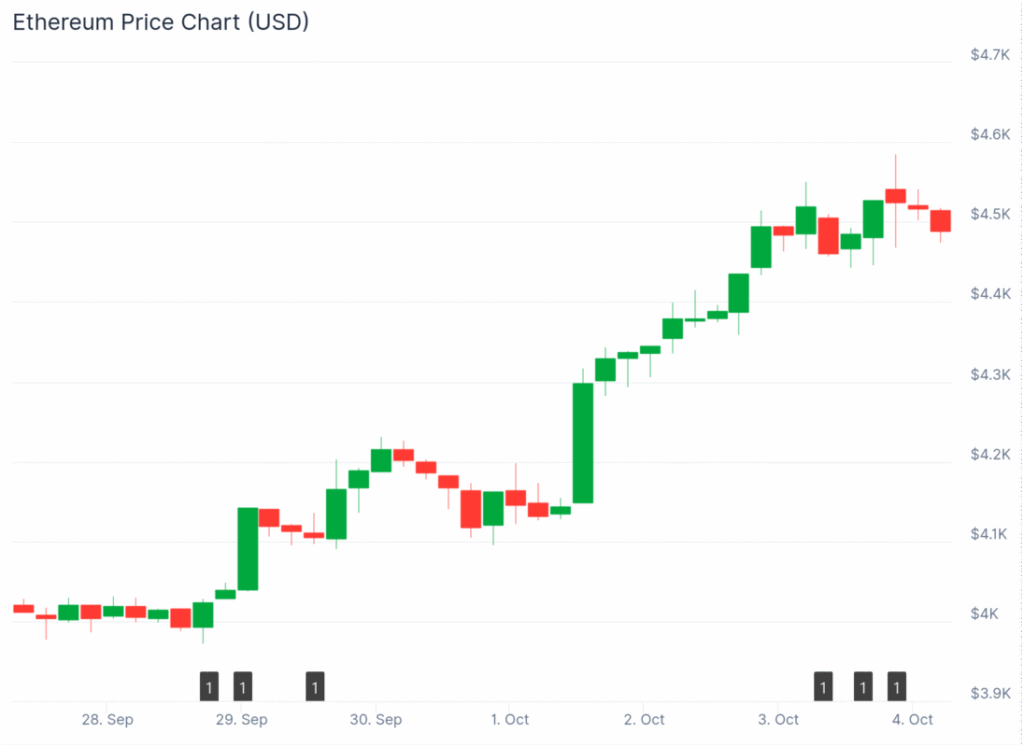

Ethereum is back in motion. The world’s second-largest cryptocurrency just posted a 17% weekly gain, pushing prices near $4,488 as traders eye a move toward the $4,700–$6,000 range. It’s the first time ETH has climbed above $4,500 in two weeks, and analysts say the charts are looking surprisingly bullish.

Over the last 24 hours alone, Ethereum rose another 2%, carrying strong trading volume of $47 billion and open interest above $60 billion. Futures premiums are steady around 7%, which sits right in the neutral zone but hints at confidence building underneath. Momentum? Definitely growing.

Key Levels and Analyst Outlook

Market analyst Ted Pillows thinks $4,500 is the next big wall for ETH. He notes that a clean break above that resistance could open the door to $4,700—or even $4,750—before the next pause. On the flip side, failure to hold momentum could drag ETH back toward $4,250 in a short-term pullback.

Kamran Asghar, another well-followed analyst, believes we’re already seeing a confirmed breakout. His chart puts the next major target at $6,035, based on the Fibonacci 1.618 extension. Asghar calls this “a structural shift, not a spike,” suggesting the rally may have deeper legs than traders think.

Technicals Stay Strong

The technicals are painting a solid picture. The RSI is sitting at 57, showing strong buying demand without dipping into overbought territory. Translation—there’s still room to run. Meanwhile, the MACD is sitting comfortably in bullish territory, with a positive histogram that continues to widen.

Market sentiment seems balanced too. Options delta skew is holding in a neutral range between +6% and -6%, meaning traders aren’t leaning too heavily bullish or bearish. It’s the kind of steady setup that often precedes big directional moves.

Institutional Moves and Network Trends

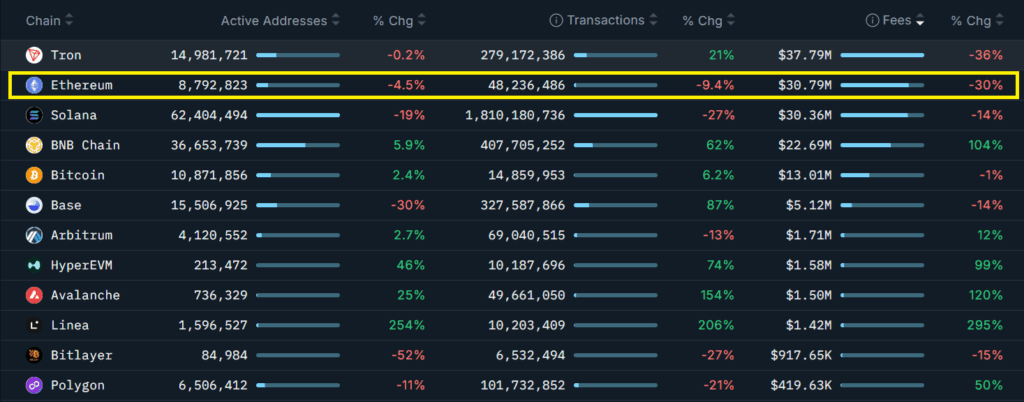

On the fundamentals side, Ethereum still dominates the DeFi landscape, locking up close to $100 billion in total value. But it’s not all sunshine. Network activity has cooled off a bit—transaction volume is down 10%, and fees have dropped around 30% month over month. Competitors like BNB Chain, Avalanche, and HyperEVM have seen their usage and fees surge by 60% or more, tightening the race across smart contract platforms.

Still, institutional interest in ETH keeps climbing. Bitmine Immersion Tech recently added nearly $12 billion worth of Ether through debt issuance and stock sales. That’s not small change. Analysts are calling it potential “supply shock” territory if more firms follow suit.

Meanwhile, Ethereum’s ecosystem continues to shift. Ethena’s synthetic stablecoin protocol saw an 18% bump in total value locked, Spark’s lending platform grew 28%, while Pendle took a 50% hit in deposits. The broader altcoin landscape is also heating up, with analysts placing 95% odds on Solana, Litecoin, and XRP spot ETFs getting approval next month.

The Bottom Line

Ethereum looks ready to keep pushing higher as technicals align and institutions quietly accumulate. The $4,500 mark remains the key battleground. A breakout could trigger a push toward $6,000—and with on-chain data showing no signs of exhaustion, the bulls might just have a little more gas left in the tank.