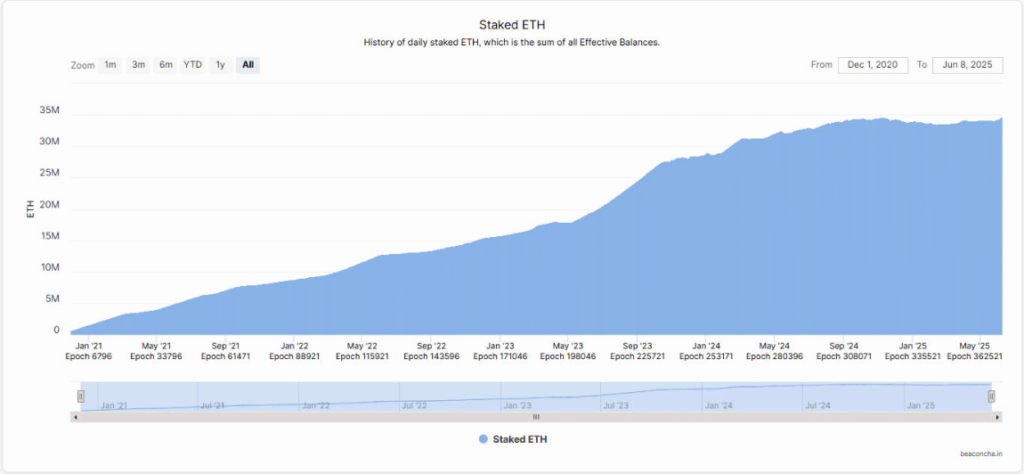

- Ethereum staking just hit an all-time high with 34.8M ETH locked, showing strong long-term confidence.

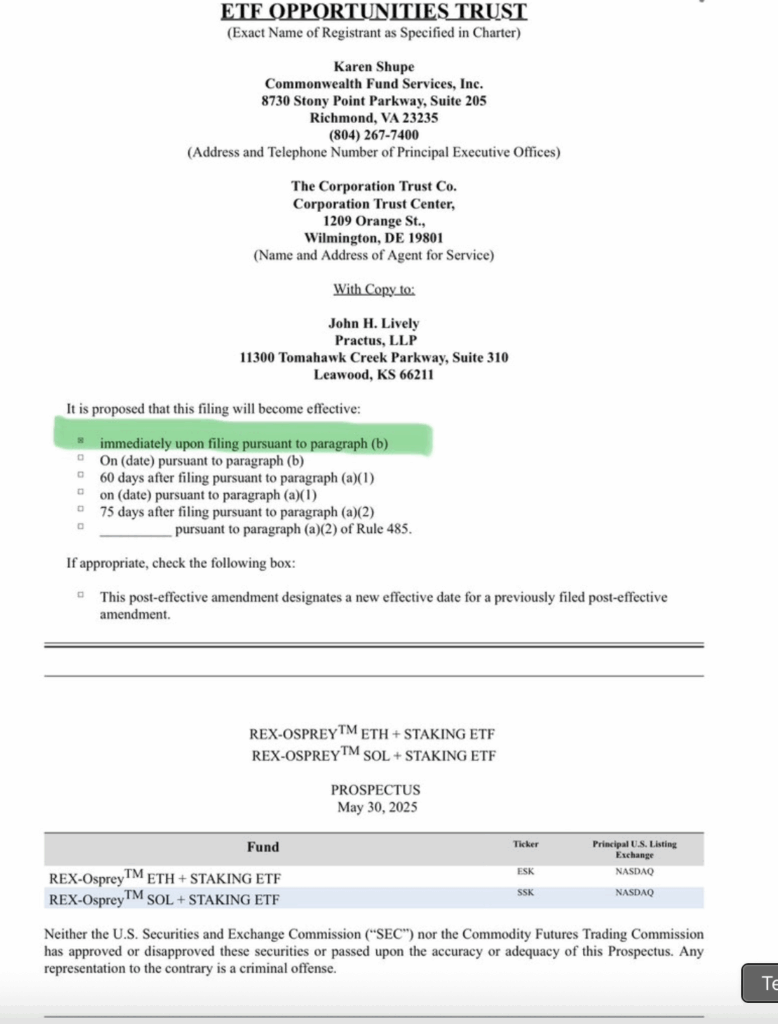

- ETF buzz is building, with staking-enabled ETH funds possibly launching in the coming weeks.

- ETH is gaining momentum, currently at $2,768 and may soon test $2,800–$2,900 resistance levels.

Ethereum’s been grabbing attention again—but this time, it’s not the usual price chatter or some shiny protocol upgrade. Nope, the big story now is staking. Nearly 30% of all ETH out there is currently locked up, marking an all-time high and sending a pretty clear signal: confidence is growing, and institutions might be sliding in, quietly but steadily.

As talk around spot Ethereum ETFs that include staking picks up steam, this shift feels bigger than just numbers. It’s about long-term commitment. People aren’t just betting on price pumps—they’re locking their ETH down, expecting solid returns over time.

34.8 Million ETH Staked—and Counting

Let’s break it down. As of June 8, Ethereum’s Beacon Chain saw staking hit 34.65 million ETH—a new record, beating out the previous high from November last year. And if you go by the numbers from Dune Analytics, that figure’s actually a bit higher, closer to 34.8 million ETH. That’s about 28% of the total circulating supply. That’s… a lot.

What’s wild is that staking levels were kinda flat for months, just hovering around 33 million. But this month, things shifted. The curve’s pointing up again—and it’s not just random.

Staking ETFs May Be Around the Corner

The real kicker? Everyone’s watching for Ethereum ETFs that include staking. And it’s not just wishful thinking—regulatory filings are starting to pop up. REX Shares is already trying to work around the usual SEC red tape. Meanwhile, BlackRock’s ETHA fund hasn’t seen a single outflow in 23 straight trading days. Not one.

If these staking ETFs go live, that’s gonna be a game changer. Suddenly, ETH isn’t just a crypto asset—it becomes a yield-bearing, Wall-Street-friendly investment. That’s the kind of shift that brings in serious capital.

ETH Price Pops, Eyes $2.8K and Beyond

So, what’s price doing in the middle of all this? ETH’s up more than 8% over the past 24 hours and sitting around $2,768 right now. That daily chart? It’s showing bullish momentum—strong green candles, an RSI at 65.39 (almost overbought), and OBV trending upward, which usually means buyers are still interested.

If the momentum holds, ETH could test $2,800 soon. And if bulls really push? A break to $2,900 might be in play. Still, short-term traders should watch the RSI—if it spikes too hard, a quick pullback could happen.