- ETH drops 8% to $3,940, triggering $115M in long liquidations.

- Analysts expect support at $3,800, followed by a potential rally toward $10,000.

- Weekly bull flag pattern still points to major upside once resistance breaks.

Ethereum (ETH) took a hit Tuesday, falling 8% from highs above $4,300 to around $3,940, sparking more than $115 million in long liquidations. Still, sentiment among traders remains strikingly bullish, with many calling the dip a “reset before the run.” Several analysts are now eyeing a massive breakout toward $10,000, provided ETH holds key support at $3,800.

Liquidations Shake Out Leverage, But Buyers Wait Below

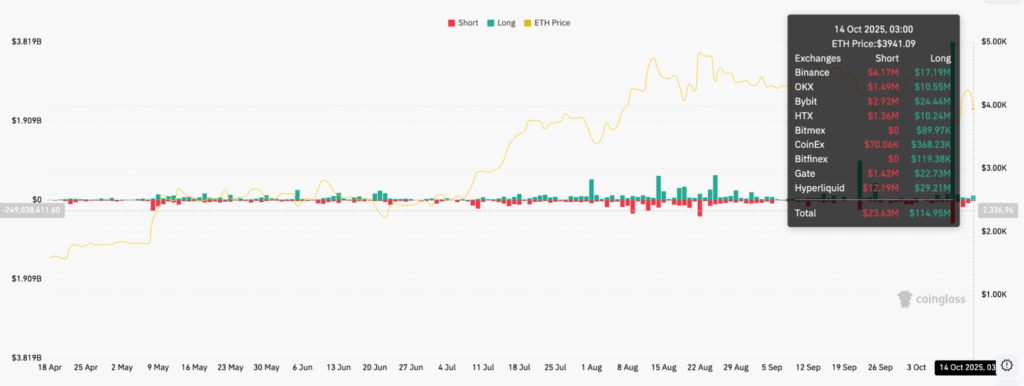

Data from CoinGlass shows over $650 million in total crypto liquidations over the past 24 hours — $455 million from long positions. ETH alone accounted for $114.5 million of that. The largest single liquidation order came from OKX, worth $5.5 million.

Interestingly, order books reveal that buyer interest clusters between $3,670 and $3,800, suggesting strong accumulation zones below current levels. Analysts believe this band could act as the “floor” before Ether gears up for its next leg higher.

Analysts Say ETH Is “Loading” for a New All-Time High

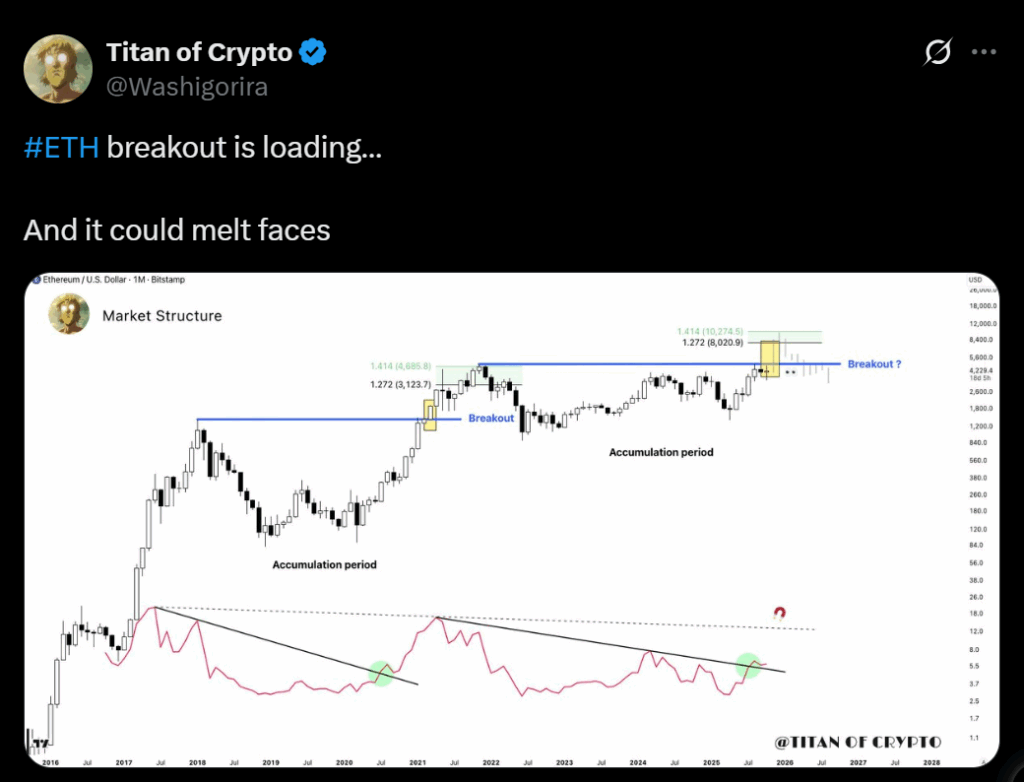

Market strategists like Michael van de Poppe and Titan of Crypto say ETH’s drop is a classic pullback inside a broader uptrend. Van de Poppe highlighted ETH/BTC’s bounce from 0.032 as a “perfect buy zone,” while Titan of Crypto noted that ETH’s RSI has broken out of a multi-year downtrend, a technical sign of long-term strength.

If history rhymes, ETH could be following a 2020-style fractal, which projects a move between $8,000 and $10,300 based on Fibonacci levels. The ongoing consolidation, they argue, is “simply reloading momentum” before the next big rally.

The Technical Picture: Bull Flag in Play

From a technical standpoint, ETH remains inside a bull flag on the weekly chart — a pattern that typically resolves in another major move upward. The lower boundary of the flag sits near $3,870, acting as current support. A breakout above $4,440 would validate the pattern and set a measured target of $10,050, roughly 164% higher than current prices.

That said, if ETH loses $3,800, it could slide to $3,500 as short-term traders take profits. Still, the broader setup remains bullish, with most analysts agreeing that Ethereum’s next leg — when it comes — could be its most explosive yet.