- Ethereum has rebounded over 15%, forming a bull flag pattern above key support at $3,900.

- On-chain data shows ETH stabilizing near a historic rally zone, signaling strength toward a potential breakout.

- Analysts target $4,500 in the short term, with $3,550 as the critical support level to watch.

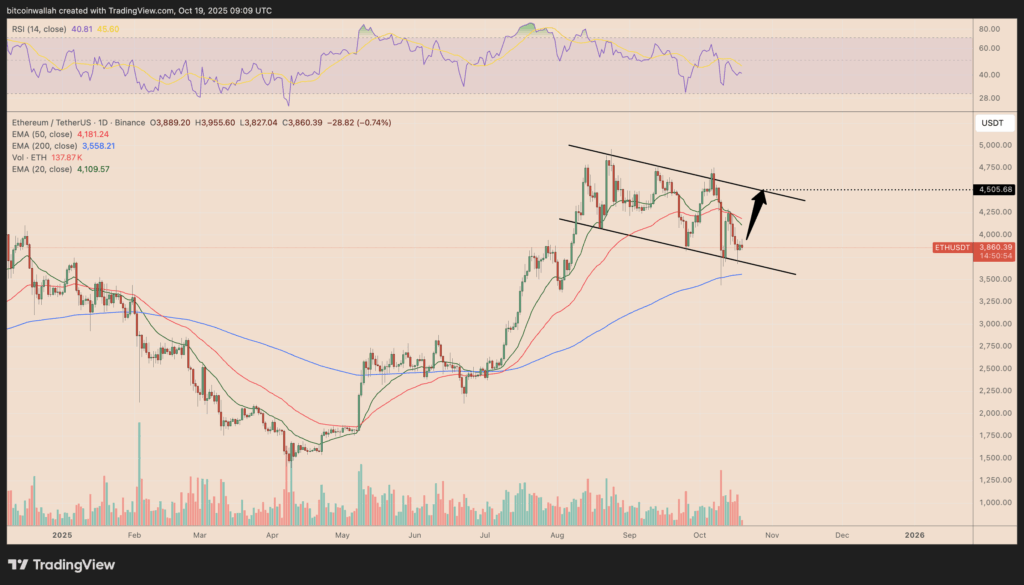

Ethereum is quietly regaining momentum. After dipping to $3,435 just two weeks ago, ETH has climbed more than 15%, now holding steady above $3,900. Traders are starting to believe this recovery might be the start of something bigger. The charts show a clean bull flag pattern forming, and if support holds, Ethereum could be heading toward $4,500 by the end of October.

Bull Flag Formation Points to a Breakout

ETH’s current setup looks promising. The token is moving inside a bull flag—a pattern that often signals continuation in an uptrend. The rebound began right around $3,500, which also aligns with the 200-day EMA, a level that’s acted as long-term support during past rallies. If ETH manages to break through the upper flag boundary, the next target sits around $4,450 to $4,500.

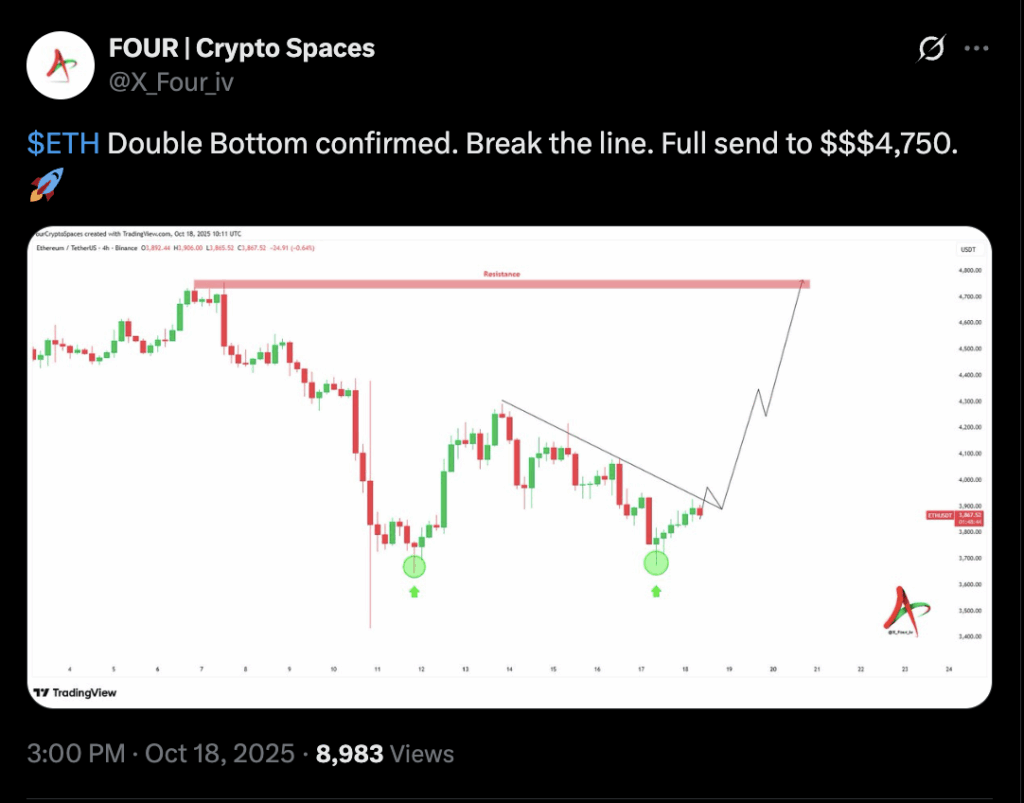

Analysts have also spotted a possible double bottom pattern forming, suggesting even stronger upside potential. If momentum continues, ETH could test resistance near $4,750 later this month. Still, traders are cautious; the market needs sustained volume and follow-through for a confirmed breakout.

On-Chain Data Signals Stability

Ethereum’s MVRV deviation bands show the token stabilizing around $3,900—an area historically known for strong rebounds. Each time ETH settled near this level in the past (2021, 2023, 2024), it eventually made a sharp move upward, sometimes reaching the +1σ band, which now hovers around $5,000.

Analysts say this phase looks more like a healthy correction within a bigger bullish trend than a reversal. As long as ETH stays above $3,550, the structure remains intact, keeping the bull flag alive.

Traders Eye $4,500 as Short-Term Target

Several market watchers, including analysts Luca and FOUR, agree that $4,500 is the next key level to watch. Luca points out that ETH is holding above its “weekly bull market support band,” suggesting that buyers still have control. FOUR’s chart highlights a neckline resistance near $4,750—if ETH pushes past $4,500, that could be the next zone to test.

A confirmed breakout could even open the door to $5,200, according to some technical projections. But the market’s still fragile, and one misstep below support could flip sentiment fast.

Support Levels and Risks Ahead

Despite all the optimism, there’s still risk on the table. The $3,550 region remains crucial—it’s where both the 200-day EMA and the bull flag’s lower edge meet. A break below that could drag ETH toward $3,000–$3,200, erasing recent gains and invalidating the bullish structure.

For now, though, buyers seem to be holding the line. If Ethereum can keep momentum above $3,900 and push through $4,200 in the coming days, a strong move toward $4,500 looks more likely than not.