- Standard Chartered raised its ETH year-end target from $4,000 to $7,500, citing institutional accumulation and stablecoin growth.

- Corporate treasuries and ETFs have acquired 3.8% of ETH supply since June, outpacing bitcoin’s fastest accumulation rates.

- Bank projects ETH hitting $25,000 by 2028, fueled by regulation, DeFi growth, and expanded Layer 1 capacity.

Standard Chartered has taken a much more aggressive stance on Ethereum, hiking its 2025 price target by a hefty 87.5% to $7,500. The bank says a lot has changed since its earlier $4,000 projection back in March — namely, a surge in institutional buying and a powerful new stablecoin narrative.

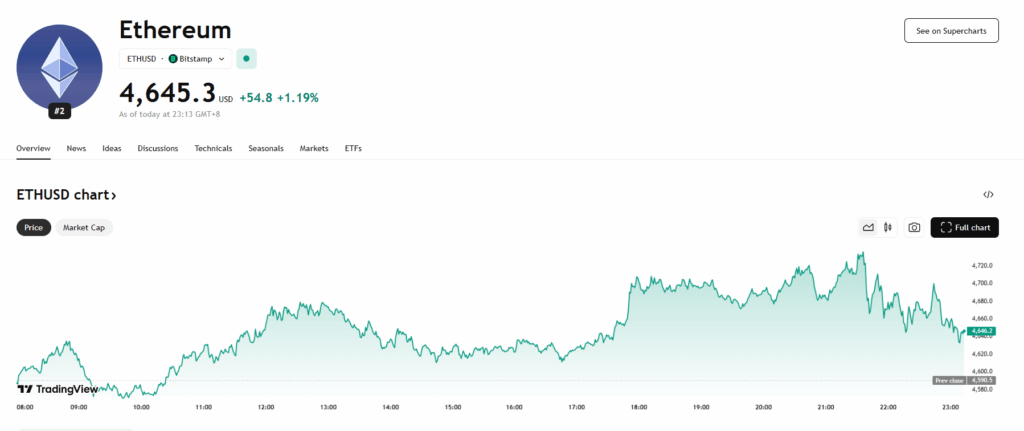

The revised forecast puts ETH well past its 2021 all-time high of $4,891, with the bank expecting it to close the year roughly 59% above current levels near $4,707. Geoff Kendrick, head of digital assets research, says the combination of tighter supply and stronger demand makes the setup “decidedly bullish.”

Institutional Hoarding Tightens ETH Supply

Ethereum’s rally has been fueled by a new wave of corporate buyers — treasury firms snapping up tokens for long-term holdings. These entities have locked down 2.95% of the entire ETH supply, outpacing the accumulation pace seen in bitcoin by nearly double during the last U.S. election cycle.

Leading the charge is Bitmine with 1.2 million ETH worth around $5.4 billion. SharpLink follows with roughly 598,800 ETH ($2.82 billion), and Ether Machine has piled up 345,400 ETH ($1.63 billion).

Adding to the squeeze, U.S. spot Ethereum ETFs have also been vacuuming supply. On Aug. 11, they pulled in a record $1.02 billion in a single day. Together, ETFs and corporate treasuries have amassed 3.8% of the supply since June.

Stablecoin and DeFi Growth Add Fuel

The bank’s thesis leans heavily on Ethereum’s dominance in the stablecoin sector — now supercharged by the passage of the GENIUS Act in July. This legislation gives clearer rules for stablecoin issuance, making it easier for institutions to participate.

Standard Chartered projects the stablecoin market will balloon to $2 trillion by 2028, and with Ethereum holding more than half that market today, it stands to capture a massive slice of future transaction fees. Stablecoins already account for about 40% of all Ethereum network fees, a key revenue driver for validators and stakers.

Fundstrat’s Tom Lee has called Ethereum’s positioning here “the biggest macro trade of the decade,” and others like Mr. Xoom see $10,000 ETH as possible in the near term.

Looking Further Out: $25,000 in 2028

Beyond this year’s $7,500 target, Standard Chartered sees ETH continuing higher: $12,000 by 2026, $18,000 in 2027, and topping out at $25,000 by 2028, where it could hold into 2029. The bank also forecasts Ethereum maintaining an average ETH/BTC ratio of 0.0445 over that period.

While some analysts have even bolder predictions, Standard Chartered’s updated outlook reinforces the growing consensus that Ethereum is entering a new era of institutional-led growth.