- Ethereum whales bought 30,432 ETH worth $141M, signaling strong accumulation despite the price dip.

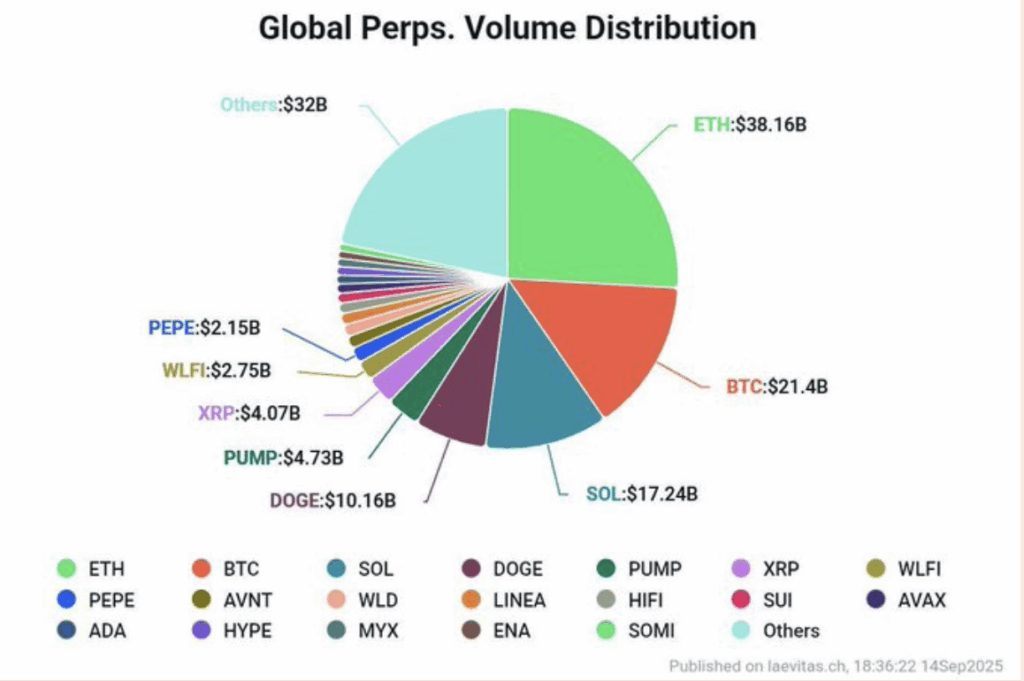

- ETH trading volume ($38.1B) surpassed Bitcoin’s ($21.4B), showing growing altcoin dominance.

- On-chain data shows $244M in ETH outflows and 60% of traders betting long, supporting a bullish outlook.

Ethereum jumped 11% last week, reaching highs near $4,760 before correcting back to $4,520. Despite the pullback, on-chain trackers show whales are quietly stacking. Over the last 24 hours, large holders scooped up 30,432 ETH, worth around $141.6 million. This suggests strong conviction that the dip could be short-lived.

Ethereum Trading Volume Surpasses Bitcoin in Perps Market

Altcoins have taken the spotlight, with ETH leading the charge. Data from Laevitas shows altcoins made up over 85% of perpetual trading volume in the past day. Ethereum topped the charts at $38.1 billion, far above Bitcoin’s $21.4 billion. Solana and Dogecoin followed with $17.2 billion and $10.1 billion, respectively. This shift underlines growing bullish confidence in Ethereum versus Bitcoin.

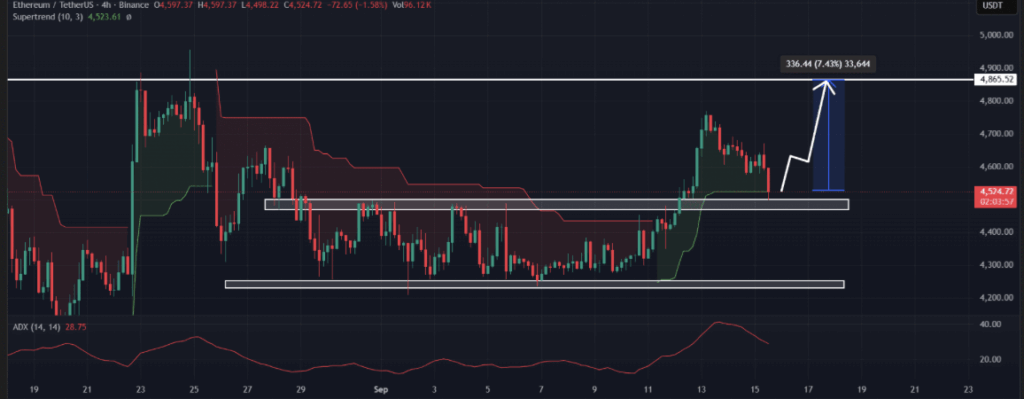

Ethereum Price Prediction: Can ETH Defend $4,500 Support?

Technical signals remain favorable, with ETH still riding an uptrend on the Supertrend indicator. Analysts highlight the $4,490–$4,500 range as key support. Holding this zone could spark a fast move toward $4,865, representing another 7.5% upside. The ADX reading of 28.75 points to strengthening momentum, reinforcing the bullish case if buyers defend support.

On-Chain Data Shows Accumulation as ETH Outflows Spike

CoinGlass reports $244 million worth of ETH leaving exchanges in the past 48 hours, suggesting strong accumulation. At the same time, Binance’s ETH/USDT long-to-short ratio sits at 1.5, with about 60% of traders betting long. Combined with whale buying, the on-chain data signals traders expect Ethereum’s uptrend to continue.