- Ethereum is approaching a potential breakout as price tightens near the top of a descending wedge

- Network activity is rising sharply, with new address creation jumping over 100% in recent weeks

- Mid-term holders may provide short-term support, but could add selling pressure as ETH rises

Ethereum is slowly, almost stubbornly, pressing higher, now trading near the upper edge of a descending wedge that’s been forming for weeks. It’s not a dramatic surge, more of a patient grind, but price is getting uncomfortably close to a breakout zone. Traders are watching closely, because moves like this tend to resolve one way or another, and usually with force.

Much of the recent momentum is being linked to the Fusaka upgrade, which went live on December 3. The upgrade focuses on improving scalability and lowering Layer 2 costs, an issue Ethereum has wrestled with for a long time. With market participants already positioning for 2026, these changes are landing at a moment when confidence is slowly rebuilding, not exploding, but stabilizing.

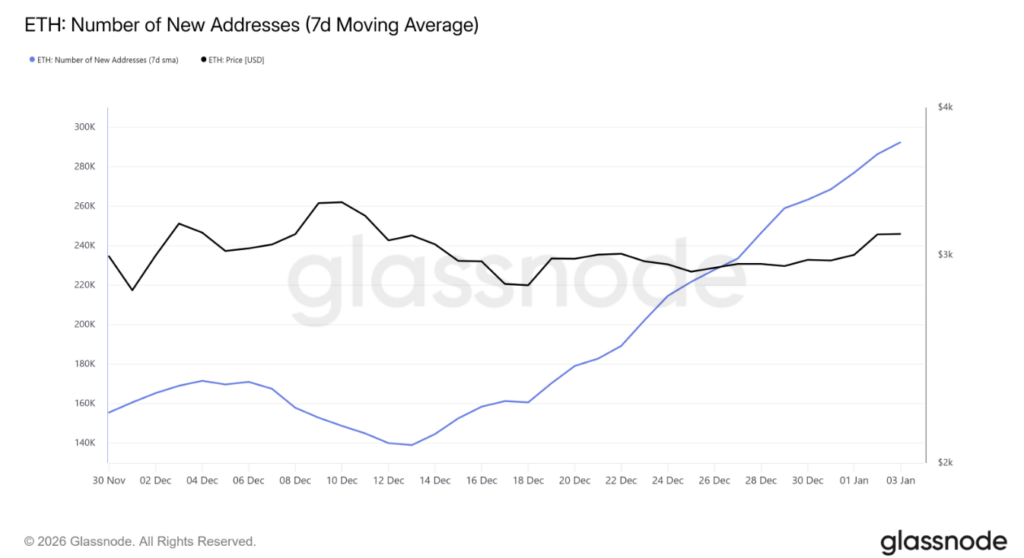

Network Activity Picks Up as New Users Arrive

On-chain data shows Ethereum’s network activity has picked up sharply over the past three weeks. New address creation, wallets interacting with ETH for the first time, has jumped by roughly 110% in that period. That’s not a small bump, it’s a noticeable acceleration.

Ethereum is now adding close to 292,000 new addresses per day. Some of that is likely seasonal, holiday trading, year-end positioning, the usual stuff. But optimism around the Fusaka upgrade also appears to be pulling users back into the ecosystem. Not every new wallet becomes a long-term holder, of course, but growth at this pace often feeds into higher transaction demand over time.

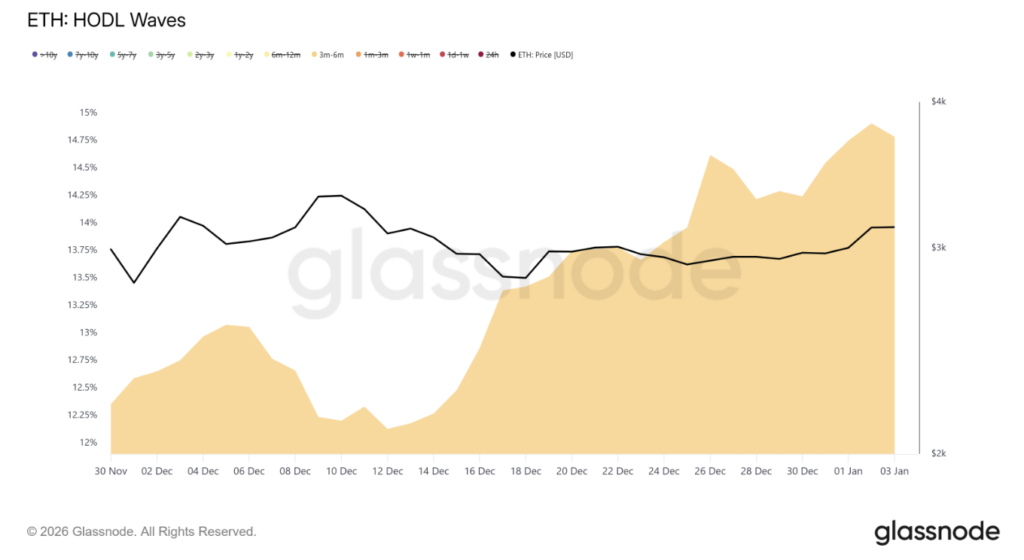

Mid-Term Holders Add a Layer of Support, and Risk

Zooming out, Ethereum’s HODL Waves reveal an interesting dynamic. Wallets holding ETH for three to six months have grown noticeably, meaning a large chunk of supply entered the market between July and October 2025. Early July buyers are sitting on gains, while those who entered later remain underwater.

This creates a kind of forced patience. Many holders aren’t eager to sell at a loss, which reduces near-term sell pressure and can help support price during pullbacks. That’s the good part. The flip side is that as ETH climbs back toward break-even levels for these holders, selling pressure could reappear. Any sustained upside will likely need fresh demand to absorb that potential distribution.

Price Action Tightens Near a Breakout Zone

From a technical standpoint, Ethereum remains locked inside a descending wedge that began forming in early November. ETH is currently trading around $3,141, placing it right near the structure’s upper boundary. When price compresses like this, it often sets the stage for a directional move, though the direction isn’t guaranteed.

Based on the wedge projection, a full breakout could theoretically target the $4,061 area, implying roughly 29.5% upside. That’s a stretch without a surge in buying pressure. A more realistic near-term scenario would see ETH break out and push above $3,287, opening the door toward $3,447 if momentum builds.

Downside Still Lurks If the Setup Fails

None of this comes without risk. If macro conditions worsen or buyers hesitate, a rejection at resistance could send Ethereum back below the $3,000 mark. In that case, a retest of support near $2,902 becomes likely, and the bullish setup would lose credibility.

For now, Ethereum sits in a delicate balance. Adoption is rising, upgrades are in place, and price is pressing higher, but confirmation is still missing. The next move, whichever way it goes, is likely to define sentiment well into early 2026.