- ETH is struggling in Q4, posting its worst quarterly performance vs. BTC since 2019, but long-term holders aren’t selling.

- Staking continues to hit new all-time highs, with over 36.27M ETH locked despite heavy price weakness.

- Historical patterns and a stabilizing ETH/BTC ratio suggest a potential year-end rebound similar to 2018.

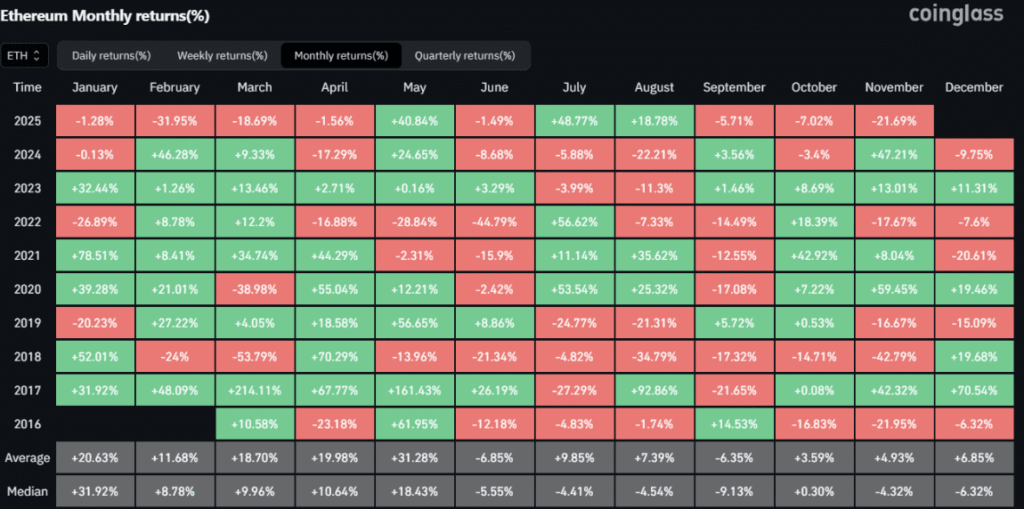

Ethereum has been wobbling around the $3,000 mark lately, almost like it’s hanging on by its fingertips, and yet… it keeps holding. Price-wise, Q4 has been rough. ETH is lagging behind Bitcoin, dropping about 28% this quarter—its most bearish performance against BTC since 2019. November alone delivered nearly 75% of those losses, making it ETH’s harshest monthly drop since that brutal -42.79% move back in 2018. On paper, it looks ugly. But charts sometimes hide the real story behind the noise, and zooming in reveals something a little more interesting.

Long-term conviction stays strong as staking hits fresh highs

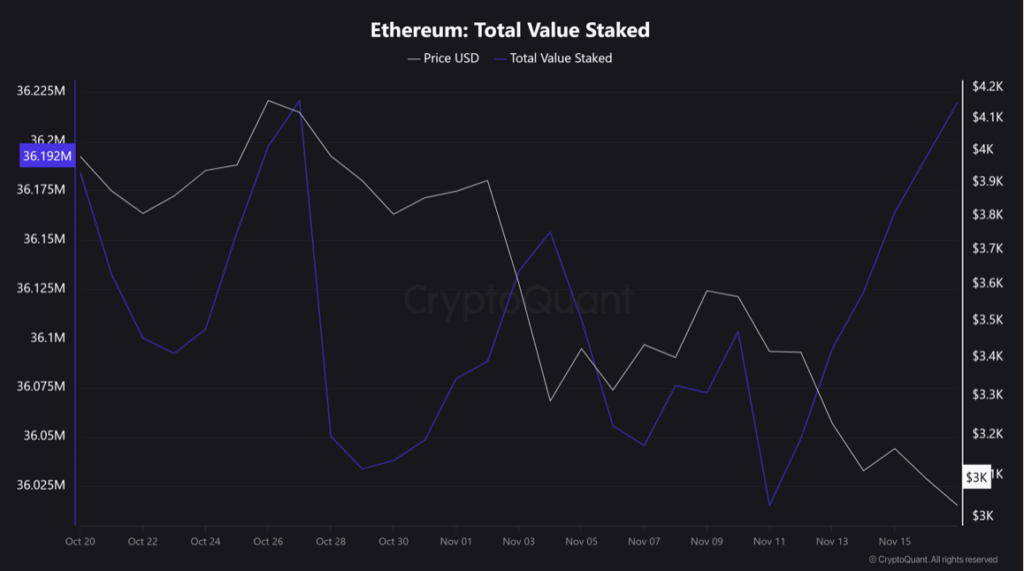

Even while price action looks shaky, long-term holders aren’t budging. Ethereum’s staking ecosystem is hitting all-time highs, with Total Value Staked now sitting around 36.27 million ETH. Roughly 200,000 ETH were added just this week—which is pretty wild for a market that’s supposedly “bleeding.” This kind of steady accumulation usually hints that conviction remains intact, even if the market mood feels risk-off. In simple terms: people who matter aren’t looking to bail. They’re positioning.

The fact that staking continues rising during one of ETH’s toughest months sends a quiet but powerful signal. Weak hands may have been flushed out, leverage unwound, but long-term holders still see value here. That’s usually how bottoms begin forming, even if it doesn’t feel like it in real time.

A historical pattern that keeps reappearing

There’s also this interesting echo from the past. In 2018, Ethereum suffered a massive -42% quarterly drop—very similar to the severity of this recent decline. Yet, right after that, ETH rallied around 20% in December while Bitcoin slipped another 6%. Big quarterly losses didn’t translate into prolonged weakness; instead, they helped form the base of a rebound. It’s not a guarantee, obviously, but patterns like this aren’t something traders tend to ignore.

The ETH/BTC ratio adds to the story too. After three months of lower lows, it’s holding sideways above 0.03 through November. Stability in this ratio after a heavy downtrend often hints that selling pressure is fading out, making room for an upside move.

Could ETH actually bounce into year-end?

With Ethereum sliding harder than Bitcoin this quarter, it’s easy to assume the trend continues downward… but the underlying metrics say something different. Staking is rising, long-term holders aren’t retreating, leverage has been flushed from the system, and the ETH/BTC ratio isn’t breaking down anymore. That combination sometimes lays the foundation for a recovery rally, especially when sentiment is slumped and most traders have given up expecting one.

So yeah, $3,000 looks fragile, like it could snap at any moment—but Ethereum has been known to rebound sharply after quarters like this. If history rhymes even a little, a late-year ETH move (something 2018-style, maybe) is still very much on the table.