- Pectra Upgrade on May 7: Ethereum is set for a major network upgrade introducing key features like increased staking caps (from 32 to 2048 ETH) and wallet improvements, but short-term volatility is expected during deployment.

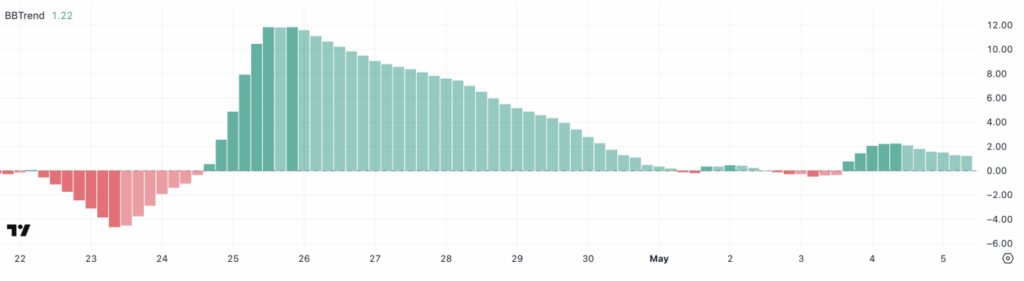

- Mixed Technical Signals: ETH’s BBTrend indicator at 1.22 suggests weak bullish momentum; price remains range-bound between $1,749 and $1,828, with a potential breakout or breakdown depending on volume and sentiment shifts.

- Whale Activity & Outlook: Whale wallets are steady but not aggressively accumulating. With declining exchange reserves and steady ETF inflows, ETH could push toward $2,000—if the upgrade rolls out smoothly and buyer interest holds.

Ethereum’s entering a make-or-break week. Between a key network upgrade, mixed on-chain data, and tight price action, there’s a lot swirling around ETH right now. The long-awaited Pectra upgrade is scheduled to go live on May 7, and while it promises smoother staking and better wallet functionality, traders should brace themselves—things might get a little wobbly before they get better.

ETH’s BBTrend is currently sitting at 1.22, flashing a soft bullish glow… but not quite lighting the fireworks yet. Price-wise? ETH is kinda stuck. It’s been hovering in a narrow range between $1,828 and $1,749. So yeah, we’re at one of those turning points where the market could pop—or flop.

Pectra Upgrade Set to Shake Things Up

The upgrade, dropping May 7 (assuming no more delays), will bring 11 new Ethereum Improvement Proposals (EIPs). The one folks are really talking about is EIP-7251, which bumps up the staking cap from 32 ETH to 2048 ETH. It’s a big deal for validators—think more efficient, less cluttered.

Other bits in the upgrade include quality-of-life boosts for wallet users. Stuff like smoother recovery and gasless transactions might pull more people into Ethereum-based apps, especially on the dApp side of things.

That said, exchanges could freeze ETH transfers during the rollout to avoid chaos, so expect some price turbulence. And yeah, it’s already been delayed a couple of times due to testing hiccups on Hoodi and Sepolia networks. If this thing rolls out clean, confidence and price could get a nice bump. If not? Well… buckle up.

BBTrend Signals Mild Uptrend—But It’s Fragile

ETH’s BBTrend—basically a trend strength meter—is currently reading 1.22. That’s above the neutral line, so slightly bullish. The thing is, it recently hit 2.23 before dialing it back, so the momentum’s been a bit choppy.

Anything above 1.00 leans bullish, and below -1.00 is bearish. But in between? It’s a gray zone, and right now we’re floating right there. If BBTrend bounces back over 2.00, that would be a more solid green light. Drop below 1.00 though, and the bears might take the wheel.

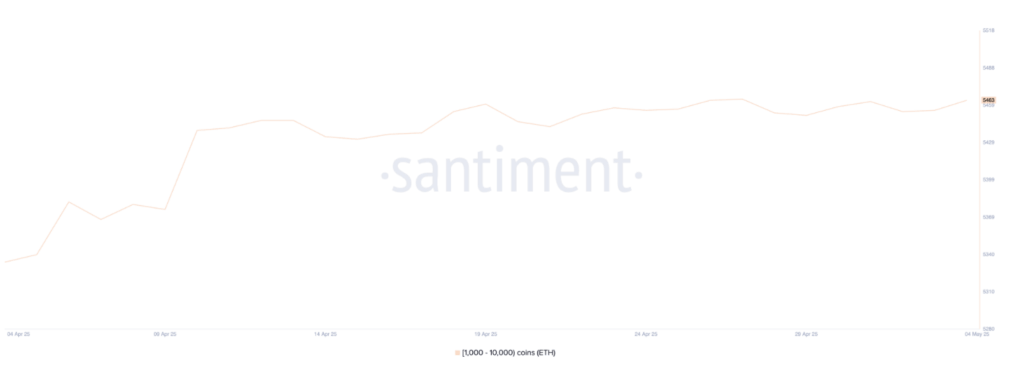

Whales Hanging Around—But Not Charging In

Ethereum whale count is sitting around 5,463 addresses holding between 1,000 and 10,000 ETH. Not bad, but it’s been stuck in this range for a bit. These big players usually shape market moves. If they start buying in bulk, price tends to follow. If they back off, the market might stall out.

Right now, they’re not selling off, but they’re not gobbling up ETH either. So, cautiously optimistic? Let’s go with that.

ETH Still Range-Bound: $1,749 Support vs. $1,828 Resistance

ETH has been ping-ponging between $1,828 and $1,749 for over two weeks. Market’s indecisive, plain and simple. EMA lines are still stacked bullishly—short-term above long-term—but they’re tightening. If they cross, a death cross could hit the charts, which would be a bearish sign.

If ETH breaks below $1,749, look out for $1,689 as the next line in the sand. A deeper drop could even drag it to $1,538 or $1,385 if things really unravel.

On the flip side, busting past $1,873 opens the door to $1,954, and maybe even $2,104 if momentum holds. That’d be the first time ETH’s seen $2K since late March.

Final Thoughts

So, where does ETH go from here? All eyes are on May 7. If Pectra rolls out smoothly and whales get back in the saddle, we could see a serious breakout. But with mixed signals and market nerves still on edge, caution’s probably the smart play—for now.