- Ethereum rebounds: ETH climbed back to $1,847 after dipping below $1,750 in late April, showing signs of renewed strength amid broader market uncertainty.

- Exchange outflows surge: Over $380 million worth of ETH was withdrawn from exchanges last week, indicating growing investor accumulation and reduced selling pressure.

- Key support and resistance: The $1,770–$1,824 zone is a crucial support range backed by 4.5M wallet holders. If ETH holds above this, the next resistance to watch is $1,881.

Ethereum seems to be finding its footing again. After wobbling below $1,750 at the tail end of April, the second-largest crypto by market cap bounced back, now hovering around $1,847. That’s a nice little climb—but what’s behind it?

Well, a few things.

Investors Pull $380M in ETH Off Exchanges—Here’s Why That Matters

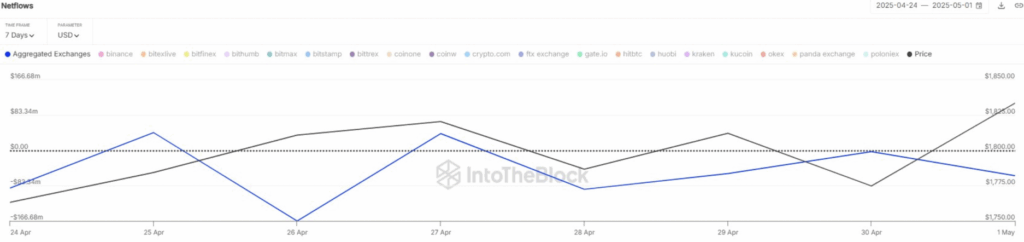

According to data from IntoTheBlock, a whopping $380 million worth of ETH was yanked off centralized exchanges in just the past week. That’s not small change—it’s a strong sign that investors are moving toward long-term holds, shifting ETH into cold storage or self-custody wallets. Historically, when people stop leaving their coins on exchanges, it often hints at something bigger brewing… bullish, maybe?

We’re also seeing five straight days of negative netflows across 19 top exchanges. The last time we saw a positiveinflow was April 27—with about $50 million rolling in. But just a day before that? Over $166 million left the exchanges. This back-and-forth action might look chaotic, but the big picture says: people are accumulating.

And when supply on exchanges drops? You guessed it—less ETH available to sell usually means less pressure downward.

$1,770 – Ethereum’s Line in the Sand?

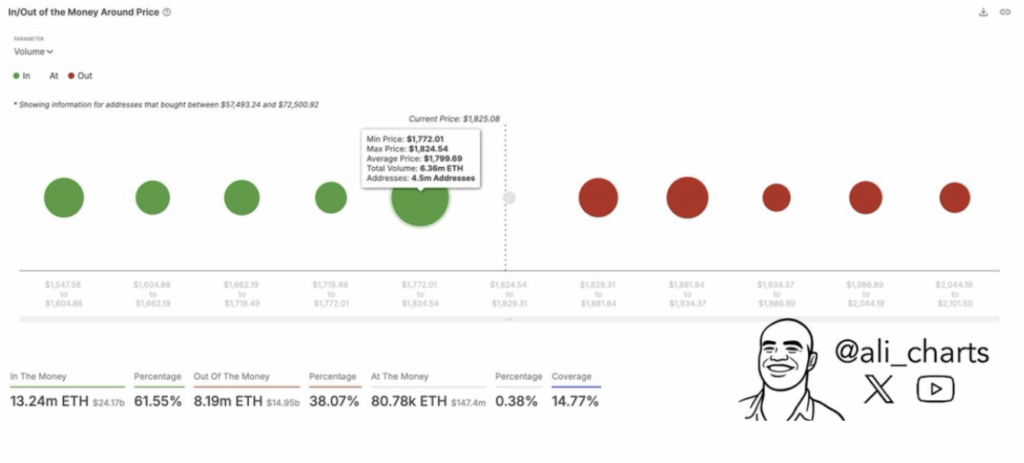

Crypto analyst Ali Martinez chimed in with some timely insight too. Using IntoTheBlock’s “In/Out of the Money Around Price” model, he flagged a key support zone for ETH—between $1,772 and $1,824.

Roughly 4.5 million wallets bought ETH in that range. So now that ETH has clawed back up to $1,845, all those holders are in profit territory. That price area? It’s becoming a psychological stronghold. If Ethereum holds the line above $1,770, the bullish case stays alive. Dip below it though, and we might be staring at another round of downside volatility.

What Comes Next?

Right now, Ethereum trades at around $1,839, slowly inching toward the next hurdle at $1,881. If it manages to close above that, it could start picking up real momentum. But it’s a wait-and-see moment—ETH’s been unpredictable lately.

For now, the takeaway is clear: less ETH on exchanges = less selling pressure. And that means Ethereum could be setting the stage for a more sustained move… assuming the bulls don’t get spooked again.