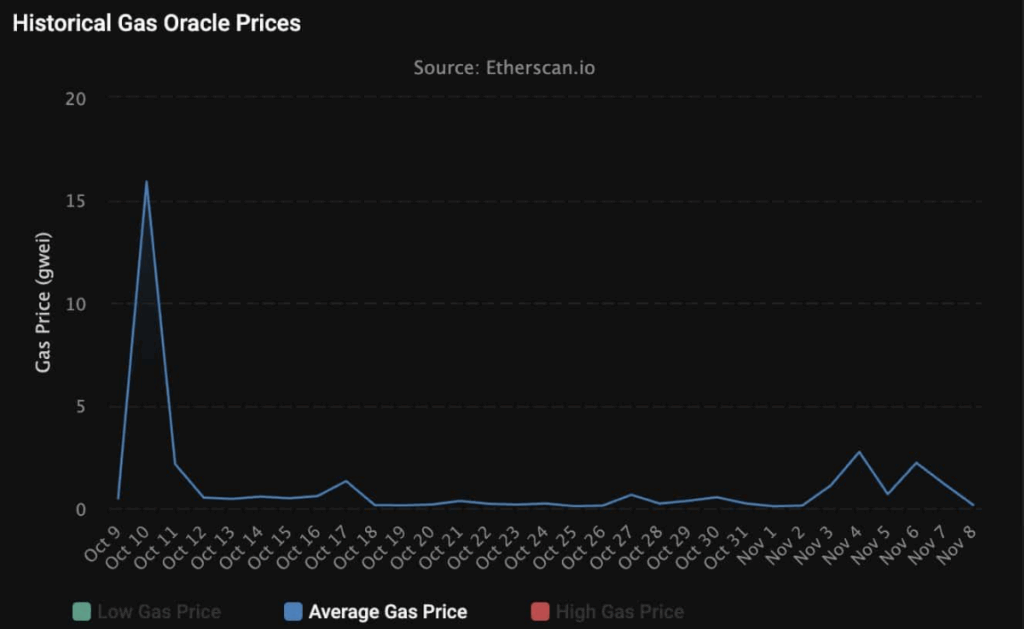

- Gas fees on Ethereum have dropped to around 0.067 Gwei as network activity cools, making transactions extremely cheap but also reducing fee revenue for the chain.

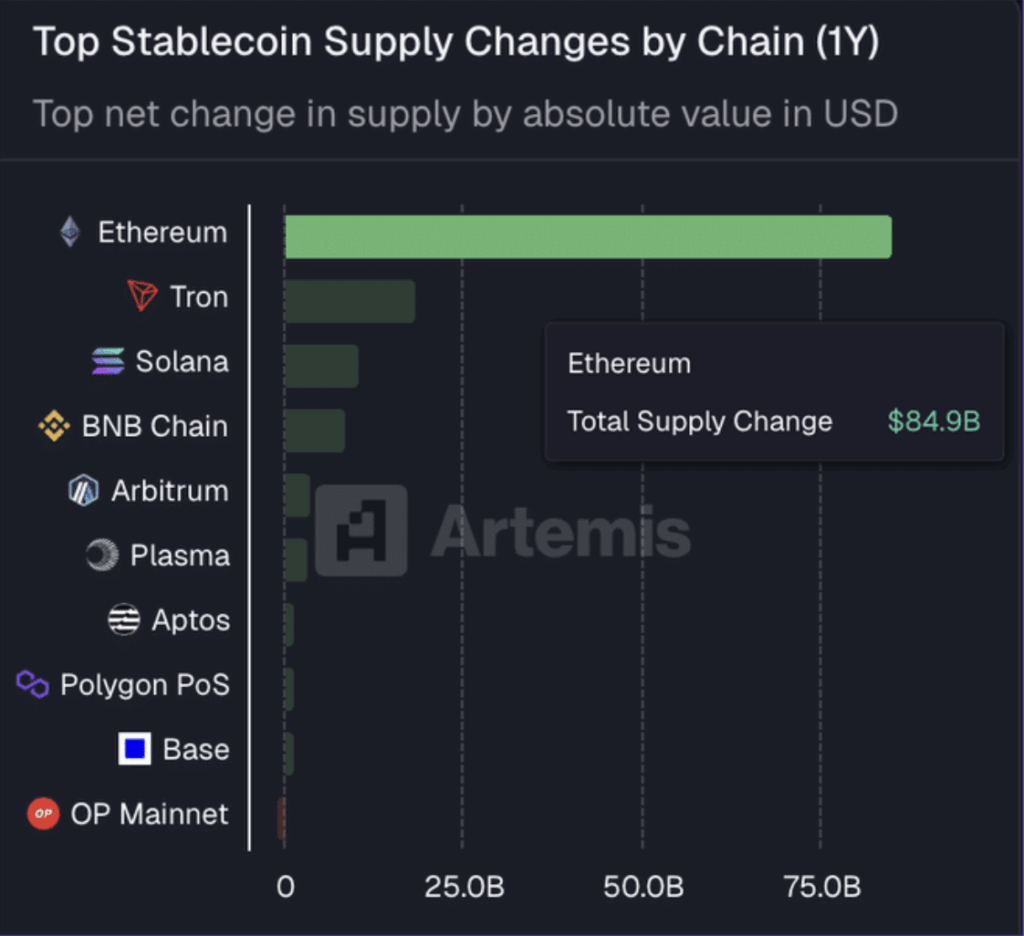

- Despite the slowdown, about $84.9 billion in new stablecoins have been added to Ethereum over the past year, keeping it the dominant hub for real liquidity.

- Major whales are stacking leveraged and spot ETH positions while technical indicators hint at a potential bullish shift, suggesting this quiet phase could set up the next big move.

Ethereum network activity has slowed down, gas fees have crashed, and yet billions in stablecoins keep flowing onto ETH. It looks boring on the surface, but this kind of “quiet” rarely stays quiet for long.

Ethereum is oddly calm right now

Ethereum is in one of those weird phases where it feels like nothing is happening, but under the hood a lot still is. Network demand has dropped to the point where the average gas price is sitting around 0.067 Gwei, which is insanely low compared to the usual spikes we see during hype phases. Transactions are going through with almost no friction, and for casual users it almost feels like the chain is on sale.

Despite the slowdown, Ethereum hasn’t suddenly become irrelevant or anything like that. Over the last 12 months, roughly $84.9 billion in new stablecoins have been added to Ethereum. That’s not a “ghost chain” number. Capital is still parking itself on ETH, and big-money players aren’t exactly rushing for the exit. It’s more like the market is taking a deep breath and deciding what comes next.

This creates a strange contrast: the chain is quiet, fees are cheap, but the value sitting on top of it is still massive. The question now is whether this is the calm before a breakout, or just the market drifting off to other narratives for a while.

Dirt-cheap gas, slowing activity

Ethereum’s average gas price dropping to around 0.067 Gwei puts it near the lowest levels seen this year. That doesn’t happen unless activity drops off pretty hard. We’re nowhere near the kind of demand spikes that showed up around mid-October, when every on-chain move felt like a small financial decision. Right now, it’s the opposite: low noise, low congestion, low cost.

For traders and on-chain strategies, this is kind of a dream environment. Transactions are so cheap that arbitrage flows, stablecoin transfers, and complex DeFi moves can scale much more easily. Bots and active wallets love this setup because execution becomes cleaner and less risky from a fee perspective. It’s almost like the network is quietly telling people: hey, if you want to build or rotate positions, now’s a pretty good time.

But for Ethereum’s own economics, it’s not all sunshine. Lower gas fees also mean lower revenue for the network. If this low-demand phase drags on without a rebound in activity, it could put some pressure on ETH’s long-term fee-based value capture. The burn slows, issuance dynamics shift a bit, and the “ultrasound money” meme doesn’t hit quite as hard without sustained on-chain demand.

Stablecoins are still choosing Ethereum

Here’s where things get interesting. Even with the slowdown in activity and near-zero gas fees, stablecoin capital is still flowing into Ethereum at a massive scale. Over the past 12 months, about $84.9 billion in new stablecoins have been added to the network. Other blockchains combined saw around $48 billion over the same period, which is still big, but clearly less than what ETH is pulling in.

Those numbers basically underline where the real liquidity still prefers to live. Ethereum remains the main hub for stablecoins, big pools, and deeper liquidity conditions, even if the day-to-day activity looks muted right now. It’s like the money has chosen its home base, even if the party is a bit quieter this week.

So while some traders might be chasing the next hype cycle on faster, cheaper chains, the stablecoin flow suggests that Ethereum’s role at the center of crypto’s money layer hasn’t really changed. It might be moving slower at the moment, but it’s still the main settlement layer for serious capital.

Whales are quietly betting big on ETH

On top of the stablecoin growth, whale behavior is adding another layer of intrigue. One well-known whale, Machi, reportedly expanded a 25x leveraged long position to 5,600 ETH, worth around $20 million, while sitting on close to $1 million in floating profit. That’s not exactly a “I’m scared of this market” posture, especially considering the rest of his portfolio is in the red overall.

Another big player dubbed the “Anti-CZ Whale” flipped from shorting to holding around 32,802 ETH, roughly $119.6 million, with about $15 million in unrealized gains. Moves like that send a pretty clear signal: some of the largest wallets aren’t just sticking around, they’re leaning bullish. They may be early, wrong, or very early but they’re definitely not indifferent.

Technically, ETH has already shown signs of life by reclaiming levels above $3,600. The RSI bounced from oversold territory, and the MACD hinted at a potential bullish crossover, which lines up with the idea that downside pressure might be easing. None of this guarantees an explosive breakout, of course, but it does stack the odds a bit more in favor of a bigger move rather than a slow fade into nothing.

Right now, Ethereum is in that awkward middle zone: cheap to use, quieter than usual, but still packed with liquidity and backed by confident whales. When all those pieces line up, the boring phase doesn’t usually last forever.