- Ethereum Foundation moved 160,000 ETH ($654M) between internal wallets — no exchange activity detected.

- Analysts view it as routine treasury or security maintenance, not a market move.

- ETH price rebounded above $4,000, signaling calm sentiment despite the large transfer.

According to Lookonchain data, the funds were sent from one EF-controlled address to a Gnosis Safe wallet, which is basically a secure multi-signature vault. That detail alone makes it clear this wasn’t a move to a centralized exchange. In simpler terms: no dumping, no panic, just what looks like an internal shuffle of treasury funds.

Routine Shuffle or Hidden Motive?

Whenever the Ethereum Foundation moves ETH, it tends to spark wild speculation. In the past, similar wallet activity sometimes happened right before token sales, which had traders sweating bullets. This time, though, there’s zero indication of anything like that.

Fresh data from Arkham shows all 160,000 ETH are still sitting safely in EF-controlled wallets. Analysts believe it’s part of a security upgrade or routine treasury management—maybe even a reorganization of internal custody systems.

Still, that doesn’t stop the rumor mill. Some community members think the timing could tie to Ethereum’s latest push toward scaling and new governance adjustments. But for now, all signs point to business as usual inside the Foundation.

ETH Price Rebounds Past $4,000 Despite the Move

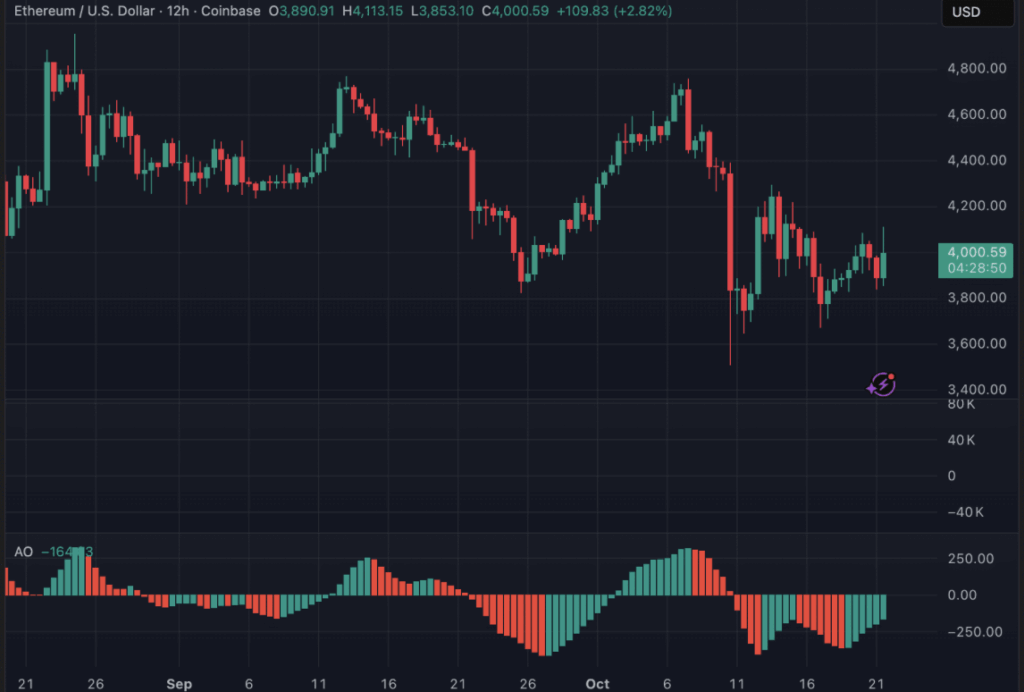

Surprisingly (or maybe not), Ethereum’s price didn’t even flinch after the news. In fact, ETH rose 2.8% in the past 12 hours, climbing back above the $4,000 mark after dipping below $3,600 earlier this week.

The Awesome Oscillator (AO) flipped green for the first time in days, suggesting a mild return of bullish momentum. That tells us traders aren’t treating the transaction as a warning sign — quite the opposite, actually. The market seems to have shrugged it off completely.

If anything, this calm reaction shows just how mature Ethereum’s ecosystem has become. A half-billion-dollar transfer barely moves the needle anymore.

Why It Still Matters

Even though this move doesn’t seem market-related, people pay close attention when the Ethereum Foundation shifts funds. With such a huge stash of ETH under its control, even the smallest sign of selling can ripple across the market.

Historically, when EF sends ETH to exchanges, prices tend to wobble. But in this case, none of the funds have left internal wallets, and no unusual short activity has appeared on derivatives markets.

It’s more likely just a custodial update — boring, yes, but important for keeping the Foundation’s security airtight.

Market Outlook: Calm, for Now

Technically speaking, Ethereum looks steady. Resistance sits near $4,200, with a healthy support zone around $3,700. If bulls manage to push through $4,250, a short-term breakout toward $4,500 could be on the cards.

For now, EF’s move doesn’t seem to be rocking the boat. The transfer fits neatly into a pattern of operational housekeeping — not a liquidation signal. Traders can breathe easy, at least for now.