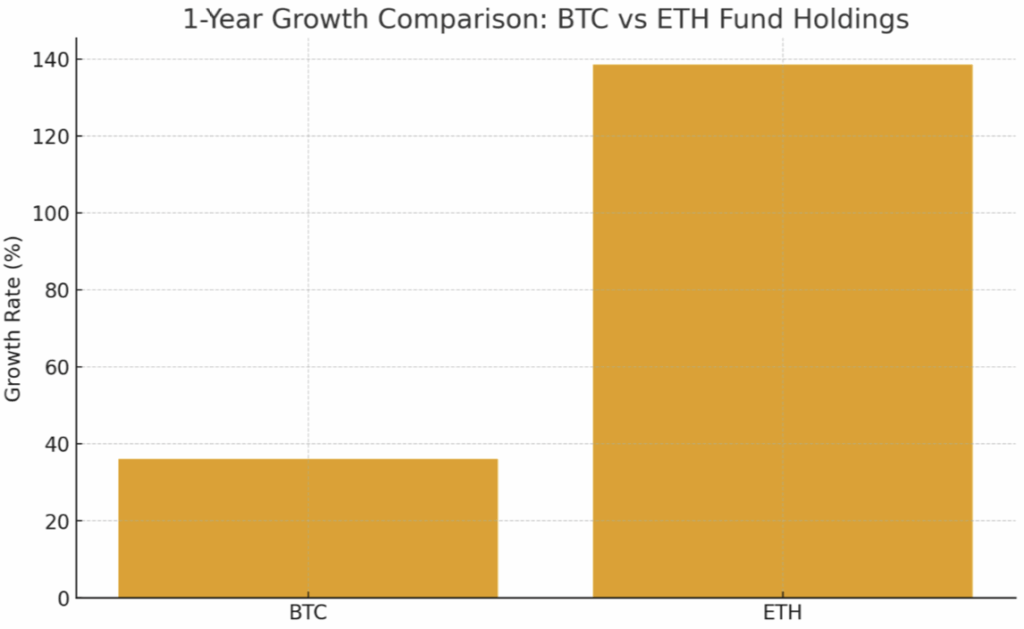

- Institutional Ethereum holdings surged 138% in one year, outpacing Bitcoin’s 36%.

- The ETH-to-BTC ratio in funds shifted from 3:1 to 5:1, showing long-term confidence.

- ETH must hold above $4,100 for bulls to stay in control amid mixed market sentiment.

Institutional money seems to be shifting. Over the past year, Ethereum (ETH) has quietly become the star of big-money portfolios, growing nearly four times faster than Bitcoin (BTC) in institutional holdings. It’s not just a temporary trend anymore — it’s starting to look like a strategic shift in how major investors view the two biggest cryptocurrencies.

Ethereum’s Rapid Growth Outpaces Bitcoin

Fresh data from XWIN Research Japan paints a pretty clear picture: institutions aren’t just stacking Bitcoin anymore. Over the past year, Bitcoin fund holdings grew by around 36%, reaching roughly 1.3 million BTC. Impressive, sure — but Ethereum blew past that. Institutional ETH holdings jumped 138%, climbing to about 6.8 million coins.

Analysts believe this acceleration is tied to the rollout of spot Ethereum ETFs and ETH’s expanding role in DeFi and broader digital ecosystems. Ethereum isn’t just “Bitcoin’s sidekick” anymore — it’s being treated as a core asset in its own right.

The ratio of ETH-to-BTC held in institutional funds has shifted from 3:1 to 5:1, showing a clear and lasting change in allocation. XWIN’s report noted that the sustainability of this divergence will depend on ETF inflows, on-chain activity, and overall global liquidity conditions in the months ahead.

Adding fuel to the bullish case, some large ETH investors have started buying again after months of trimming their positions. Tom Lee of Bitmine, which manages one of the world’s biggest Ethereum treasuries, said he expects a potential year-end rally now that leveraged positions have cooled off.

Market Still Testing Key Levels

Despite the bullish accumulation, Ethereum’s price action hasn’t reflected that optimism just yet. At the time of writing, ETH was trading around $4,114, down 1.8% in the past 24 hours. Analyst Daan Crypto Trades described this moment as a “big test” for the bulls, noting that ETH needs to hold above $4,100 to keep momentum alive.

Bitcoin, meanwhile, was priced at about $114,198, but its recent breakout above $115K raised some eyebrows. Analyst TedPillows called the move “a liquidity grab,” pointing out that it came without meaningful institutional inflows or retail excitement. On-chain researcher PelinayPA backed this up, noting that exchange fund movement is near historic lows, a sign that market tops often lurk nearby.

Long-Term Outlook Still Strong

Even with short-term volatility, institutional participation in crypto remains massive. Bitcoin futures volume on Binance alone hit $543 billion in October, proving that interest from both institutional and speculative traders hasn’t faded.

The surge in institutional Ethereum holdings — especially at a time when Bitcoin’s growth has slowed — might set the stage for a new phase in the market. If current trends continue, Ethereum could cement its position as the go-to institutional altcoin, sharing the spotlight with Bitcoin rather than standing in its shadow.