- Spot Ether ETFs saw $2.4B in inflows over six days, outpacing Bitcoin ETFs’ $827M.

- BlackRock’s ETHA led the charge with $1.79B, while Fidelity’s FETH set a new daily record.

- Analysts predict ETH could hit $4,000 soon, with institutional accumulation signaling a possible supply squeeze.

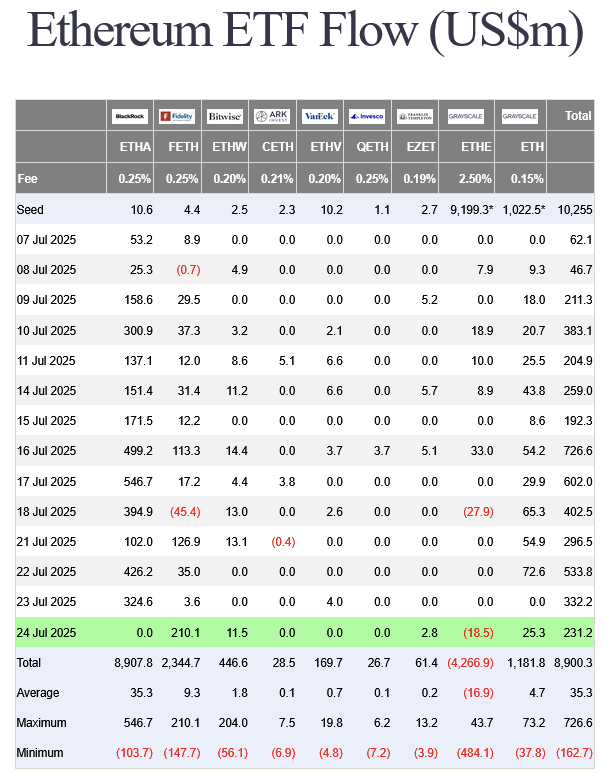

It looks like big investors are leaning toward Ethereum this week. Over the last six trading days, spot Ether ETFs have pulled in almost $2.4 billion — nearly triple the $827 million flowing into spot Bitcoin ETFs during the same period, according to Farside Investors.

For each of the last six sessions, Ether ETFs have consistently outshined Bitcoin, marking a shift in sentiment. Clearly, institutions are betting heavy on ETH right now.

BlackRock’s ETHA Dominates the Inflow Game

The biggest winner here? BlackRock’s iShares Ethereum ETF (ETHA). This single fund raked in $1.79 billion — that’s roughly 75% of the total ETH ETF inflows over the past week. ETHA recently became the third-fastest ETF ever to reach $10 billion in assets under management, doing it in just 251 trading days. That’s fast by any measure.

Meanwhile, Fidelity’s Ethereum Fund (FETH) had its best day yet last Thursday, bringing in $210 million. That’s a 4% jump over its previous daily record set back in December 2024.

Institutional Accumulation Could Spark a Supply Squeeze

Demand for ETH isn’t slowing down. BitMine Immersion Technologies has scooped up $2 billion worth of ETH in just 16 days, making it the largest corporate holder of the asset.

Across all corporate treasuries, 2.31 million ETH is now being held — nearly 1.91% of ETH’s circulating supply, per data from Strategic Ether Reserves. Galaxy Digital’s Michael Novogratz believes this kind of accumulation could push ETH to $4,000 and even outperform Bitcoin over the next six months. He also flagged the buying spree from SharpLink Gaming as another factor that could trigger a supply shock.

Bitcoin ETFs Lose Momentum

While ETH is seeing strong inflows, Bitcoin ETFs just broke their 12-day streak of positive net flows. On Monday, they collectively recorded a net outflow of $131 million. Before that dip, the 12-day streak had amassed $6.6 billion in net inflows.

Swissblock Research thinks this shift isn’t just a blip. “ETH is rotating into leadership as the next leg of the cycle unfolds,” the firm noted. If this trend holds, Bitcoin could find itself playing second fiddle to Ethereum for a while.