- ETH dropped nearly 11% to a five-month low, but whales accumulated over $241M worth of ETH during the pullback.

- Exchange reserves sank to a 55-month low, tightening sell-side liquidity and hinting at long-term bullish pressure.

- Price action remains bearish for now, but sustained whale demand could help ETH reclaim the $3,000 level.

Ethereum hasn’t had the easiest stretch lately. The world’s biggest altcoin slipped nearly 10.9%, falling all the way to a five-month low around $2,650 before managing a small bounce back toward $2,720. It’s been stuck inside a descending channel throughout Q4—basically grinding lower week after week, as broader market volatility keeps squeezing altcoins harder than Bitcoin. The decline isn’t subtle anymore; it’s the kind of slow bleed that usually shakes out weak hands. But interestingly… this very same drop has opened a window for buyers who’ve been waiting on the sidelines.

Whales treat the correction as a bargain

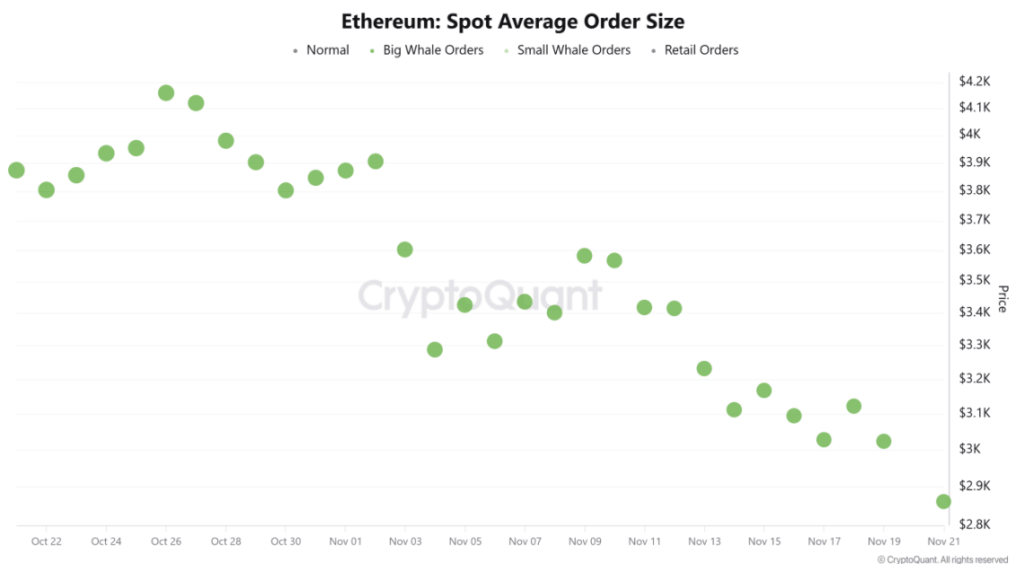

While retail traders panicked, Ethereum whales did the complete opposite—they doubled down. Throughout November, whale activity stayed unusually high even as ETH kept dropping. CryptoQuant’s Spot Average Order Size data showed repeated large orders hitting the books, a sign that big players weren’t scared off by the downtrend. Instead, they looked almost eager to scoop up ETH at a discount.

One of the standout moves came from the so-called “66,000 Borrowed Whale,” who grabbed another $162.77 million worth of ETH from Binance and then supplied it straight into Aave V3. That buy pushed his total stash to 432,718 ETH—roughly $1.23 billion. Three other whales picked up nearly 10,000 ETH (~$30 million) from Binance. And then there was Bitmine, tied to Tom Lee’s group, adding another 17,242 ETH (about $49 million) sourced from FalconX and BitGo. In total, these high-conviction players accumulated roughly $241.84 million in fresh ETH.

When whales step in this aggressively during a downtrend, it usually means they’re betting that the correction is temporary—and that the upside will outweigh the fear.

Exchange supply tightens sharply as accumulation rises

Whale buying hasn’t just been loud—it’s actually reshaping supply dynamics. Ethereum’s exchange reserves just dropped to a 55-month low, hitting 15.6 million ETH according to CryptoQuant. That’s around $42.9 billion worth of supply effectively pulled out of the open market. When exchange balances sink like this, sell-side liquidity dries up. And historically, thin sell-side liquidity sets the stage for big price swings upward once demand kicks in.

In simple terms: whales have absorbed a giant chunk of the floating supply. If this continues, ETH becomes harder to buy at current prices, and the market often reacts by repricing higher.

But the charts still scream bearish — for now

Here’s the twist: even with all that accumulation happening behind the scenes, Ethereum’s price structure hasn’t flipped bullish yet. On the charts, seller dominance is still strong. The Stochastic Momentum Index fell all the way to –74.69, which is deep in bearish territory. The Advance-Decline Ratio has stayed under 1, confirming that downward pressure still outweighs upward momentum.

So the market sits at this weird crossroads. On one side: whales are loading up, exchange reserves are thinning, and long-term signals look like early accumulation. On the other: the downtrend hasn’t technically broken.

If bears keep control, ETH could retest the $2,535 area. But if whale demand finally overpowers the slide—and it often does after heavy accumulation phases—Ethereum could regain $3,000 in the short term, flipping sentiment almost overnight.