- Ethereum breaks $4,600 despite the Ethereum Foundation selling 1,000 ETH, showing market resilience.

- Derivatives traders added $700M in fresh longs, lifting open interest to $41.3B even as volumes dipped.

- Institutional demand remains strong with $1.3B in ETF inflows and Bitmine’s treasury climbing to 2.6M ETH.

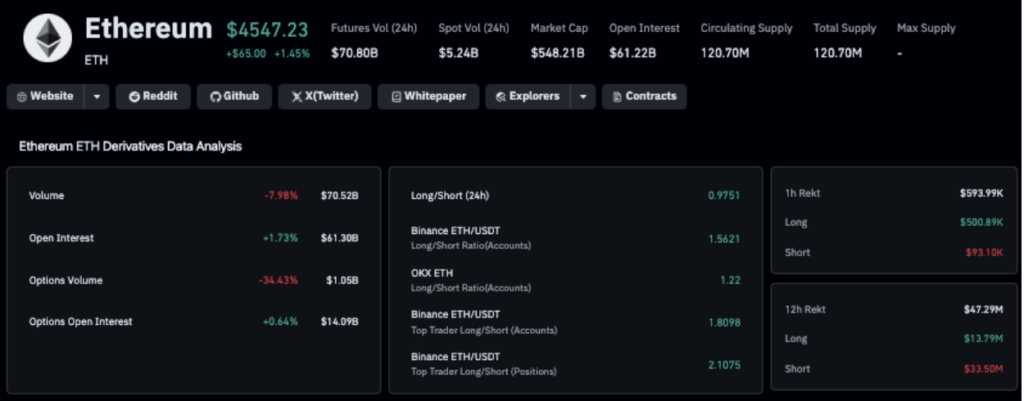

Ethereum finally cracked through the $4,600 mark on October 5, notching a 1.4% daily gain even after the Ethereum Foundation confirmed it sold 1,000 ETH on Friday. Normally, insider moves like that spook the market, but this time the sell-off barely made a dent. In fact, derivatives traders seemed to take it as a green light, piling into fresh long positions as open interest climbed 1.7% over the weekend.

At its intraday peak, ETH tapped $4,619 according to CoinMarketCap, holding its ground even while spot trading volume looked pretty thin. The Foundation explained the sale was intended to fund grants, research, and donations—nothing unusual there—but historically these sell-offs tend to weigh on price. That didn’t happen this time, suggesting a pretty strong backdrop of demand and confidence.

Derivatives Data Shows Speculators Growing Bold

Coinglass numbers revealed ETH open interest rose to $41.3 billion in the last 24 hours, even as trading volume actually dropped nearly 8%. That divergence usually means speculative traders are setting up for a sustained move, not just chasing a pump. Even with the Foundation’s conversion of 1,000 ETH to stables (about $4.6 million at current pricing), bulls look unbothered, almost defiant.

New futures positions alone added $700 million to the books on Sunday, and that surge helped price push cleanly through resistance. Instead of triggering fear-driven exits, the insider transaction seems to have acted as background noise against the louder rhythm of institutional flows.

Institutions Keep Pouring In

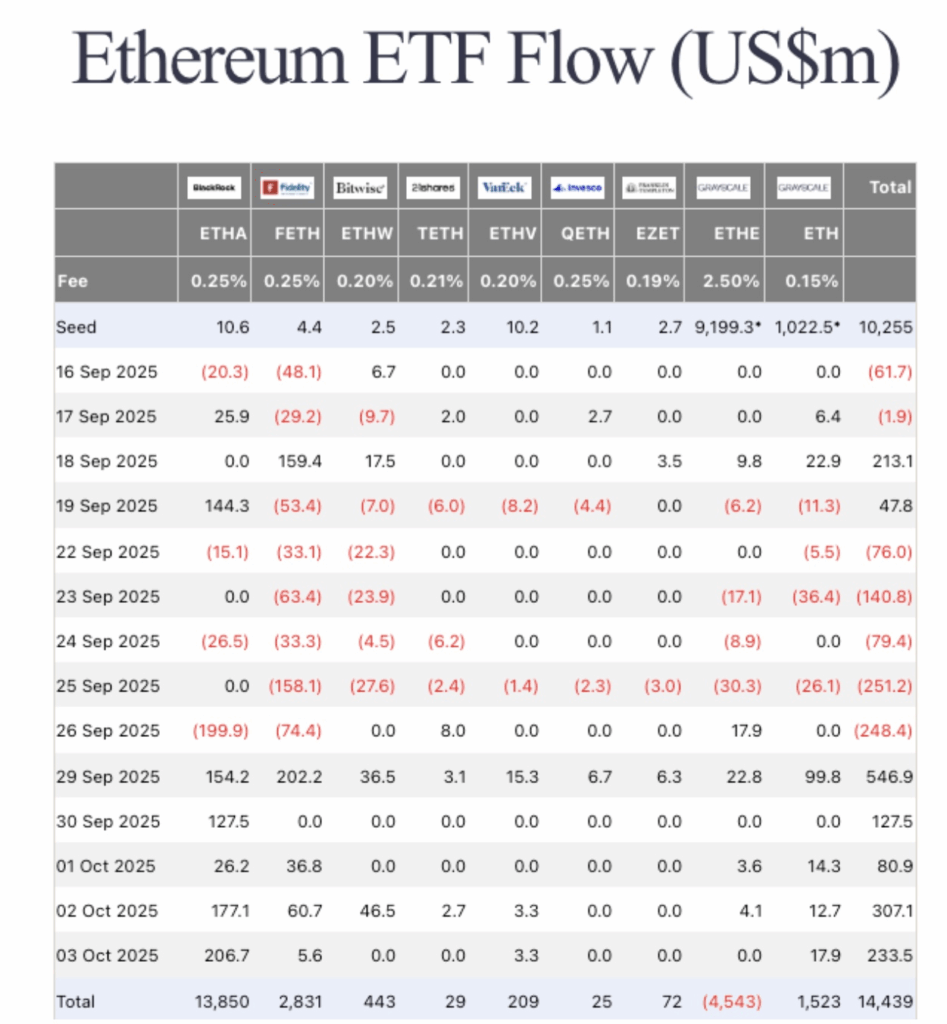

And those flows are hard to ignore. Ethereum ETFs logged $1.3 billion in net inflows across just five trading days last week, per Farside Investors. That’s not just a blip—it’s steady, consistent demand from the same type of players who anchored Bitcoin’s breakout run. At the same time, Bitmine (BMNR) has quietly bumped its treasury reserves to 2.6 million ETH, locking in its spot as the biggest Ethereum holder on the corporate side.

Put together, this activity has given ETH the liquidity cushion to break resistance and stay there. Foundation sell-offs might have been a bearish story in the past, but right now the balance of power is tilting heavily toward institutions and ETFs providing a floor under the market.

Price Outlook: $4,750 in Sight?

Technically, ETH has cleared an important hurdle, with the $4,600 zone now acting as support rather than resistance. If open interest keeps climbing alongside ETF inflows, the path looks open for a retest of $4,750 in the days ahead.

That said, volume remains thin compared to the size of leveraged bets being placed, so a sudden pullback can’t be ruled out. Still, with institutional inflows humming and speculators showing no hesitation, Ethereum has managed to turn a Foundation sell-off into little more than a speed bump on its way higher.