- Ethereum slipped into a short-term downtrend after losing $3,400, triggering heavy derivatives losses

- Whale longs on Hyperliquid are deep in drawdown, but liquidation levels remain far below current price

- Cascading liquidations and falling open interest suggest continued downside pressure unless $3,000 is reclaimed

Ethereum’s recent slide didn’t come out of nowhere, but it still caught plenty of traders leaning the wrong way. About six days ago, ETH failed to hold above the $3,400 level, and that rejection flipped the short-term structure bearish. Since then, price has drifted lower inside a modest descending channel, briefly tagging a local low near $2,800 before attempting to stabilize.

At press time, Ethereum was trading around $2,926, down nearly 7% on the day and extending a week-long run of weakness. That move didn’t just hurt spot holders. It sent unrealized and realized losses surging across derivatives markets, where leverage had quietly piled up.

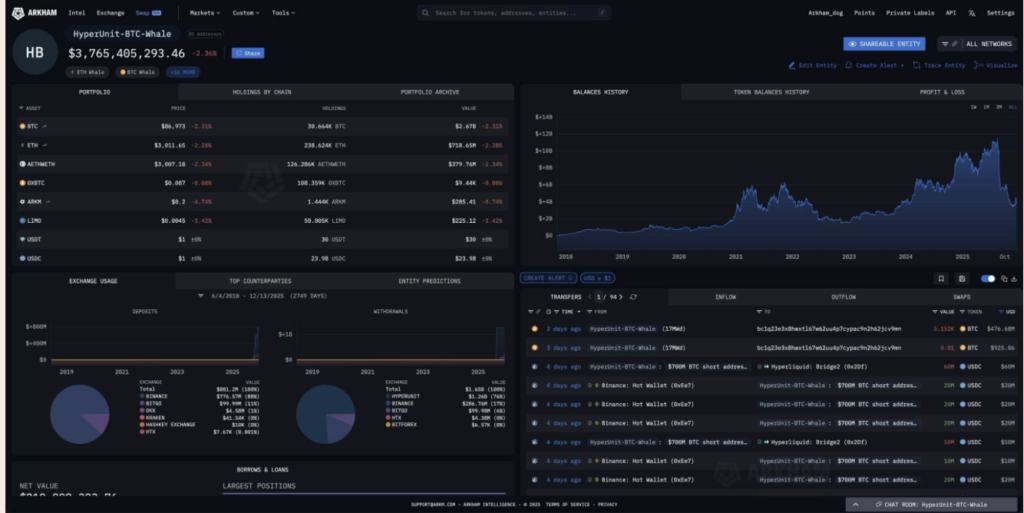

Whale Drawdowns Grow on Hyperliquid

One of the more eye-catching developments came from a large Ethereum whale on Hyperliquid. As ETH slipped below $3,000, this whale’s unrealized losses ballooned past $54 million. The position traces back to a post-April crash recovery phase, when a well-known Bitcoin whale rotated capital into Ethereum.

Labeled “BitcoinOG” on Arkham, the entity shifted out of BTC and opened aggressive leveraged ETH longs. In total, the whale built close to $700 million in long exposure, making it the single largest ETH long holder on Hyperliquid.

As prices fell, unrealized profit shrank dramatically, dropping from around $119.6 million to roughly $54 million. Even so, there was no sign of panic. The estimated liquidation level sat near $2,082, leaving a wide buffer. Despite the growing drawdown, the whale hasn’t closed positions, a sign of conviction, or stubbornness, depending on how you look at it.

Liquidations Spike as Traders Exit in Force

Beyond individual whale losses, the broader derivatives market showed clear signs of stress. CoinGlass data revealed that derivatives volume surged 53.5% to $87.15 billion, while open interest collapsed by more than 55% to $37.67 billion.

That combination usually signals mass position unwinding. Traders weren’t adding risk, they were getting out. As positions were closed and liquidated, Ethereum saw a sharp jump in forced exits. Liquidations hit $196 million on December 15, followed by another $58 million the next day. Long positions took the brunt, with total long liquidations topping $213 million over that stretch.

On-chain trackers even flagged repeated blowups. According to Onchain Lens, trader Machi Big Brother suffered yet another forced liquidation on a 25x SETH long, marking his tenth liquidation in recent weeks. Since the October 10 market crash, that account has logged more than 200 liquidations, with cumulative losses exceeding $22.9 million. At last check, the balance sat at just over $53,000.

Momentum Breaks Down as Selling Accelerates

Price action mirrored the chaos unfolding in derivatives. As cascading liquidations hit, Ethereum slid lower, reinforcing downside momentum. The Stochastic RSI plunged deep into oversold territory, hovering near 17 at press time.

Readings like that usually point to intense selling pressure and very weak short-term momentum. If liquidation-driven selling continues, ETH could drift back toward the $2,700 area, where Parabolic SAR support previously appeared.

On the flip side, any meaningful recovery likely requires bulls to reclaim $3,000 with conviction. Until that happens, upside looks capped, with resistance clustering near $3,436, where Parabolic SAR last aligned. For now, Ethereum remains under pressure, and the market is still digesting the damage left behind by leverage.