- DOGE surged on ceasefire hopes but quickly dipped after renewed conflict tensions.

- A $24.6M whale transfer rattled markets, while $18M in exchange outflows hint at accumulation.

- A breakout above $0.17 could set the stage for a sharp rally—but volume and global news remain critical.

Dogecoin’s been having a wild ride lately, and it’s not just from memes or Elon tweets this time. The memecoin initially jumped over 7% on news of a supposed ceasefire between Israel and Iran—but things unraveled fast. Turns out, the ceasefire declaration came without a real agreement in place. Not long after, Iran launched an attack. That whiplash in global headlines sent markets into a spin, and DOGE wasn’t spared. It surged to $0.1674, only to stumble right after, now hovering around $0.164.

This type of price action isn’t just random noise—it reflects just how sensitive the crypto space has become to macro tension. Even a coin born as a joke isn’t immune to geopolitics these days.

Weak Volume and Whale Moves Stir Doubt

Despite the price jump, trading volume dipped over 10%, which… isn’t exactly a bullish sign. You’d expect volume to rise alongside price in a healthy uptrend. This drop signals weak momentum and hesitation from traders. Then came the whale move: Whale Alert flagged a $24.6 million transfer of DOGE to Robinhood—155 million coins in one go. It’s unclear if this was for selling or something else, but markets clearly didn’t like it. DOGE dropped not long after.

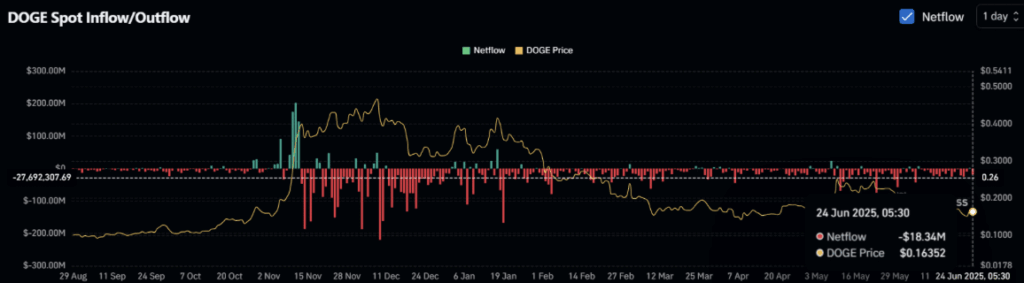

Still, not everything’s bearish. CoinGlass data shows that while one whale may have bailed, $18.34 million worth of DOGE left exchanges over the past 24 hours. That kind of outflow often means someone’s scooping up coins for long-term storage—aka, accumulation. Maybe some folks are buying the dip, quietly.

Technical Setup Hints at a Breakout—Maybe

Zooming out to the charts, DOGE is currently stuck in a descending channel—one it’s been trapped in for a while now. Price is brushing up against the upper boundary of that channel, right at the $0.165 resistance level. If it breaks through and closes a candle above $0.17, that would be a technical breakout.

Could it run 20% to 50% from there? Technically yes—especially if the market stabilizes and meme sentiment returns. But without a confirmed breakout or volume boost, it’s still risky territory. This one might fake people out if they’re not careful.

Final Thoughts: Is DOGE About to Bark or Just Whimper?

Right now, Dogecoin’s caught between bullish whispers and bearish jitters. That $0.17 level is key—clear it with volume and the mood could flip fast. Until then, caution makes sense. Macro tension, low trading activity, and sudden whale dumps are keeping traders on edge.

But if accumulation continues and broader markets chill out, DOGE might have one more meme-fueled run left in the tank.