- Dogecoin has massive brand power and liquidity, but an inflationary supply that pressures long-term price growth

- Institutional interest and payment apps could improve utility, though adoption is still uncertain

- DOGE remains highly speculative, with price driven more by sentiment than fundamentals

Dogecoin started as a joke back in 2013, but somehow it turned into one of the most talked-about cryptocurrencies on the planet. At the time of writing, DOGE trades around the $0.10 level, with daily trading volume sitting in the low billions, which is not small by any measure. Its circulating supply is close to 170 billion coins, placing it among the largest crypto assets by market value, even though it was never designed to be taken this seriously.

That massive supply is also part of the story. Unlike Bitcoin, Dogecoin has no hard cap, meaning new coins enter circulation every single year. This setup puts constant pressure on price growth, because demand has to keep climbing just to maintain current levels, let alone push higher. It’s not fatal on its own, but it does change how DOGE behaves over time.

Recent Developments Bringing Dogecoin Back Into Focus

Over the past few months, Dogecoin has seen renewed interest from institutions and businesses, which caught many people off guard. NASDAQ recently introduced a Dogecoin-focused investment product, giving professional investors a regulated way to gain exposure. That alone signals a shift in how parts of traditional finance now view meme coins, even if cautiously.

There is also growing attention around a House of Doge-backed payment app called “Such,” expected to launch in early 2026. The idea is simple, make Dogecoin easier to use for everyday payments. If merchants actually adopt it and the user experience is smooth, DOGE could finally see real-world usage expand. Still, that outcome is far from guaranteed, and adoption has always been the hard part.

Strengths That Keep Dogecoin Relevant

Dogecoin’s biggest advantage is its brand and community. Few cryptocurrencies are as recognizable, and that matters more than people like to admit. Public figures, especially Elon Musk, have played a huge role in keeping DOGE in the spotlight, and social media hype can still move the price fast, sometimes within hours.

On a technical level, Dogecoin also has low transaction fees and relatively quick transfers. These features make it suitable for small payments and tipping, at least in theory. If adoption increases, DOGE could function reasonably well as a digital payment coin, not just a speculative asset, which is something many meme coins cannot claim.

Weaknesses and Long-Term Risks to Watch

The inflationary supply model remains one of Dogecoin’s biggest weaknesses. With no maximum cap, new coins dilute the supply every year. This means demand must keep growing just to prevent slow price erosion over time, which is not easy to sustain without strong, consistent usage.

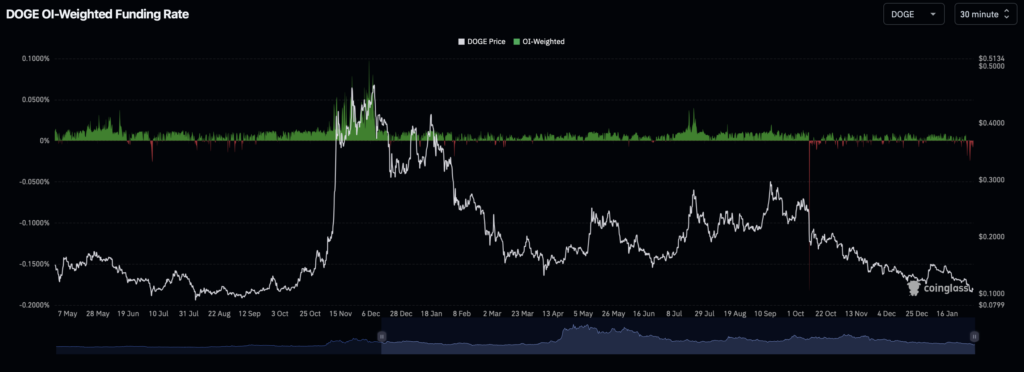

Dogecoin’s price history is another concern. It tends to surge on hype, then fall sharply once attention fades. These moves are driven more by emotion, headlines, and online trends than by fundamentals or upgrades. For long-term holders looking for steady growth, that kind of behavior can be frustrating, and risky too.

Macro Conditions and Regulatory Pressure

Like most meme coins, Dogecoin is heavily influenced by the broader crypto market. Interest rates, overall liquidity, and ETF flows can impact DOGE more aggressively than larger assets like Bitcoin or Ethereum. When risk appetite drops, Dogecoin often falls faster, sometimes without much warning.

Institutional products do add legitimacy, but wider adoption would likely require easier access for retail investors as well. Until that happens, much of DOGE’s price action will remain speculative and driven by news cycles, not long-term fundamentals.

Bubble or Real Opportunity?

Dogecoin sits in an uncomfortable middle ground between speculation and potential utility. Short-term traders can find opportunity thanks to volatility and sudden rallies driven by news or social media buzz. Long-term value, however, depends almost entirely on real adoption, especially payment use cases.

If tools like the “Such” payment app gain traction and actual users start spending DOGE, the coin could maintain relevance for years. If that adoption fails to materialize, price growth may continue to rely on hype cycles, which almost always end with sharp corrections.

Final Thoughts on Dogecoin’s Future

Dogecoin is neither a guaranteed bubble nor a safe investment. It offers opportunity, but it also carries real risk. Current data shows strong market presence, with billions in daily trading volume and a supply nearing 170 billion coins, yet its inflationary design and hype-driven behavior remain serious concerns.

Ultimately, DOGE’s future value will depend on adoption, regulation, and whether new tools turn it into something more than a meme. Without meaningful progress on those fronts, Dogecoin may continue moving in emotional market cycles, making it unpredictable for serious long-term investors.