- Whales added 270M DOGE since Aug. 14, buying dips around the $0.21 support zone.

- Spent Coins Age Band halved, showing older holders are not selling into the market.

- DOGE trades in an ascending triangle, with a breakout above $0.232 pointing bullish, but $0.216 acting as a must-hold support.

Dogecoin’s been putting up some interesting moves lately. It’s up 14% over the past month and more than 130% year-over-year—not bad for a meme coin that many thought was fading out. Even after a small dip in the last 24 hours, DOGE is still green on the week, holding a 3% gain. The question floating around now: are we seeing a pause before the next leg up, or is momentum starting to burn out? On-chain data says it’s leaning toward consolidation, not exhaustion.

Whales Step In and Buy the Dip

The first clear bullish sign comes from the mega-wallets. Since August 14, wallets holding at least 1 billion DOGE have increased their stash from 70.84 billion to 71.11 billion—that’s nearly 270 million coins added in just a couple days. And this accumulation happened right as DOGE tested its $0.21 support zone. When the biggest players are buying dips instead of selling into weakness, it usually sets the tone for the rest of the market.

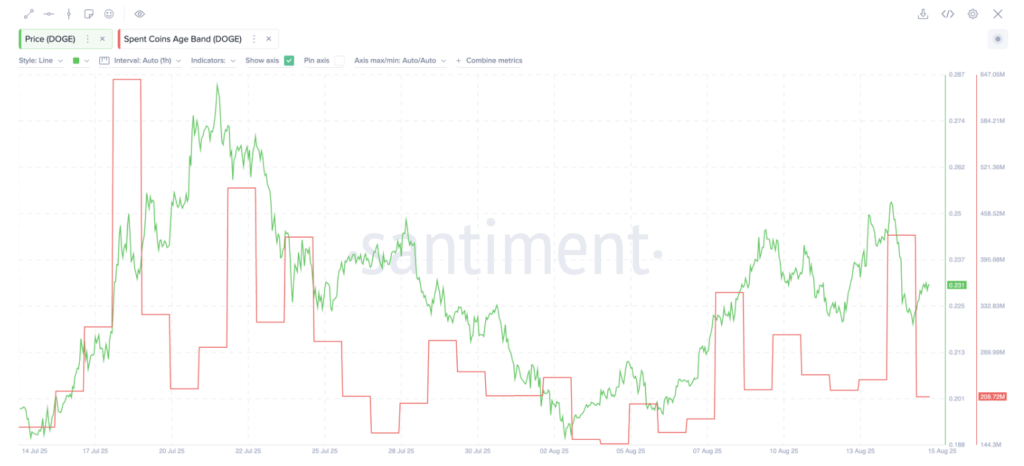

Dormant Coins Show Selling Pressure is Cooling

It’s not just whale wallets that matter—the Spent Coins Age Band metric shows how much older, dormant DOGE is being moved. Less old supply hitting the market means less selling pressure during consolidations. Just yesterday, this metric dropped from 429.77 million to 209.72 million DOGE, almost cutting in half. That tells us long-term holders are sitting tight, which fits the pattern of whales soaking up supply while older coins stay quiet. Historically, DOGE rallies have followed right after these drops in spent coin activity.

Technicals Point to a Breakout Setup

Zooming into the 4-hour chart, DOGE is trading inside an ascending triangle, with resistance stacked around $0.232, $0.239, and $0.246. These levels matter because once one gives way, momentum can pile up fast. The Bull-Bear Power indicator is already lifting off its lows, showing that sellers are losing steam as buyers lean back in. If DOGE breaks above $0.232 with conviction, bulls regain control. On the flip side, a close below $0.216 would scrap this bullish structure and reopen downside.