- Dogecoin remains trapped between $0.18 and $0.30, trading at $0.218.

- Momentum indicators and social sentiment both show weakness, with hype fading.

- Network activity is subdued, making a retest of $0.18 more likely than a breakout.

Since the start of 2025, Dogecoin has been caught in a frustrating sideways range, bouncing between $0.18 and $0.30 without much conviction. Buyers have been trying to accumulate in the lower end of that box, while short-term sellers keep unloading whenever DOGE inches higher. At the moment, the coin trades around $0.218 after slipping 1.8% in a day, sitting just above its mid-range support.

The $0.25 level continues to act like a stubborn ceiling, rejecting upside attempts, while $0.18 has so far been the solid floor keeping prices from slipping further. Traders see these two boundaries as the battle lines—until Dogecoin finally breaks out, any volatility spikes are likely to stay stuck inside this consolidation zone. It’s like the market is waiting for someone to make the first real move.

Momentum Signals Still Weak

Looking at technicals, things don’t scream strength. The Relative Strength Index (RSI) sits around 47, dipping under the neutral 50 mark and tilting slightly bearish. The Directional Movement Index (DMI) shows +DI and -DI practically sitting on top of each other, while the ADX is sliding lower, hinting that trend strength is fading fast. Neither bulls nor bears really own the market right now, and that kind of indecision often comes before a sharp move.

If the RSI pushes lower or the DMI tilts more negative, DOGE could slip back toward the $0.18 level. On the other hand, a sudden momentum spike could give bulls the energy to retest $0.25—but so far, the signals aren’t leaning in their favor.

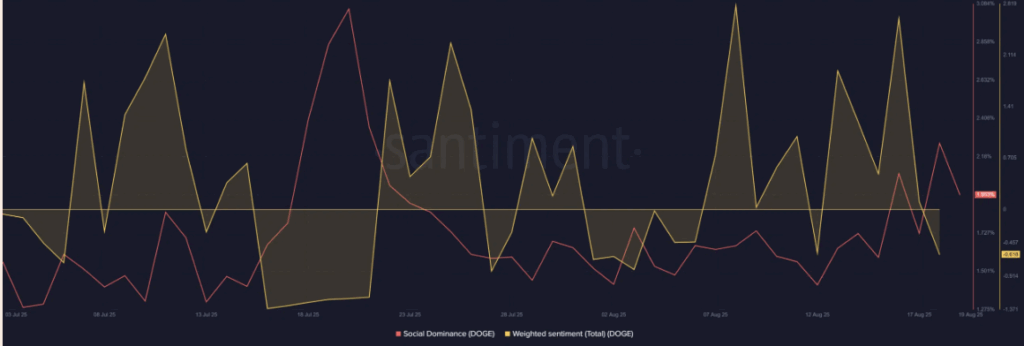

Social Buzz Losing Steam

Dogecoin has always been a hype-driven coin, and that hype is clearly cooling down. On-chain data shows Social Dominance dropping to just 1.95%, meaning fewer people are even talking about DOGE compared to the rest of the market. Weighted Sentiment is sitting negative at -0.61, a sign traders are leaning bearish in their outlook.

Historically, DOGE rallies needed strong community chatter and viral momentum. Right now, neither of those things are in play, and without them, buyers may struggle to build enough excitement to push the price back up toward the higher end of its range.

Network Activity Raises Red Flags

The fundamentals aren’t looking much better. Dogecoin’s daily transaction count has slid to just 6,507, reflecting weak activity compared to earlier highs. Its NVT ratio is way up at 686, which basically signals DOGE is priced higher than its actual network usage can justify. When network activity doesn’t keep pace with valuation, it usually puts the asset at risk of correction.

Unless transaction flow picks up, Dogecoin could stay vulnerable, with the market leaning toward another retest of the $0.18 support instead of a breakout to $0.30. The structure looks heavy, momentum is fading, and sentiment isn’t there—it may take a surprise catalyst or another wave of hype to flip the script.