- DOGE/ETH ratio rose 25% this month as Dogecoin delivered a 35% ROI vs ETH’s 6%.

- Meme market cap hit $83B, nearing July highs when DOGE last topped out.

- With RSI not overheated and OI at ATH, Dogecoin looks poised to break $0.30.

Dogecoin has started flexing its meme strength again, this time against major altcoins. The DOGE/ETH ratio has climbed 25% month-to-date from the 0.000049 support zone, marking its first real retest of the 0.000060 resistance since Q1.

The result has been staggering: DOGE delivered a 35% monthly ROI compared with Ethereum’s modest 6%. That’s nearly five times the gains, making this level of outperformance the strongest since the election cycle rally.

Dogecoin Echoes Election Cycle Surge With Strong Ratio Performance

Back during the election cycle, Dogecoin rocketed 160% in November to a three-year high of $0.48, while ETH managed just 48%. The DOGE/ETH ratio ripped 78% off support, and today’s chart patterns look eerily familiar.

Why it matters now is simple—technicals are lining up again. Instead of a random spike, Dogecoin’s rally seems to be driven by capital rotation back into memecoins, with DOGE taking the lead while other altcoins struggle to keep pace.

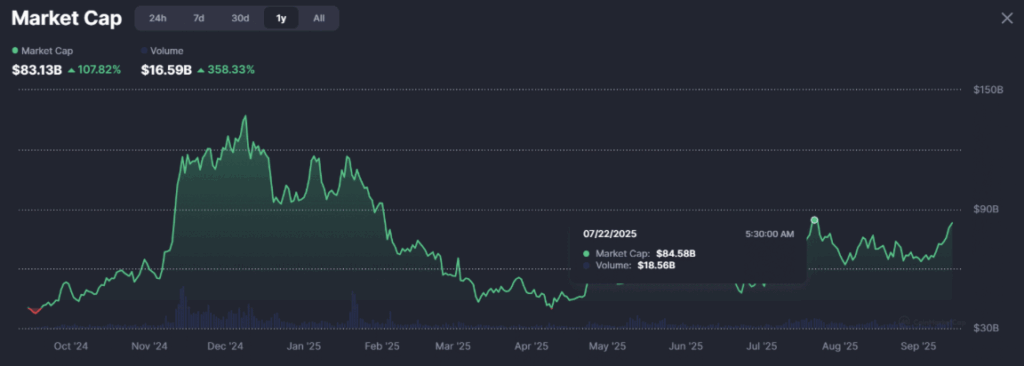

Memecoin Market Cap Climbs to $83B as Speculative Flows Return

Speculative inflows have added nearly $20 billion this month, pushing the total meme market cap to $83.12 billion. That’s the highest in two months, but the test is only beginning.

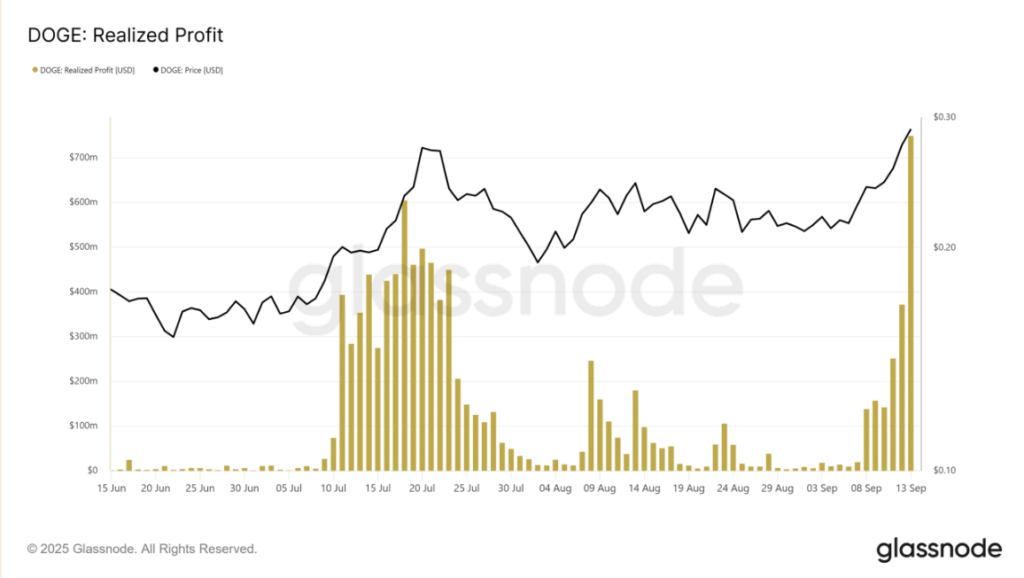

In July, the market peaked at $85B when DOGE hit $0.28 resistance and RSI overheated. Within two weeks, $20B drained out, profits hit $600M, and DOGE dumped 35%. Traders are now asking: will history repeat itself, or does Dogecoin have more room to run this time?

Dogecoin Price Eyes $0.30 Resistance With Fresh Momentum

DOGE has surged to $0.29, setting up its first real attempt at breaking $0.30 resistance since Q1. Profit-taking spiked to $728M at $0.28—the largest since the election run—but the structure looks different this time.

DOGE’s RSI hasn’t yet entered the overheated 85+ “green zone,” leaving room for more upside. Open Interest is also at an all-time high, while the DOGE/ETH ratio confirms strong relative performance. Together, these signals point to bullish continuation and increase the odds of a clean breakout above $0.30.