Decentralized finance (DeFi) continues to entice many investors as they reap profits despite the ongoing crypto winter. A new study published earlier this week by Bolide Finance reveals yield aggregators, lending, and the farming sectors of the DeFi industry have continued to “produce double-digit annual percentage yields (APYs)” during the first half of 2022, despite the unfavorable market conditions.

Yield Aggregators Record High Returns

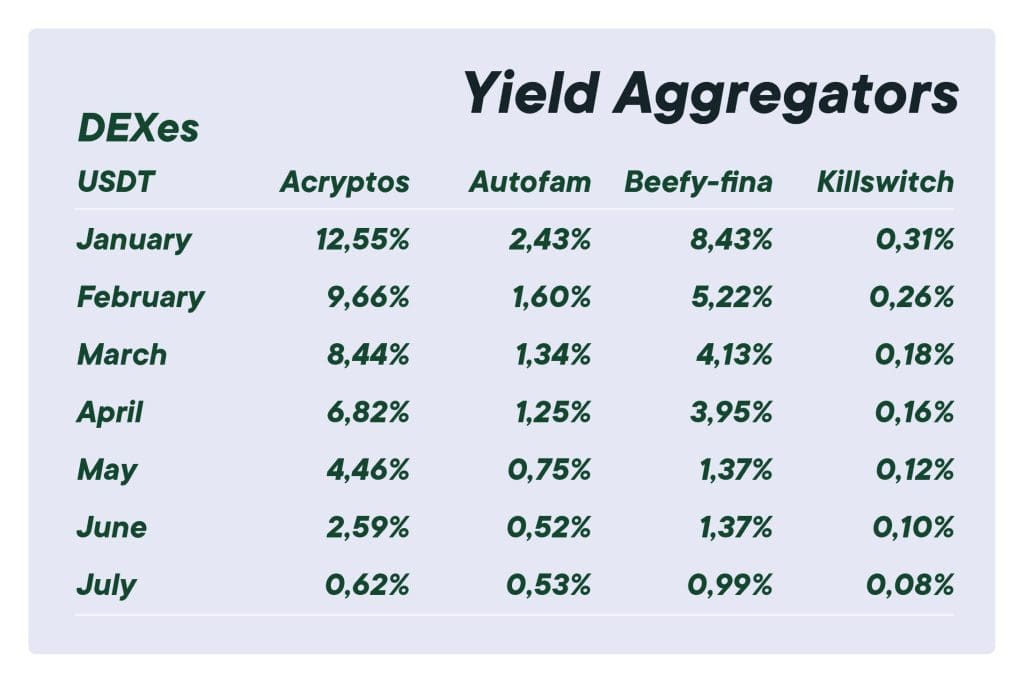

The data released by Bolide Finance on October 4 points to a maturing DeFi industry. In particular, DeFi companies such as CREAM, Dforce, and Valas continued to display impressive performance in the first (Q1/2022) and second (Q2/2022) quarters of 2022. The top four yield aggregators recorded a return of 2.87% on average between January and July 2022. Companies such as Acryptos posted around 7% yield in April and 4.46% in May, and an average of 6.4% over the first half, with profits peaking in January at 12.55%.

Beefy finance recorded a 4% and 1.37% yield for April and May, respectively, with an average of 3.75%. Other yield aggregators with positive returns between January and July include Autofam and Killswitch, with an average of 1.2% and 0.17% yield, respectively

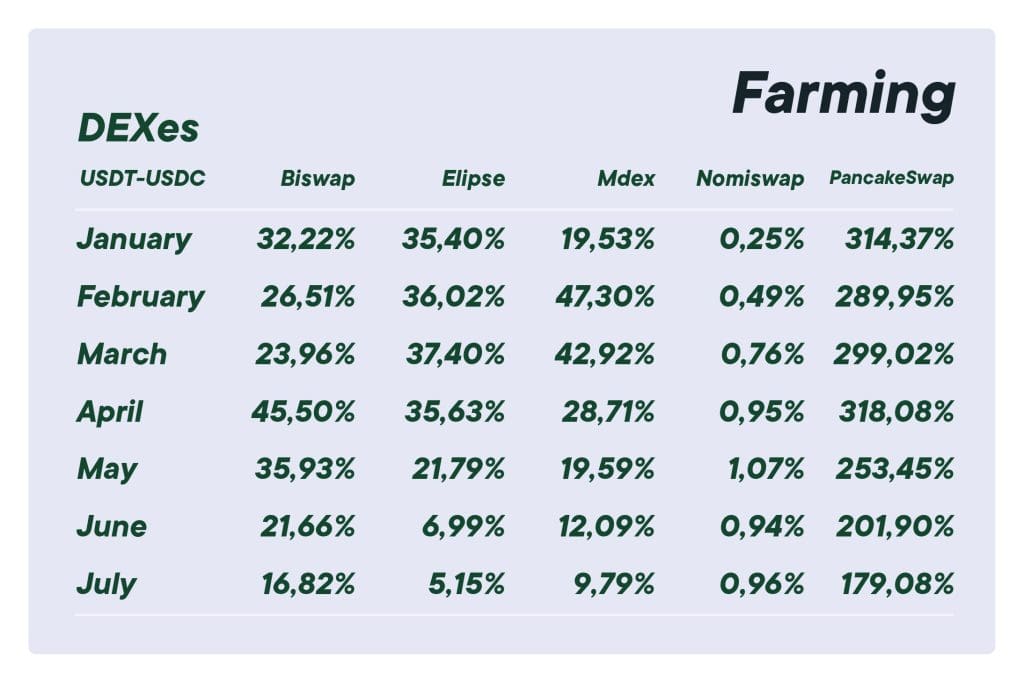

For the farming sector, PancakeSwap topped the charts outperforming the rest with an average return of 265.12% during Q1/2022 and Q2/2022. The platform’s returns peaked in April at 318%. Even after the crypto market crash triggered by the collapse of Terra’s ecosystem in May, PancakaSwap posted 253% returns that month.

Biswasp, the first Decentralized Exchange (DEX) on BNB Chain, recorded the second-highest returns over the period averaging 28.94%. Just like PancakeSwap, investors on the platform registered the highest returns in April at 45.5%. Coming in third was the Index at 25.7%, while Elipse ranked fourth at 25.4%.

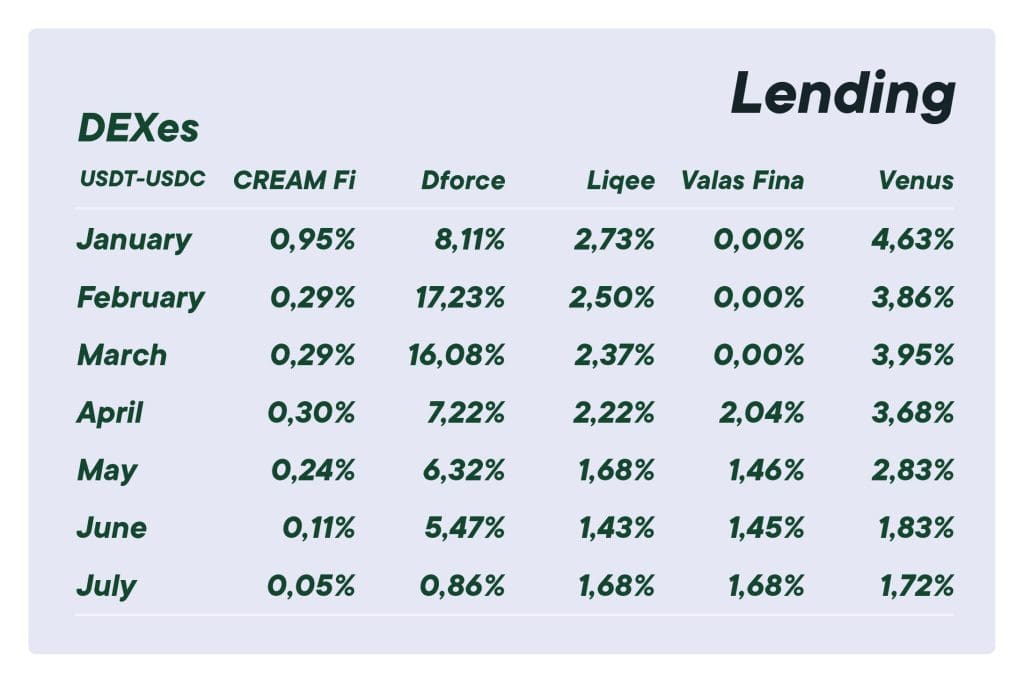

Dforce posted the highest lending returns in the lending sector, averaging 8.75%, between January and July 2022. The platform registered the highest returns in February at 17.23%. The other lending platforms, including CREAM Finance, Liqee, Valas, and Venus, had profits of 3.05% on average.

Changing Investors’ Strategies In A Bear Market

According to Bolide, the yield farming sector has generally remained strong in 2022. The yield farming aggregator says this is because:

“… investors look to change their strategies, preferring to trade less, hold their coins, and earn a stable yield until the crypto winter passes.”

Insights from the Bolide data show that the DeFi sector is on a path to maturity as it responds to market changes and investors’ needs more efficiently than most staking strategies. It is worth noting that most investors prefer to trade less and focus on passive ways of earning through stable yields awaiting another bull run.

In addition, the market volatilities experienced in 2022 have pushed investors to leverage the benefits of yield farming aggregators. This is because these DeFi platforms automate the processes of staking and collecting the generated rewards on behalf of their users.