- Tony of JRNY Crypto sees 2026 as the real acceleration phase for Bitcoin’s cycle.

- Institutional accumulation and shrinking exchange supply are setting up a supply squeeze.

- Regulatory clarity and bank participation could unlock the next wave of retail demand.

Tony from JRNY Crypto has been pretty vocal lately, and his message cuts through the noise: the surface looks slow, messy, even kind of boring… but underneath, the cycle is shifting in ways most people aren’t paying attention to. He believes 2026 is when the real acceleration begins for Bitcoin — not the warm-up we’re seeing now, but the phase where everything suddenly clicks into motion. Rate cuts are on the horizon, banks in the U.S. have finally been cleared to handle crypto directly, and that single structural change could unlock an entirely new wave of everyday investors who never touched offshore platforms or awkward custody tools in the past.

It’s a completely different environment compared to earlier cycles, and Tony thinks that difference matters way more than people realize right now.

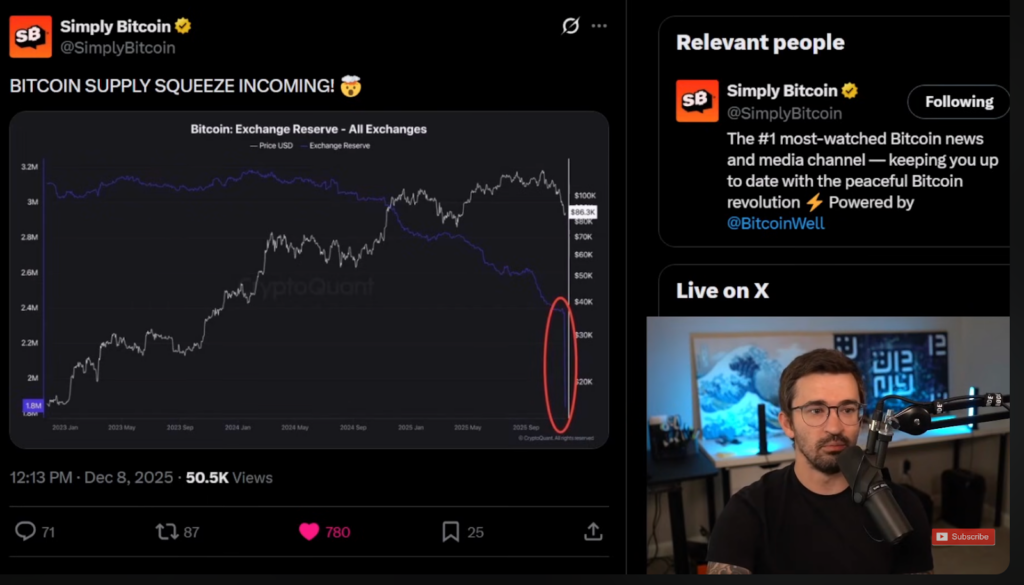

Exchange Supply Keeps Shrinking While Big Money Keeps Buying

One of the clearest signals Tony highlights is the steady drop in Bitcoin sitting on exchanges. It’s been declining quarter after quarter — not in one dramatic drop, but in this quiet, persistent bleed-out that long-term holders and institutional players cause as they pull coins into cold storage. For an asset with fixed supply, that trend is huge.

When supply thins out and demand eventually picks back up, even small inflows can push prices way faster than people expect. Tony calls this one of the most overlooked forces shaping the next cycle, a slow-burn supply squeeze building in the background while most traders get distracted by short-term noise.

Institutions Aren’t Day-Trading Bitcoin — They’re Preparing

Another point he keeps hammering: institutions aren’t treating Bitcoin like retail. They’re not chasing every green candle. They’re positioning — quietly, methodically — during uncertain, low-energy phases like this one. They build multi-year allocations while the crowd feels tired or confused, and only later does that confidence trickle outward.

Tony believes this early accumulation phase, happening right now, is what eventually filters to advisors, then to wealth managers, and finally to everyday investors. By the time retail decides it wants in, the foundation is already set.

Closing Thoughts

Tony from JRNY Crypto isn’t calling for an instant breakout or some dramatic moonshot tonight. His outlook is grounded in structure, not hype. Exchange supply keeps shrinking, institutions are getting comfortable, and access to Bitcoin through banks is right around the corner.

He argues the cycle is quietly rebuilding from the inside out — and when momentum finally hits again, it probably won’t arrive slowly. It’ll show up all at once, and plenty of people will look back and realize the setup was right in front of them long before the crowd noticed.

rebuilt from the inside. When momentum finally returns, he believes it won’t arrive gently. It will arrive quickly, and many will realize the setup was forming long before the crowd noticed.