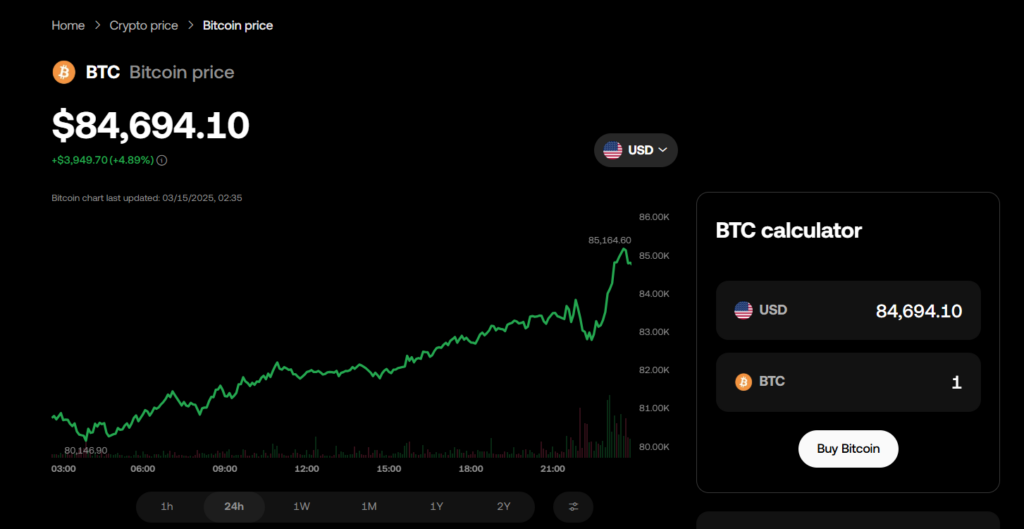

- Bitcoin surged past $85,000 before settling at $84,400, gaining 4.7% as risk appetite returned to crypto and stock markets.

- The S&P 500 and Nasdaq rallied alongside Bitcoin, while gold retreated below $3,000 after briefly hitting an all-time high.

- Traders are watching Bitcoin’s 200-day moving average at $83,767, with a close above it signaling potential market recovery.

After a sluggish week, sellers in risk markets are finally hitting the pause button, giving crypto a chance to breathe—and bounce. On Friday, digital assets surged alongside U.S. stocks, flipping the script on recent price stagnation.

Bitcoin made a run past $85,000 during U.S. trading hours, now holding at around $84,400, marking a 4.7% climb in the past 24 hours. The broader crypto market followed suit, with every asset in the CoinDesk 20 Index flashing green. Among the biggest gainers? Chainlink’s LINK, Solana’s SOL, and SUI, all making strong moves upward.

Risk Appetite Returns, Gold Takes a Backseat

Traditional markets also got a jolt of energy. The S&P 500 popped 1.7%, while the Nasdaq—a favorite for high-risk tech plays—jumped 2.3%. Interestingly, gold, which had been stealing the show while Bitcoin stumbled in recent weeks, dipped back below $3,000 after breaking that historic level just a day earlier.

According to Paul Howard, senior director at Wincent, this rally isn’t just random noise. “Seeing markets bounce like this is likely a mix of improving sentiment in risk assets—think inflation, tariffs—and a sign that crypto might be stabilizing after the recent pullback,” he shared in a Telegram update.

Adding to that, the past week has seen about $2.6 billion worth of leveraged crypto positions get wiped out, mostly long bets. With excess leverage flushed out, the market might be on sturdier ground moving forward, Howard noted.

BTC Bulls and the 200-Day Moving Average Battle

Bitcoin’s jump also nudged it back above its 200-day moving average, a major trendline that traders watch closely. Dropping below it for the first time since last August’s correction had been a red flag, but reclaiming it—currently sitting at $83,767—could mean bulls are regaining control.

A strong close above this level would fuel optimism that the worst of the dip is behind us. On the flip side, failing to hold it might signal another leg down.

Veteran cross-asset trader Bob Loukas believes there’s more room for this rally to stretch, at least for now. “Feels like we’re nearing the end of the panic phase. Expecting a few weeks of recovery before the market takes another hard look at things,” he shared earlier this week.

So, is the storm finally passing, or are we in for more turbulence? Only time will tell, but for now, the crypto market seems to be catching its breath.