- Credit Suisse, a Swiss bank has ongoing liquidity issues.

- A bank rescue plan for Credit Suisse may impose losses on its bondholders and even result in a full or partial nationalization of Credit Suisse Group AG.

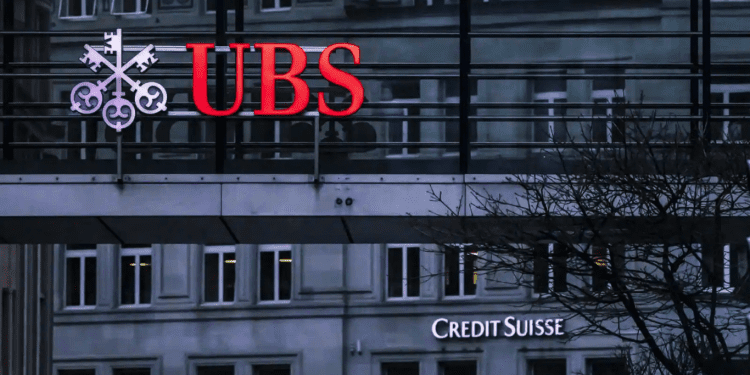

- USB acquisition is being consider as CS “only option” left to rescue the Swiss Bank Giant

A rescue plan for Swiss banking giant Credit Suisse may impose losses on its bondholders and even result in a full or partial nationalization of Credit Suisse Group AG, multiple reports revealed on March 19.

Swiss authorities are considering applying losses to Credit Suisse bondholders as part of the bank’s ongoing recovery efforts, Reuters learned from two sources. European regulators are concerned that the move might undermine investor confidence in Europe’s financial sector.

Another report from Bloomberg claims that the Swiss government is analyzing the bank’s full or partial nationalization, the only available alternative if the UBS takeover still needs to be completed. Investment bank UBS is Switzerland’s largest bank.

On March 18, the Swiss National Bank (SNB) and Switzerland’s financial regulator said Credit Suisse’s acquisition by UBS is the “only option” to prevent a “collapse in confidence” in Credit Suisse.

Due to the deal’s complexities and limited time, nationalization would be an emergency option. Swiss authorities are working over the weekend on “emergency measures” to accelerate the value before Asian markets open, including allowing the deal to proceed without a shareholder vote.

UBS is reportedly asking the government to shoulder around $6 billion on legal costs and potential future losses in the event of a takeover. UBS is offering $1 billion for Credit Suisse, a considerable discount under the bank’s market value on March 17 of nearly $8 billion, according to Companies Market Cap.

Swiss authorities are also concerned about job losses due to the deal. According to reports, Credit Suisse previously considered laying off 9,000 employees to save its business.

Investment company BlackRock denied on March 18 plans or interest in acquiring Credit Suisse. “BlackRock is not participating in any plans to acquire all or any part of Credit Suisse and has no interest in doing so,” the firm said on Twitter.