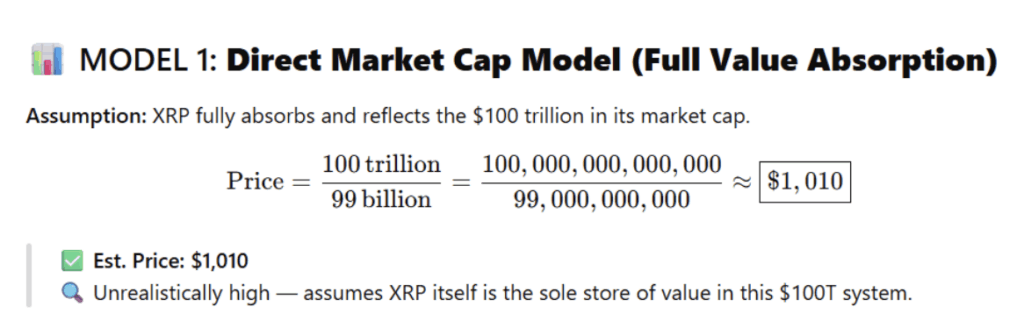

- A $1,010 XRP is mathematically possible—but realistically far-fetched unless XRPL becomes the global financial rails.

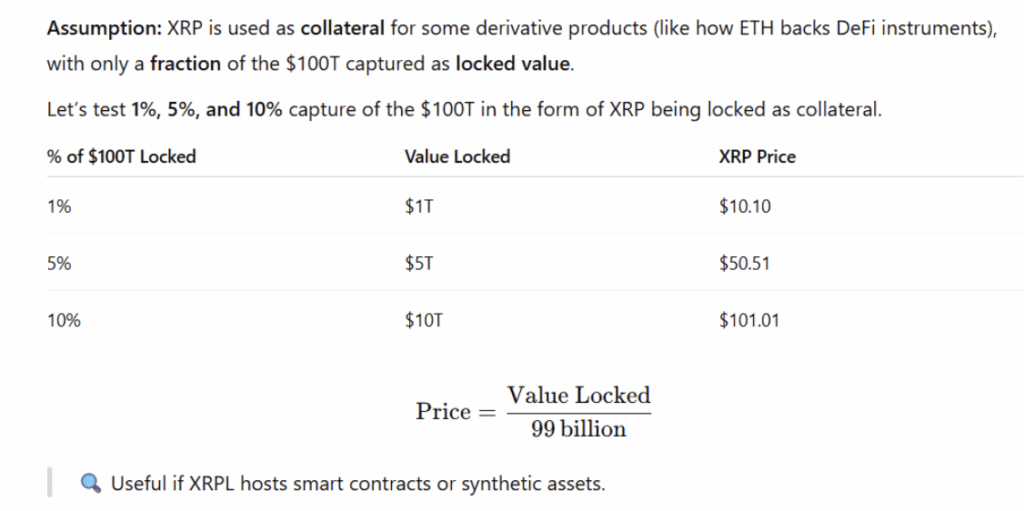

- Collateral models give XRP more achievable targets between $10 and $100, assuming XRPL supports smart contracts.

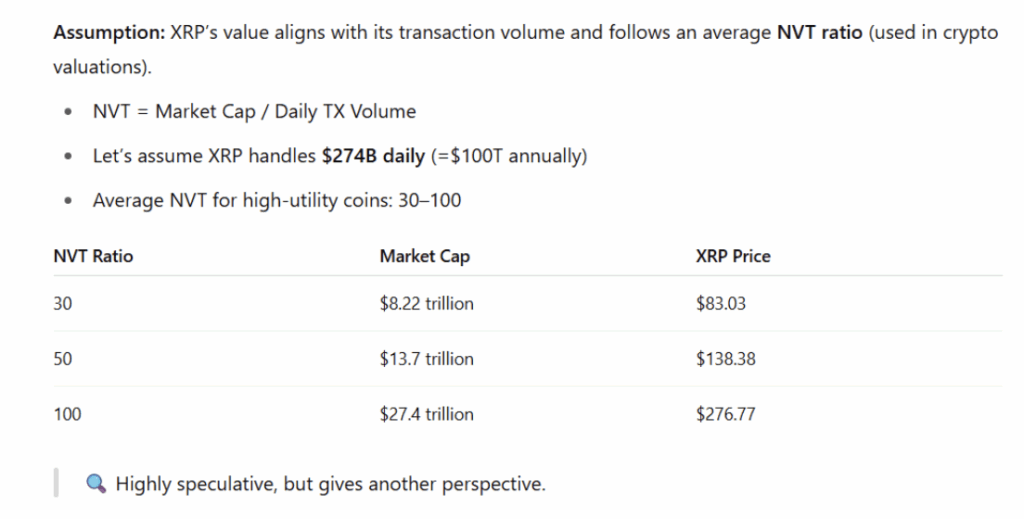

- Based on real usage and the NVT model, XRP could rise to between $83 and $276 with high transaction volumes.

So here’s the idea floating around: if the XRP Ledger (XRPL) ever grabbed just 10% of the global derivatives market, XRP’s price could absolutely take off. We’re talking—well, let’s just say, numbers most folks wouldn’t believe at first glance.

Right now, XRP’s been chillin’ around the $2 mark for what feels like forever. $2.18, to be exact. Not a ton of action lately, but that hasn’t stopped analysts from calling it wildly undervalued. A lot of that optimism hinges on XRP’s role in cross-border payments… and now, possibly, the massive $1 quadrillion derivatives market. Sounds big? It is. But how would that kind of money move the price? Let’s walk through it.

Scenario 1: The $1,010 XRP Fantasy

Using a straight-up market cap model, the math goes like this: divide $100 trillion (10% of the $1 quadrillion market) by XRP’s supply—around 99 billion tokens—and you get a price per coin of about $1,010. Yup, over a grand per XRP. But here’s the thing. This assumes XRP becomes the value for all those derivatives, which is… not how XRPL works. It’d basically need to replace every other system and become the global financial backbone. Not likely, not anytime soon.

Scenario 2: XRP as Collateral, More Realistic

A much more grounded take involves using XRP as collateral. Think of how Ethereum works in DeFi, right? If XRPL supported smart contracts and similar setups, XRP wouldn’t need to be the derivatives market—it’d just back it. Now, if 1% of that $100 trillion (so, $1 trillion) was locked in XRP, we’d see the token hit about $10.10. If it’s 5%? That’s $50.51. At 10% locked up? Boom, we’re looking at $101.01 per coin. Not bad, and way more believable.

Ripple’s already playing with smart contract tech, by the way. If XRPL keeps expanding its features, this path becomes a lot more viable.

Scenario 3: The NVT Ratio—A Transactional Take

Last model? ChatGPT ran numbers using the Network Value to Transactions (NVT) ratio. That’s just a fancy way of measuring how efficiently a blockchain turns usage into value. Let’s say XRPL processes $274 billion in daily volume—that adds up to $100 trillion a year. If XRP’s NVT ratio lands between 30 and 100, you’re looking at a market cap somewhere between $8.2 trillion and $27.4 trillion.

What’s that mean for price? Roughly $83 to $276 per XRP. Again, not as eye-popping as the first model, but it’s still a monster return from today’s levels. And it’s rooted in usage, not fantasy.