- CoinDesk, a subsidiary of DCG, is exploring options for growth capital, which may include a partial or full sale.

- Genesis Global Capital, also a DCG subsidiary, is negotiating a prepackaged bankruptcy plan with creditors.

- Genesis recently announced it has reduced its workforce by 30% to navigate industry challenges.

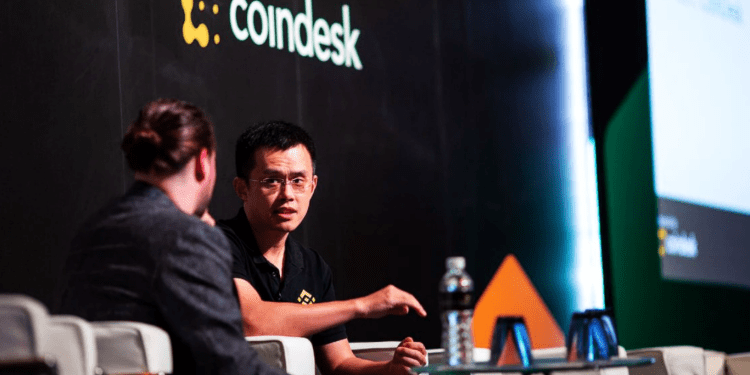

CoinDesk, the leading cryptocurrency-focused media company, has retained investment bankers at Lazard Ltd. to help it explore options, including a partial or total sale, according to its CEO Kevin Worth. The move comes after CoinDesk’s parent company, Digital Currency Group (DCG), has received multiple unsolicited offers north of $200 million in the past few months.

This news comes amid turmoil in the crypto industry, as crypto exchange FTX filed for bankruptcy protection, and other DCG businesses, such as fund manager Grayscale Investments and bitcoin miner Foundry, also face significant challenges.

CoinDesk, which DCG acquired in 2016 for $500,000, generated $50 million in revenue last year from online advertising and its index and events business. The $13.5 billion Grayscale Bitcoin Trust, offered by CoinDesk sister company Grayscale Investments, tracks the CoinDesk Bitcoin Price Index. CoinDesk delivers news on trends, events, technologies, and people/companies making significant moves in the digital currency sphere.

Genesis Global Capital Creditors Negotiate Prepackaged Bankruptcy Plan

The news of CoinDesk’s potential sale comes after it was reported that Genesis Global Capital creditors are negotiating a prepackaged bankruptcy plan with the firm. Creditors like the Winklevoss twins’ Gemini would agree to a forbearance period between one and two years under the prepackaged bankruptcy plan. This is in exchange for cash payments and equity in Genesis’s parent company, Digital Currency Group.

Gemini formed an ad hoc committee late last year to coordinate efforts with other creditors and advocate for a resolution after Genesis halted withdrawals on its platform. The creditor committee has been privately negotiating with Genesis for the past few weeks to finalize a Chapter 11 bankruptcy protection plan before filing.

The Winklevoss twins have publicly accused Barry Silbert, the head of Genesis parent Digital Currency Group, of comingling funds at the crypto conglomerate, negotiating in bad faith, and have insisted he steps down as DCG’s top executive.

Layoffs at Genesis Amid Industry Challenges

Moreover, according to a source familiar with the matter, Genesis began a new round of layoffs, reducing its workforce by 30%. “As we continue to navigate unprecedented industry challenges, Genesis has made the difficult decision to reduce our headcount globally. These measures are part of our ongoing efforts to move our business forward.” said a spokesperson for Genesis.

Genesis halted withdrawals and new loan originations from its lending affiliate on November 16th in the wake of FTX’s collapse. Genesis’s derivatives business had $175 million stuck in FTX after its demise. The failure of the hedge fund firm 3AC had previously impacted the firm.

It is unclear at this time what the outcome of the negotiations will be for CoinDesk, Genesis Global Capital, and DCG. However, it is clear that the crypto industry is facing significant challenges, and companies are looking for ways to navigate and survive in the current market conditions. The potential sale of CoinDesk, a leading player in the crypto media space, could signify further consolidation and changes in the industry.