- Coinbase’s Q4 loss reflects falling volumes, not a broken business

- Trading fees still dominate revenue, proving crypto is still speculation-led

- The results expose how fragile “utility revenue” remains in downturns

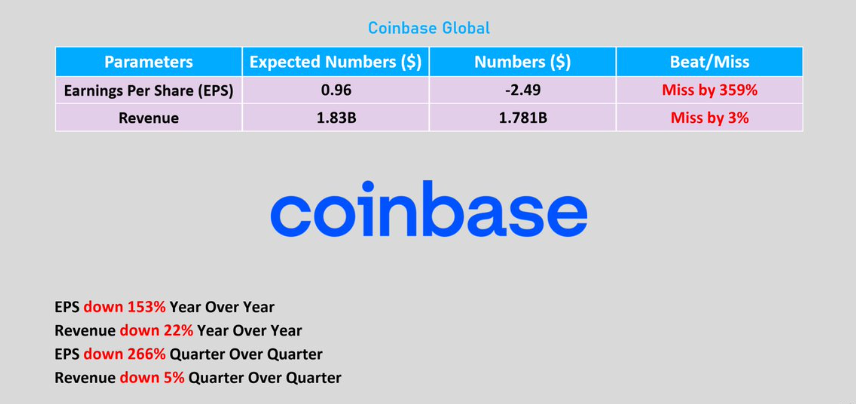

Coinbase posting a $667 million loss in Q4 sounds like the kind of number that makes people yell “crypto is dead” into the void. But the reality is way less dramatic. This wasn’t a surprise implosion, and it wasn’t Coinbase suddenly losing operational competence. It was the basic math of a risk market cooling off: lower volatility, lower retail participation, and thinner trading volumes hitting an exchange that still makes most of its money when people are actively speculating.

Coinbase didn’t break. The market stopped feeding it.

Trading Fees Still Run Coinbase’s Reality

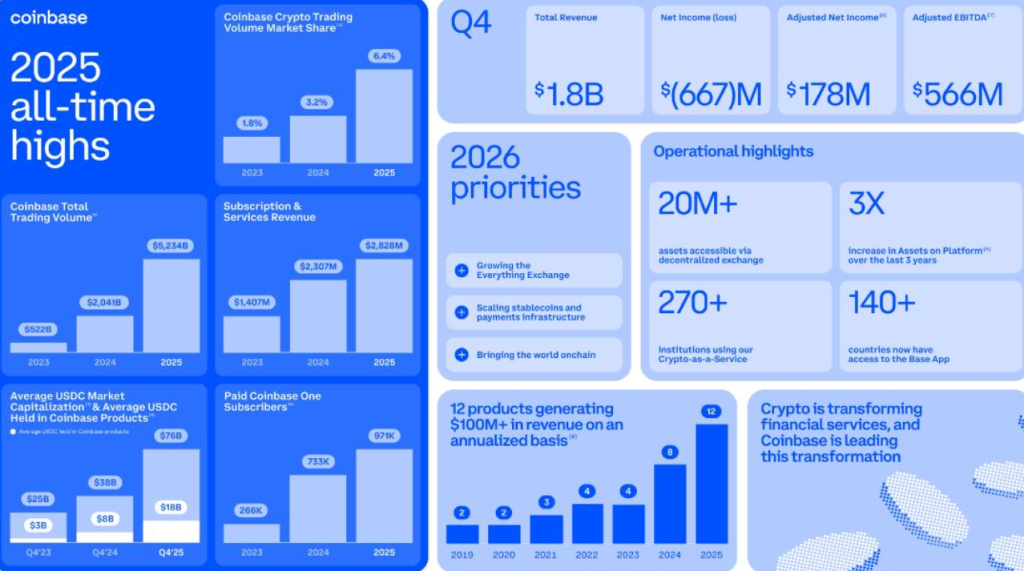

For years, Coinbase has tried to broaden the story. Subscriptions, custody, staking, institutional products, Base, even prediction markets — the pitch has been “we’re becoming a diversified crypto infrastructure company.” And yes, those revenue lines exist. But when Q4 hits and volumes drop, the truth shows up fast: transaction activity still dominates the business model.

That dependency is the real issue, not the loss itself. It shows crypto’s biggest “infrastructure” firms are still tied to the same thing as meme tokens: momentum. When the casino gets quiet, the house earns less, simple as that.

Cost Discipline Helps, But It Doesn’t Fix Cyclicality

Coinbase has cut staff, tightened expenses, and leaned hard into being the most regulation-friendly U.S. exchange. That positioning matters long-term, especially if the U.S. continues pushing clearer market structure rules. But even the most compliant exchange in the world still needs traders to trade.

Cost discipline is survival. It’s not immunity. And Q4 proves that the earnings curve still swings violently with sentiment.

The Market’s Misread Is the Bigger Story

Some people will use this earnings miss as proof that crypto is structurally failing. That’s lazy analysis. This is what immature financial markets look like. They print money during frothy phases, then look broken during the hangover. Traditional brokerages and early fintech platforms went through similar cycles when their markets were still retail-heavy and narrative-driven.

Coinbase’s results don’t show the end of crypto. They show crypto still hasn’t fully grown into a stable economic engine.

Conclusion

Coinbase’s Q4 loss isn’t a warning siren. It’s a mirror. It reflects a market where speculation still drives the majority of economic activity, and where “utility” revenue is not yet strong enough to stabilize the biggest players. Until crypto generates steady demand beyond trading and hype cycles, exchanges like Coinbase will keep riding these earnings waves, whether they want to or not.