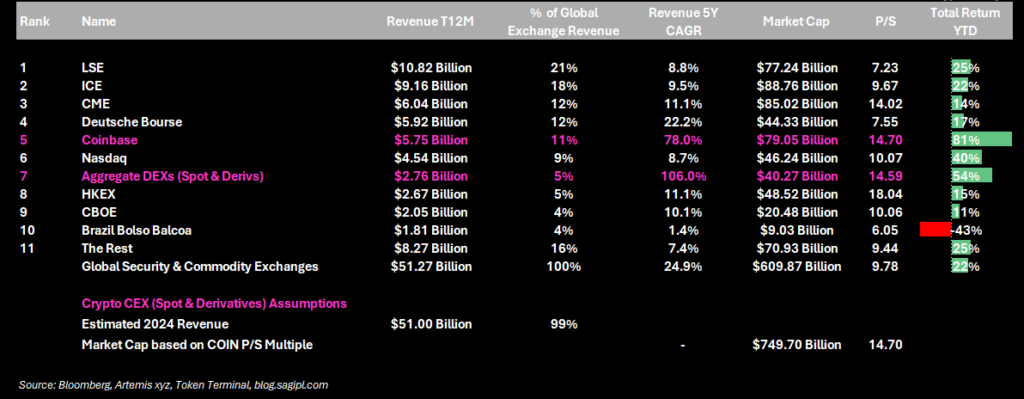

- Coinbase ranks fifth globally in exchange revenue, generating $5.75 billion over the past year and surpassing traditional stock exchanges like Nasdaq and CBOE.

- Coinbase alone accounts for 11% of global exchange revenue, more than double the decentralized exchange (DEX) sector’s 5% share.

- Analyst Jamie Coutts expects competition to intensify in 2025 as traditional finance integrates crypto activities, while DeFi protocols could potentially outperform major cryptocurrencies by offering attractive returns.

Coinbase, a leading cryptocurrency trading platform based in the U.S., is making significant strides in the financial sector. It now ranks fifth globally in exchange revenue, outdoing traditional financial institutions such as Nasdaq and CBOE.

Coinbase Outshines Traditional Exchanges

In what is a clear indication of the rapid growth of cryptocurrency trading, Coinbase has generated a staggering $5.75 billion in exchange revenue over the past year. This figure considerably surpasses the revenues of traditional stock market exchanges like Nasdaq and CBOE. Moreover, Coinbase alone accounts for 11% of global exchange revenue, which is more than double that of the entire decentralized exchange (DEX) sector.

The Rise of Decentralized Exchanges

While Coinbase is making waves in the global exchange revenue rankings, DEXs are not far behind. These platforms have managed to capture a 5% share of the global exchange revenue, overtaking traditional platforms like HKEX and CBOE. The growth of centralized exchanges (CEXs) and DEXs is estimated to be 25 to 4 times faster than that of traditional finance.

Predictions for the Future

Considering the current trends, the combined market capitalization of CEXs could touch $749 billion, given Coinbase’s price-to-sales multiple. This valuation would be higher than the $610 billion of traditional finance (TradFi). The year 2025 is expected to witness intensified competition as traditional finance institutions integrate crypto-related activities. In addition, decentralized finance (DeFi) protocols could potentially outshine top cryptocurrencies like Bitcoin and Ethereum by offering attractive returns.

Conclusion

The rapid growth of Coinbase and other crypto trading platforms is a testament to the shifting dynamics of the financial sector. The rise in exchange revenue for these platforms not only underscores the growing popularity of cryptocurrencies but also suggests a promising future for the crypto industry as a whole. As traditional finance institutions start integrating crypto activities, the competition in this space is set to intensify. This scenario could potentially lead to an even more dynamic and vibrant crypto economy.