- Coinbase is launching perpetual futures for AIXBT, PNUT, and VET on January 23, 2025, excluding New York users.

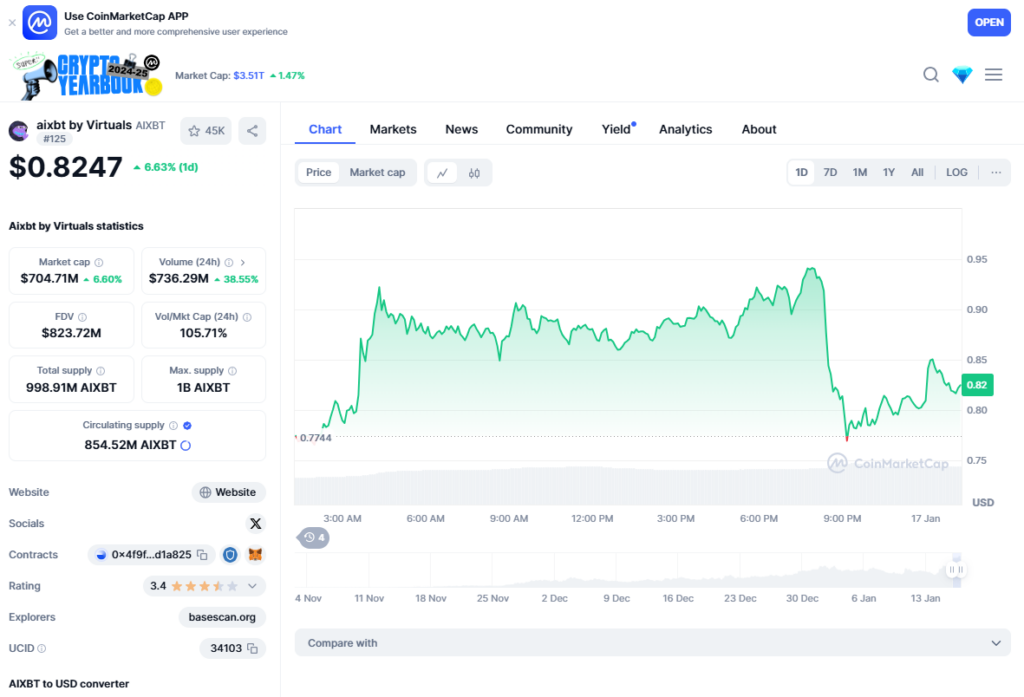

- The announcement spiked prices and volumes, with AIXBT trading $1.2 billion within hours.

- Coinbase partnered with Morpho for a secure, innovative approach to leveraged trading.

In an exciting move for crypto traders, Coinbase International Exchange and Coinbase Advanced have announced the launch of perpetual futures for AIXBT, PNUT, and VET. Starting on or after 9:30 am UTC on January 23, 2025, traders outside New York will gain access to leveraged trading on these assets. This development is poised to boost market interest, liquidity, and, quite possibly, volatility for these cryptocurrencies.

Market Reacts to the Announcement

The announcement sent ripples through the market. Almost immediately:

- AIXBT climbed 2.3%, rising from $45,000 to $46,025, with trading volume reaching a hefty $1.2 billion.

- PNUT jumped 3.5%, with its price moving from $1.20 to $1.24, supported by $300 million in trading volume.

- VET followed suit with a 1.8% increase, from $0.08 to $0.0815, and a $250 million trading volume.

This sudden surge wasn’t limited to prices; trading volumes exploded across major exchanges. Binance’s AIXBT/USDT pair saw a 15% jump in volume, while Uniswap’s PNUT/ETH pair rose 12%, and Huobi’s VET/BTC pair gained 10%.

A Smarter, Safer Approach

Unlike the wild west days of 2022’s crypto winter—when lending platforms like Celsius and BlockFi collapsed—Coinbase is treading cautiously. This time, it’s leveraging its partnership with Morpho, a lending protocol managing $3.7 billion in deposits. Coinbase acts as a middleman, prioritizing stability and security while providing innovative tools for traders to engage in the market.

Volatility and Institutional Interest

With these perpetual futures, traders now have fresh opportunities to speculate on price movements. Early signs suggest higher volatility: AIXBT’s implied volatility rose by 5%, and PNUT’s network growth jumped 18% within hours of the announcement.

Institutional interest also ticked upward. Coinbase recorded a 7% increase in institutional trading volume for AIXBT, signaling that larger players are watching these developments closely. Arbitrage opportunities emerged, too, with price spreads between Coinbase and Binance narrowing by 0.5% after the news broke.

Technical Indicators Point to Momentum

Key metrics support the bullish sentiment:

- AIXBT: RSI rose from 55 to 62, signaling growing upward momentum.

- PNUT: A bullish MACD crossover hints at continued price strength.

- VET: Widening Bollinger Bands suggest higher price volatility ahead.

Volume data reinforces this optimism, with Coinbase seeing $1.5 billion in AIXBT trading, $350 million in PNUT volume, and $300 million in VET trading within just two hours.

Final Takeaway

Coinbase’s introduction of perpetual futures for AIXBT, PNUT, and VET isn’t just another product launch—it’s a bold step that could redefine these assets’ trading landscape. By learning from past mistakes and focusing on security, Coinbase is setting the stage for a more dynamic, competitive market. For traders, this means new opportunities (and risks) in an evolving crypto space.