- Coinbase has entered the top 20 rankings on the US iOS App Store amid Bitcoin’s recent price surge, signaling renewed interest in crypto investing.

- The rise of investing apps like Coinbase and Robinhood in the App Store rankings reflects a broader trend of retail investors turning to digital platforms to diversify their portfolios and engage with new financial markets.

- Factors fueling Coinbase’s popularity include Bitcoin’s price rally, institutional adoption and ETF hype, and the platform’s mainstream appeal and user-friendly interface.

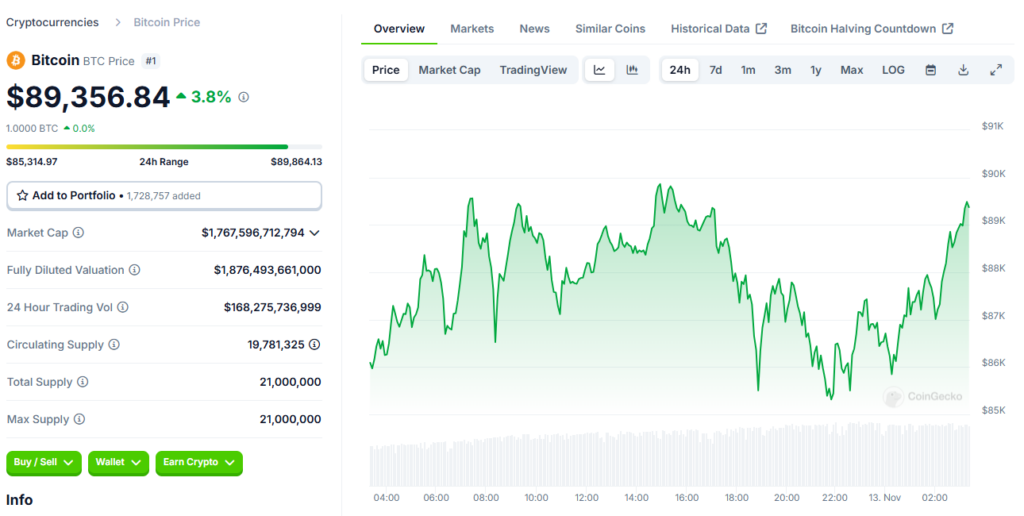

Coinbase has recently broken into the top 20 of the US iOS App Store rankings, hitting the 20th spot and marking a significant moment for the crypto industry. As Bitcoin‘s value rises, with prices recently topping $89,000, Coinbase’s ascent in popularity underscores the renewed interest in crypto investing.

The Rise of Investing Apps in the App Store

Coinbase’s move into the top 20 highlights a larger trend of increased app usage among retail investors. Robinhood, 17th, a platform known for its commission-free stock and crypto trading, shares the spotlight with Coinbase in the top investing apps, both ranking alongside shopping and social media giants.

As economic uncertainties persist and traditional financial options evolve, more users are turning to these platforms to diversify and engage with new financial markets. This trend also shows that investment platforms are becoming as mainstream as social and lifestyle apps. Where once the App Store was dominated by services like Instagram, TikTok and Amazon, the presence of finance and investment apps signals a shift toward financial empowerment, with digital platforms facilitating easy market access for a broader audience.

Factors Fueling Coinbase’s Popularity

- Bitcoin Price Rally – With Bitcoin’s price rally attracting both new and seasoned investors, Coinbase has benefited as a trusted platform for crypto transactions. Unlike traditional brokers, Coinbase offers straightforward access to crypto assets which appeals to a market that wants to participate in Bitcoin’s ongoing surge.

- Institutional Adoption and ETF Hype – The recent launch of Bitcoin ETFs by established players like BlackRock has lent credibility to crypto markets. For retail users, these moves signal the long-term viability of Bitcoin as an asset class, prompting them to explore crypto investment via platforms like Coinbase.

- Mainstream Appeal and Usability – Like Robinhood, Coinbase has succeeded by creating an accessible, user-friendly interface that appeals to both novice and experienced investors. Its recognizable brand and reputation have become particularly attractive to users looking to capitalize on crypto’s growth without high barriers to entry.

Conclusion

Coinbase’s presence among the top 20 US iOS apps demonstrates the increasing normalization of crypto as an investment option. Positioned alongside mainstream investing platforms, it shows that the gap between traditional and crypto investing is narrowing. As crypto prices fluctuate and financial platforms evolve, Coinbase’s rise may herald a new era where financial apps are as integrated into daily life as social media or shopping apps.