- Coinbase quietly stacked 841 BTC in Q4, pushing holdings above $1 billion

- Armstrong says the buying continues, even in shaky market conditions

- The move reinforces a growing corporate-treasury Bitcoin strategy

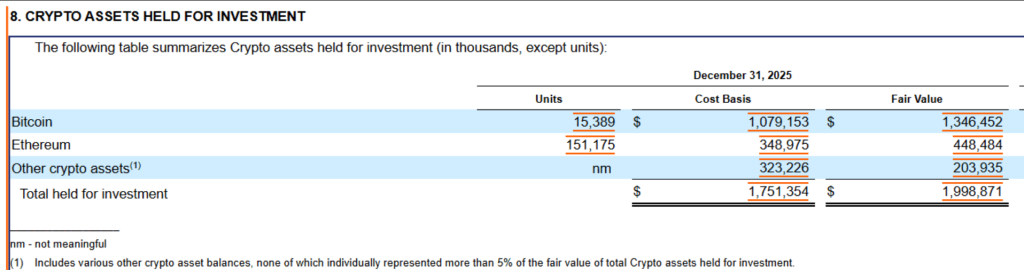

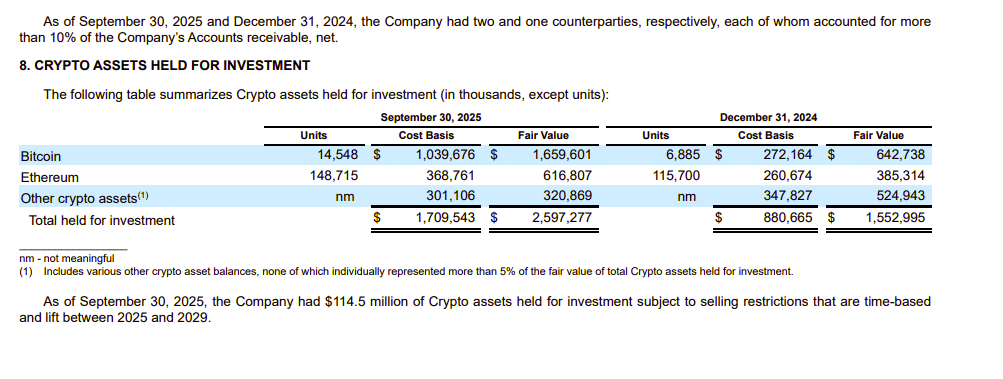

Coinbase just made a move that feels more like Strategy than a typical crypto trading platform. According to a new SEC filing, the company acquired 841 Bitcoin in Q4 2025, raising its total holdings to 15,389 BTC worth more than $1 billion. That places Coinbase among the top corporate Bitcoin holders globally, and the ranking matters because it signals intent, not just accounting.

This is not Coinbase “holding some BTC because it’s crypto.” It’s Coinbase treating Bitcoin like a strategic asset on the balance sheet, the same way institutions treat gold or long-duration reserves. And that’s a different kind of statement.

Armstrong and Haas Made the Message Unusually Clear

The language from leadership was not vague, and it wasn’t cautious either. Brian Armstrong said Coinbase will keep buying Bitcoin, even in current market conditions, and CFO Alesia Haas explained it was done through a structured weekly program. That detail matters because it implies this wasn’t a one-time opportunistic buy. It was systematic accumulation, designed to steadily grow exposure regardless of short-term price noise.

In other words, Coinbase is not trying to time bottoms. It’s trying to build a long-term position.

The Ethereum Add-On Shows This Isn’t a One-Asset Bet

Alongside the Bitcoin buy, Coinbase also increased its Ethereum exposure, adding 2,460 ETH in Q4 and bringing total ETH holdings to 151,175 ETH. That gives the company a meaningful secondary crypto treasury position, and it fits Coinbase’s broader ecosystem push through Base and onchain products.

This part is important because it suggests Coinbase is diversifying within crypto, not just maxing out Bitcoin. It’s building a portfolio that matches where its business is heading.

Conclusion

Coinbase buying 841 BTC in Q4 isn’t a flashy headline, but it’s a serious signal. The company is positioning itself not only as an exchange and custodian, but as a corporate treasury participant that believes Bitcoin still belongs on the balance sheet. If more public firms follow this playbook, the next phase of institutional adoption may look quieter, but a lot more permanent.